Ophir Energy plc Annual Report and Accounts 2011

Ophir Energy plc Annual Report and Accounts 2011

Ophir Energy plc Annual Report and Accounts 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

87<br />

<strong>Ophir</strong> <strong>Energy</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

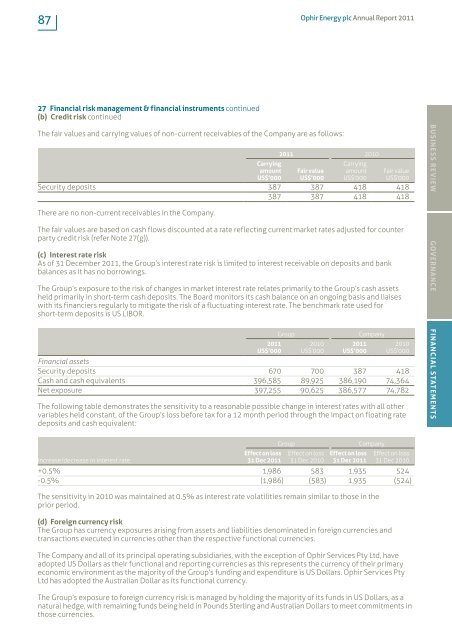

27 Financial risk management & financial instruments continued<br />

(b) Credit risk continued<br />

The fair values <strong>and</strong> carrying values of non-current receivables of the Company are as follows:<br />

Carrying<br />

amount<br />

US$’000<br />

<strong>2011</strong> 2010<br />

Fair value<br />

US$’000<br />

Carrying<br />

amount<br />

US$’000<br />

Fair value<br />

US$’000<br />

Security deposits 387 387 418 418<br />

387 387 418 418<br />

There are no non-current receivables in the Company.<br />

The fair values are based on cash flows discounted at a rate reflecting current market rates adjusted for counter<br />

party credit risk (refer Note 27(g)).<br />

(c) Interest rate risk<br />

As of 31 December <strong>2011</strong>, the Group’s interest rate risk is limited to interest receivable on deposits <strong>and</strong> bank<br />

balances as it has no borrowings.<br />

The Group’s exposure to the risk of changes in market interest rate relates primarily to the Group’s cash assets<br />

held primarily in short-term cash deposits. The Board monitors its cash balance on an ongoing basis <strong>and</strong> liaises<br />

with its financiers regularly to mitigate the risk of a fluctuating interest rate. The benchmark rate used for<br />

short-term deposits is US LIBOR.<br />

Group<br />

<strong>2011</strong><br />

US$’000<br />

2010<br />

US$’000<br />

<strong>2011</strong><br />

US$’000<br />

Company<br />

2010<br />

US$’000<br />

Financial assets<br />

Security deposits 670 700 387 418<br />

Cash <strong>and</strong> cash equivalents 396,585 89,925 386,190 74,364<br />

Net exposure 397,255 90,625 386,577 74,782<br />

The following table demonstrates the sensitivity to a reasonable possible change in interest rates with all other<br />

variables held constant, of the Group’s loss before tax for a 12 month period through the impact on floating rate<br />

deposits <strong>and</strong> cash equivalent:<br />

BUSINESS REVIEW GOVERNANCE FINANCIAL STATEMENTS<br />

Increase/decrease in interest rate<br />

Effect on loss<br />

31 Dec <strong>2011</strong><br />

Group<br />

Effect on loss<br />

31 Dec 2010<br />

Effect on loss<br />

31 Dec <strong>2011</strong><br />

Company<br />

Effect on loss<br />

31 Dec 2010<br />

+0.5% 1,986 583 1,935 524<br />

-0.5% (1,986) (583) 1,935 (524)<br />

The sensitivity in 2010 was maintained at 0.5% as interest rate volatilities remain similar to those in the<br />

prior period.<br />

(d) Foreign currency risk<br />

The Group has currency exposures arising from assets <strong>and</strong> liabilities denominated in foreign currencies <strong>and</strong><br />

transactions executed in currencies other than the respective functional currencies.<br />

The Company <strong>and</strong> all of its principal operating subsidiaries, with the exception of <strong>Ophir</strong> Services Pty Ltd, have<br />

adopted US Dollars as their functional <strong>and</strong> reporting currencies as this represents the currency of their primary<br />

economic environment as the majority of the Group’s funding <strong>and</strong> expenditure is US Dollars. <strong>Ophir</strong> Services Pty<br />

Ltd has adopted the Australian Dollar as its functional currency.<br />

The Group’s exposure to foreign currency risk is managed by holding the majority of its funds in US Dollars, as a<br />

natural hedge, with remaining funds being held in Pounds Sterling <strong>and</strong> Australian Dollars to meet commitments in<br />

those currencies.