Towards Operational Excellence and Financial Sustainability

Towards Operational Excellence and Financial Sustainability

Towards Operational Excellence and Financial Sustainability

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

These consolidated fi nancial statements are originally issued in Indonesian language.<br />

PT INDOCEMENT TUNGGAL PRAKARSA Tbk. AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

Years ended December 31, 2004 <strong>and</strong> 2003<br />

(Expressed in rupiah, unless otherwise stated)<br />

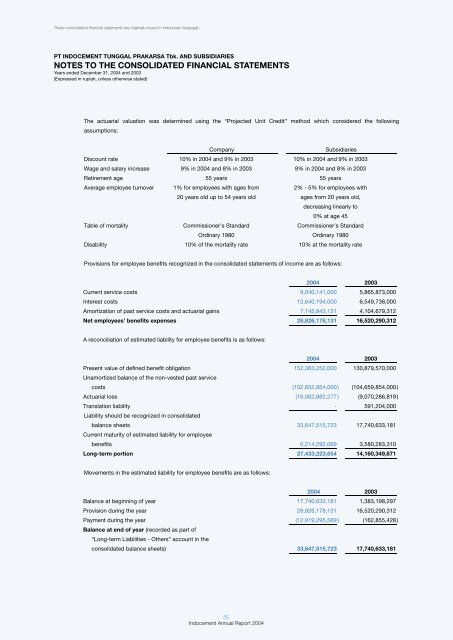

The actuarial valuation was determined using the “Projected Unit Credit” method which considered the following<br />

assumptions:<br />

Company<br />

Subsidiaries<br />

Discount rate 10% in 2004 <strong>and</strong> 9% in 2003 10% in 2004 <strong>and</strong> 9% in 2003<br />

Wage <strong>and</strong> salary increase 9% in 2004 <strong>and</strong> 8% in 2003 9% in 2004 <strong>and</strong> 8% in 2003<br />

Retirement age 55 years 55 years<br />

Average employee turnover 1% for employees with ages from 2% - 5% for employees with<br />

20 years old up to 54 years old ages from 20 years old,<br />

decreasing linearly to<br />

0% at age 45<br />

Table of mortality Commissioner’s St<strong>and</strong>ard Commissioner’s St<strong>and</strong>ard<br />

Ordinary 1980 Ordinary 1980<br />

Disability 10% of the mortality rate 10% at the mortality rate<br />

Provisions for employee benefits recognized in the consolidated statements of income are as follows:<br />

2004 2003<br />

Current service costs 9,040,141,000 5,865,873,000<br />

Interest costs 12,640,194,000 6,549,738,000<br />

Amortization of past service costs <strong>and</strong> actuarial gains 7,145,843,131 4,104,679,312<br />

Net employees’ benefits expenses 28,826,178,131 16,520,290,312<br />

A reconciliation of estimated liability for employee benefits is as follows:<br />

2004 2003<br />

Present value of defined benefit obligation 152,363,252,000 130,879,570,000<br />

Unamortized balance of the non-vested past service<br />

costs (102,652,854,000) (104,659,854,000)<br />

Actuarial loss (16,062,882,277) (9,070,286,819)<br />

Translation liability - 591,204,000<br />

Liability should be recognized in consolidated<br />

balance sheets 33,647,515,723 17,740,633,181<br />

Current maturity of estimated liability for employee<br />

benefits 6,214,292,069 3,580,283,310<br />

Long-term portion 27,433,223,654 14,160,349,871<br />

Movements in the estimated liability for employee benefits are as follows:<br />

2004 2003<br />

Balance at beginning of year 17,740,633,181 1,383,198,297<br />

Provision during the year 28,826,178,131 16,520,290,312<br />

Payment during the year (12,919,295,589) (162,855,428)<br />

Balance at end of year (recorded as part of<br />

“Long-term Liabilities - Others” account in the<br />

consolidated balance sheets) 33,647,515,723 17,740,633,181<br />

89<br />

Indocement Annual Report 2004