Ophir Energy plc Annual Report and Accounts 2011

Ophir Energy plc Annual Report and Accounts 2011

Ophir Energy plc Annual Report and Accounts 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

76<br />

<strong>Ophir</strong> <strong>Energy</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

Notes to the financial statements continued<br />

8 Taxation continued<br />

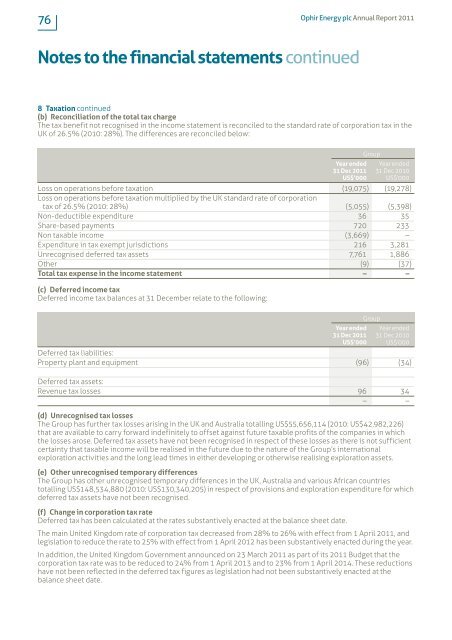

(b) Reconciliation of the total tax charge<br />

The tax benefit not recognised in the income statement is reconciled to the st<strong>and</strong>ard rate of corporation tax in the<br />

UK of 26.5% (2010: 28%). The differences are reconciled below:<br />

Year ended<br />

31 Dec <strong>2011</strong><br />

US$’000<br />

Group<br />

Year ended<br />

31 Dec 2010<br />

US$’000<br />

Loss on operations before taxation (19,075) (19,278)<br />

Loss on operations before taxation multiplied by the UK st<strong>and</strong>ard rate of corporation<br />

tax of 26.5% (2010: 28%) (5,055) (5,398)<br />

Non-deductible expenditure 36 35<br />

Share-based payments 720 233<br />

Non taxable income (3,669) –<br />

Expenditure in tax exempt jurisdictions 216 3,281<br />

Unrecognised deferred tax assets 7,761 1,886<br />

Other (9) (37)<br />

Total tax expense in the income statement – –<br />

(c) Deferred income tax<br />

Deferred income tax balances at 31 December relate to the following:<br />

Year ended<br />

31 Dec <strong>2011</strong><br />

US$’000<br />

Group<br />

Year ended<br />

31 Dec 2010<br />

US$’000<br />

Deferred tax liabilities:<br />

Property plant <strong>and</strong> equipment (96) (34)<br />

Deferred tax assets:<br />

Revenue tax losses 96 34<br />

– –<br />

(d) Unrecognised tax losses<br />

The Group has further tax losses arising in the UK <strong>and</strong> Australia totalling US$55,656,114 (2010: US$42,982,226)<br />

that are available to carry forward indefinitely to offset against future taxable profits of the companies in which<br />

the losses arose. Deferred tax assets have not been recognised in respect of these losses as there is not sufficient<br />

certainty that taxable income will be realised in the future due to the nature of the Group’s international<br />

exploration activities <strong>and</strong> the long lead times in either developing or otherwise realising exploration assets.<br />

(e) Other unrecognised temporary differences<br />

The Group has other unrecognised temporary differences in the UK, Australia <strong>and</strong> various African countries<br />

totalling US$148,534,880 (2010: US$130,340,205) in respect of provisions <strong>and</strong> exploration expenditure for which<br />

deferred tax assets have not been recognised.<br />

(f) Change in corporation tax rate<br />

Deferred tax has been calculated at the rates substantively enacted at the balance sheet date.<br />

The main United Kingdom rate of corporation tax decreased from 28% to 26% with effect from 1 April <strong>2011</strong>, <strong>and</strong><br />

legislation to reduce the rate to 25% with effect from 1 April 2012 has been substantively enacted during the year.<br />

In addition, the United Kingdom Government announced on 23 March <strong>2011</strong> as part of its <strong>2011</strong> Budget that the<br />

corporation tax rate was to be reduced to 24% from 1 April 2013 <strong>and</strong> to 23% from 1 April 2014. These reductions<br />

have not been reflected in the deferred tax figures as legislation had not been substantively enacted at the<br />

balance sheet date.