Ophir Energy plc Annual Report and Accounts 2011

Ophir Energy plc Annual Report and Accounts 2011

Ophir Energy plc Annual Report and Accounts 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

75<br />

<strong>Ophir</strong> <strong>Energy</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

7 Share-based compensation continued<br />

The comparator group consisted of Afren PLC, Bowleven PLC, Cairn <strong>Energy</strong> PLC, Chariot Oil <strong>and</strong> Gas Ltd, Cobalt<br />

International <strong>Energy</strong> Inc, Cove <strong>Energy</strong> PLC, EnQuest PLC, Essar <strong>Energy</strong> PLC, Faroe Petroleum PLC, Gulf Keystone<br />

Petroleum Ltd, Heritage Oil PLC, Ithaca <strong>Energy</strong> Inc, JKX Oil <strong>and</strong> Gas PLC, Kosmos <strong>Energy</strong> Ltd, Melrose Resources PLC,<br />

Premier Oil PLC, Rockhopper Exploration PLC, Salam<strong>and</strong>er <strong>Energy</strong> PLC, SOCO International PLC <strong>and</strong> Tullow Oil PLC.<br />

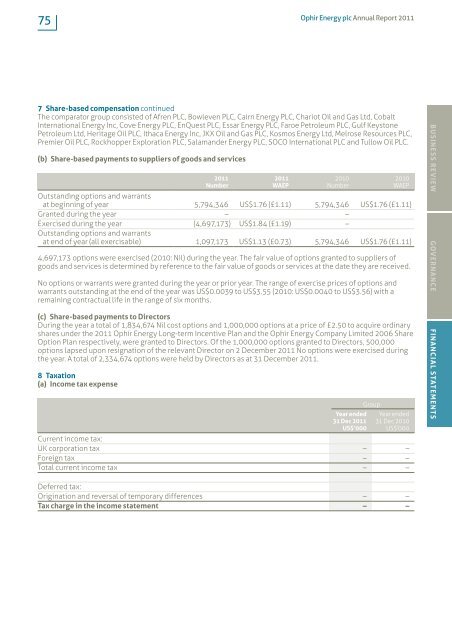

(b) Share-based payments to suppliers of goods <strong>and</strong> services<br />

<strong>2011</strong><br />

Number<br />

<strong>2011</strong><br />

WAEP<br />

2010<br />

Number<br />

2010<br />

WAEP<br />

Outst<strong>and</strong>ing options <strong>and</strong> warrants<br />

at beginning of year 5,794,346 US$1.76 (£1.11) 5,794,346 US$1.76 (£1.11)<br />

Granted during the year – –<br />

Exercised during the year (4,697,173) US$1.84 (£1.19) –<br />

Outst<strong>and</strong>ing options <strong>and</strong> warrants<br />

at end of year (all exercisable) 1,097,173 US$1.13 (£0.73) 5,794,346 US$1.76 (£1.11)<br />

4,697,173 options were exercised (2010: Nil) during the year. The fair value of options granted to suppliers of<br />

goods <strong>and</strong> services is determined by reference to the fair value of goods or services at the date they are received.<br />

No options or warrants were granted during the year or prior year. The range of exercise prices of options <strong>and</strong><br />

warrants outst<strong>and</strong>ing at the end of the year was US$0.0039 to US$3.55 (2010: US$0.0040 to US$3.56) with a<br />

remaining contractual life in the range of six months.<br />

(c) Share-based payments to Directors<br />

During the year a total of 1,834,674 Nil cost options <strong>and</strong> 1,000,000 options at a price of £2.50 to acquire ordinary<br />

shares under the <strong>2011</strong> <strong>Ophir</strong> <strong>Energy</strong> Long-term Incentive Plan <strong>and</strong> the <strong>Ophir</strong> <strong>Energy</strong> Company Limited 2006 Share<br />

Option Plan respectively, were granted to Directors. Of the 1,000,000 options granted to Directors, 500,000<br />

options lapsed upon resignation of the relevant Director on 2 December <strong>2011</strong> No options were exercised during<br />

the year. A total of 2,334,674 options were held by Directors as at 31 December <strong>2011</strong>.<br />

8 Taxation<br />

(a) Income tax expense<br />

Year ended<br />

31 Dec <strong>2011</strong><br />

US$’000<br />

Group<br />

Year ended<br />

31 Dec 2010<br />

US$’000<br />

Current income tax:<br />

UK corporation tax – –<br />

Foreign tax – –<br />

Total current income tax – –<br />

BUSINESS REVIEW GOVERNANCE FINANCIAL STATEMENTS<br />

Deferred tax:<br />

Origination <strong>and</strong> reversal of temporary differences – –<br />

Tax charge in the income statement – –