Notes to Consolidated Financial Statements - Barbados Investment ...

Notes to Consolidated Financial Statements - Barbados Investment ...

Notes to Consolidated Financial Statements - Barbados Investment ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Notes</strong> <strong>to</strong> <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong><br />

March 31, 2009<br />

(Expressed in <strong>Barbados</strong> dollars)<br />

26. <strong>Financial</strong> risk management<br />

<strong>Financial</strong> assets of the Corporation include cash and cash equivalents, accounts receivables, investments and staff loans. <strong>Financial</strong> liabilities include accounts<br />

payable and accrued liabilities and long-term debt.<br />

Overview<br />

The Corporation has exposure <strong>to</strong> the following risks from its use of financial instruments:<br />

• credit risk<br />

• liquidity risk<br />

• market risk<br />

This note presents information about the Corporation’s exposure <strong>to</strong> each of the above risks, the Corporation’s objectives, policies and processes for measuring<br />

and managing risk, and the Corporation’s management of capital. Further quantitative disclosures are included throughout these financial statements.<br />

The Board of Direc<strong>to</strong>rs has overall responsibility for the establishment and oversight of the Corporation’s risk management framework.<br />

The Corporation’s risk management policies are established <strong>to</strong> identify and analyse the risks faced by the Corporation, set appropriate risk limits and controls,<br />

and moni<strong>to</strong>r risks and adherence <strong>to</strong> limits. Risk management policies and systems are reviewed regularly <strong>to</strong> reflect changes in market conditions and the<br />

Corporation’s activities. The Corporation, through its training and management standards and procedures, aims <strong>to</strong> develop a disciplined and structured<br />

environment in which all employees understand their roles and obligations.<br />

Credit risk<br />

Credit risk is the risk of financial loss <strong>to</strong> the Corporation if a member or counterparty <strong>to</strong> a financial instrument fails <strong>to</strong> meet its contractual obligations, and<br />

arises principally from the Corporation’s receivables from cus<strong>to</strong>mers. Credit risk on cash is limited as cash is comprised of current account balances held with<br />

reputable banks and cash floats held for cashiers.<br />

Trade and other receivables<br />

The Corporation’s exposure <strong>to</strong> credit risk is influenced mainly by the individual characteristics of each cus<strong>to</strong>mer. The Corporation’s revenue is generated from<br />

the rental of leasehold properties and from government subvention.<br />

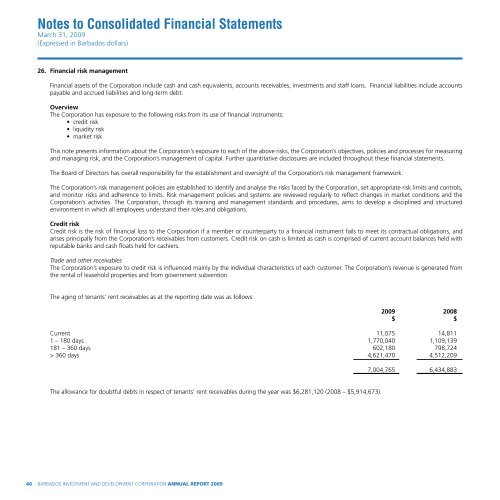

The aging of tenants’ rent receivables as at the reporting date was as follows:<br />

2009 2008<br />

$ $<br />

Current 11,075 14,811<br />

1 – 180 days 1,770,040 1,109,139<br />

181 – 360 days 602,180 798,724<br />

> 360 days 4,621,470 4,512,209<br />

7,004,765 6,434,883<br />

The allowance for doubtful debts in respect of tenants’ rent receivables during the year was $6,281,120 (2008 – $5,914,673).<br />

46<br />

BARBADOS INVESTMENT AND DEVELOPMENT CORPORATION ANNUAL REPORT 2009