Ophir Energy plc Annual Report and Accounts 2011

Ophir Energy plc Annual Report and Accounts 2011

Ophir Energy plc Annual Report and Accounts 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

89<br />

<strong>Ophir</strong> <strong>Energy</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

27 Financial risk management & financial instruments continued<br />

Significant assumptions used in the foreign currency exposure sensitivity analysis include:<br />

––<br />

Reasonably possible movements in foreign exchange rates were determined based on a review of the last two<br />

years’ historical movements <strong>and</strong> economic forecaster’s expectations.<br />

––<br />

The reasonably possible movement was calculated by taking the US Dollar spot rate as at balance date, moving<br />

this spot rate by the reasonably possible movements <strong>and</strong> then re-converting the US Dollar into AUD with the<br />

“new spot rate”. This methodology reflects the translation methodology undertaken by the Group.<br />

(e) Liquidity risk<br />

The Group has a liquidity risk arising from its ability to fund its liabilities <strong>and</strong> exploration commitments. This risk is<br />

managed by ensuring that the Group has sufficient funds to meet those commitments by monitoring the expected<br />

total cash in <strong>and</strong> out flows on a continuous basis.<br />

All of the Group <strong>and</strong> Company’s trade creditors <strong>and</strong> other payables (Note 18) are payable in less than six months.<br />

(f) Derivative instruments<br />

The Company <strong>and</strong> Group did not make use of derivative instruments during the year or during the prior year.<br />

(g) Disclosure of fair values<br />

The carrying value of security deposits <strong>and</strong> financial liabilities disclosed in the financial statements as at 31<br />

December <strong>2011</strong> approximate their fair value for both the Company <strong>and</strong> Group.<br />

The Group uses various methods in estimating the fair value for financial instruments carried at fair value in the<br />

financial statements. The methods comprise:<br />

Level 1 the fair value is calculated using quoted prices in active markets.<br />

Level 2 the fair value is estimated using inputs other than quoted prices included in Level 1 that are<br />

observable for the asset of liability, either directly (as price) or indirectly (derived from prices).<br />

Level 3 the fair value is estimated using inputs for the asset or liability that are not based on observable<br />

market date.<br />

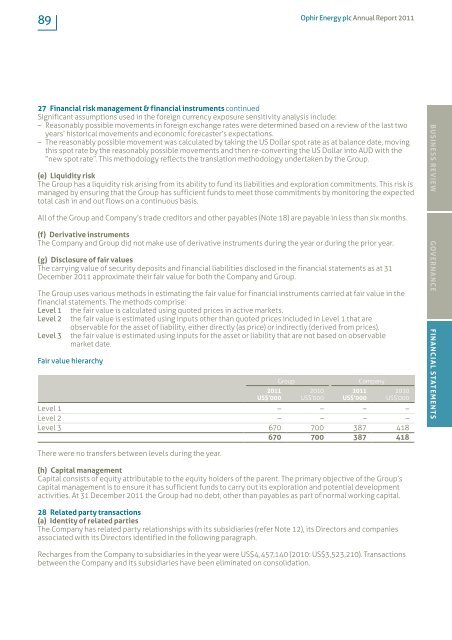

Fair value hierarchy<br />

Group<br />

<strong>2011</strong><br />

US$’000<br />

2010<br />

US$’000<br />

<strong>2011</strong><br />

US$’000<br />

Company<br />

2010<br />

US$’000<br />

Level 1 – – – –<br />

Level 2 – – – –<br />

Level 3 670 700 387 418<br />

670 700 387 418<br />

BUSINESS REVIEW GOVERNANCE FINANCIAL STATEMENTS<br />

There were no transfers between levels during the year.<br />

(h) Capital management<br />

Capital consists of equity attributable to the equity holders of the parent. The primary objective of the Group’s<br />

capital management is to ensure it has sufficient funds to carry out its exploration <strong>and</strong> potential development<br />

activities. At 31 December <strong>2011</strong> the Group had no debt, other than payables as part of normal working capital.<br />

28 Related party transactions<br />

(a) Identity of related parties<br />

The Company has related party relationships with its subsidiaries (refer Note 12), its Directors <strong>and</strong> companies<br />

associated with its Directors identified in the following paragraph.<br />

Recharges from the Company to subsidiaries in the year were US$4,457,140 (2010: US$3,523,210). Transactions<br />

between the Company <strong>and</strong> its subsidiaries have been eliminated on consolidation.