Notes to Consolidated Financial Statements - Barbados Investment ...

Notes to Consolidated Financial Statements - Barbados Investment ...

Notes to Consolidated Financial Statements - Barbados Investment ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

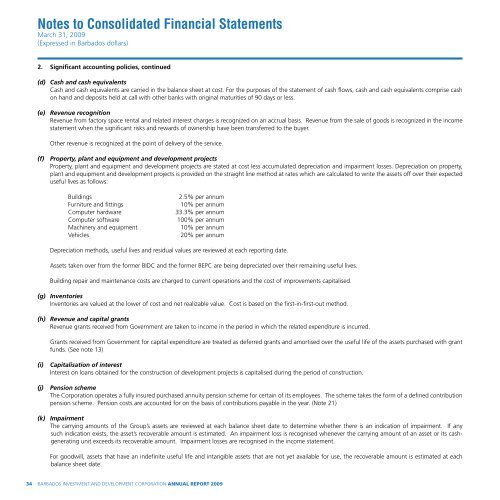

<strong>Notes</strong> <strong>to</strong> <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong><br />

March 31, 2009<br />

(Expressed in <strong>Barbados</strong> dollars)<br />

2. Significant accounting policies, continued<br />

(d) Cash and cash equivalents<br />

Cash and cash equivalents are carried in the balance sheet at cost. For the purposes of the statement of cash flows, cash and cash equivalents comprise cash<br />

on hand and deposits held at call with other banks with original maturities of 90 days or less.<br />

(e) Revenue recognition<br />

Revenue from fac<strong>to</strong>ry space rental and related interest charges is recognized on an accrual basis. Revenue from the sale of goods is recognized in the income<br />

statement when the significant risks and rewards of ownership have been transferred <strong>to</strong> the buyer.<br />

Other revenue is recognized at the point of delivery of the service.<br />

(f) Property, plant and equipment and development projects<br />

Property, plant and equipment and development projects are stated at cost less accumulated depreciation and impairment losses. Depreciation on property,<br />

plant and equipment and development projects is provided on the straight line method at rates which are calculated <strong>to</strong> write the assets off over their expected<br />

useful lives as follows:<br />

Buildings<br />

Furniture and fittings<br />

Computer hardware<br />

Computer software<br />

Machinery and equipment<br />

Vehicles<br />

2.5% per annum<br />

10% per annum<br />

33.3% per annum<br />

100% per annum<br />

10% per annum<br />

20% per annum<br />

Depreciation methods, useful lives and residual values are reviewed at each reporting date.<br />

Assets taken over from the former BIDC and the former BEPC are being depreciated over their remaining useful lives.<br />

Building repair and maintenance costs are charged <strong>to</strong> current operations and the cost of improvements capitalised.<br />

(g) Inven<strong>to</strong>ries<br />

Inven<strong>to</strong>ries are valued at the lower of cost and net realizable value. Cost is based on the first-in-first-out method.<br />

(h) Revenue and capital grants<br />

Revenue grants received from Government are taken <strong>to</strong> income in the period in which the related expenditure is incurred.<br />

Grants received from Government for capital expenditure are treated as deferred grants and amortised over the useful life of the assets purchased with grant<br />

funds. (See note 13)<br />

(i)<br />

(j)<br />

Capitalisation of interest<br />

Interest on loans obtained for the construction of development projects is capitalised during the period of construction.<br />

Pension scheme<br />

The Corporation operates a fully insured purchased annuity pension scheme for certain of its employees. The scheme takes the form of a defined contribution<br />

pension scheme. Pension costs are accounted for on the basis of contributions payable in the year. (Note 21)<br />

(k) Impairment<br />

The carrying amounts of the Group’s assets are reviewed at each balance sheet date <strong>to</strong> determine whether there is an indication of impairment. If any<br />

such indication exists, the asset’s recoverable amount is estimated. An impairment loss is recognised whenever the carrying amount of an asset or its cashgenerating<br />

unit exceeds its recoverable amount. Impairment losses are recognised in the income statement.<br />

For goodwill, assets that have an indefinite useful life and intangible assets that are not yet available for use, the recoverable amount is estimated at each<br />

balance sheet date.<br />

34<br />

BARBADOS INVESTMENT AND DEVELOPMENT CORPORATION ANNUAL REPORT 2009