Notes to Consolidated Financial Statements - Barbados Investment ...

Notes to Consolidated Financial Statements - Barbados Investment ...

Notes to Consolidated Financial Statements - Barbados Investment ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Notes</strong> <strong>to</strong> <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong><br />

March 31, 2009<br />

(Expressed in <strong>Barbados</strong> dollars)<br />

Market risk<br />

Market risk is the risk that changes in market prices, such as foreign exchange rates, interest rates and equity prices will affect the Corporation’s income or<br />

the value of its holdings of financial instruments. The objective of market risk management is <strong>to</strong> manage and control market risk exposures within acceptable<br />

parameters, while optimising the return.<br />

(i)<br />

Currency risk<br />

The Corporation is exposed <strong>to</strong> currency risk on purchases that are denominated in a currency other than the functional currency of the Corporation.<br />

(ii) Interest rate risk<br />

The Corporation faces some risks associated with the effects of fluctuations in the levels of interest rates on certain financial assets and liabilities. The<br />

interest rates and terms of repayment of long-term debt are disclosed in note 10 <strong>to</strong> the financial statements, and are fixed for the most part.<br />

(iii) Capital management<br />

The Board’s policy is <strong>to</strong> maintain a strong capital base so as <strong>to</strong> maintain credi<strong>to</strong>r and market confidence and <strong>to</strong> sustain future development of the<br />

business.<br />

There were no changes <strong>to</strong> the Corporation’s approach <strong>to</strong> capital management during the year.<br />

(iv) Fair values<br />

The fair value of cash and cash equivalents, accounts receivables, investments, staff loans, accounts payable and accrued liabilities and long term debt<br />

are determined not <strong>to</strong> be materially different from their carrying value due <strong>to</strong> their short term nature. Long-term debt is not materially different from its<br />

carrying amounts.<br />

Fair value estimates are made at a specific point in time, based on market conditions and information about the financial instrument. These estimates<br />

are subjective in nature and involve uncertainties and matters of significant judgment and therefore, cannot be determined with precision. Changes in<br />

assumptions could significantly affect the estimates. All non-financial instruments such as inven<strong>to</strong>ry are excluded from fair value disclosure. Thus the <strong>to</strong>tal<br />

fair value amounts cannot be aggregated <strong>to</strong> determine the underlying economic value of the Company.<br />

The basis for determining fair values is disclosed in note 3.<br />

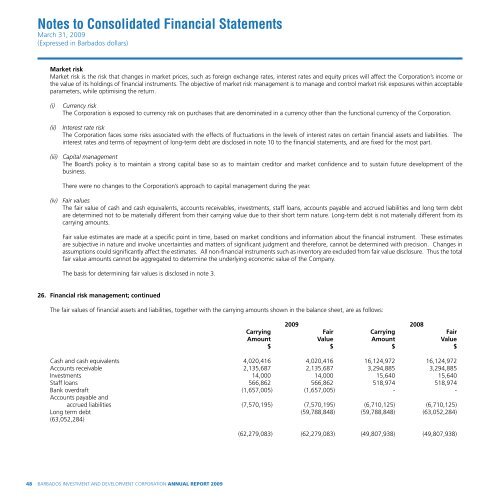

26. <strong>Financial</strong> risk management; continued<br />

The fair values of financial assets and liabilities, <strong>to</strong>gether with the carrying amounts shown in the balance sheet, are as follows:<br />

2009 2008<br />

Carrying Fair Carrying Fair<br />

Amount Value Amount Value<br />

$ $ $ $<br />

Cash and cash equivalents 4,020,416 4,020,416 16,124,972 16,124,972<br />

Accounts receivable 2,135,687 2,135,687 3,294,885 3,294,885<br />

<strong>Investment</strong>s 14,000 14,000 15,640 15,640<br />

Staff loans 566,862 566,862 518,974 518,974<br />

Bank overdraft (1,657,005) (1,657,005) - -<br />

Accounts payable and<br />

accrued liabilities (7,570,195) (7,570,195) (6,710,125) (6,710,125)<br />

Long term debt (59,788,848) (59,788,848) (63,052,284)<br />

(63,052,284)<br />

(62,279,083) (62,279,083) (49,807,938) (49,807,938)<br />

48<br />

BARBADOS INVESTMENT AND DEVELOPMENT CORPORATION ANNUAL REPORT 2009