Equity Valuation and Analysis - Mark Moore

Equity Valuation and Analysis - Mark Moore

Equity Valuation and Analysis - Mark Moore

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

facility or building without assuming all the risk that comes along if they were to own it.<br />

Because of GAAP’s loose requirements, managers have the flexibility whether to<br />

distinguish it from a capital lease or an operating lease. By choosing to use an<br />

operating lease, firms are able to lower their long term liabilities by simply expensing<br />

these payments each year. However, this makes it hard to determine how much these<br />

expenses actually are because they are consolidated in the category of “Other long<br />

term expenses.” Due to the fact that there are such loose requirements set up by<br />

GAAP, managers have given very low disclosure based around these figures.<br />

Throughout Dow’s 10-k, they have given the figures of the bare minimum yearly<br />

payments of these leases. These payments include (2007) $251 million, (2008) $208<br />

million, (2009) $179 million, (2010) $137 million, (2011) $85 million, <strong>and</strong> (2012 <strong>and</strong><br />

thereafter) $565 million. Thus, it nearly impossible to determine how firms like Dow are<br />

accounting for these expenses.<br />

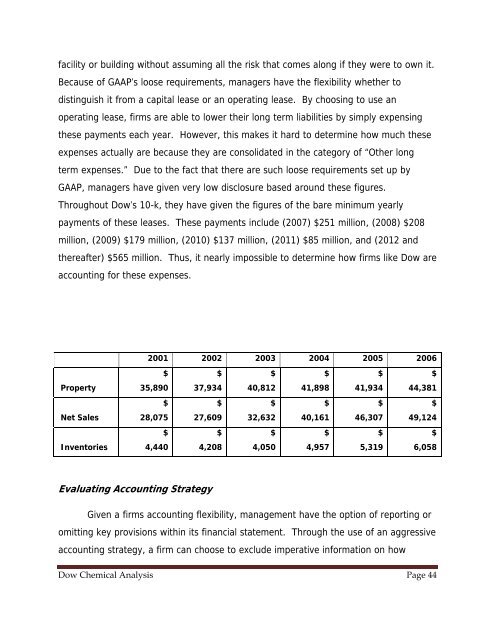

2001 2002 2003 2004 2005 2006<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

Property<br />

35,890<br />

37,934<br />

40,812<br />

41,898<br />

41,934<br />

44,381<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

Net Sales<br />

28,075<br />

27,609<br />

32,632<br />

40,161<br />

46,307<br />

49,124<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

Inventories<br />

4,440<br />

4,208<br />

4,050<br />

4,957<br />

5,319<br />

6,058<br />

Evaluating Accounting Strategy<br />

Given a firms accounting flexibility, management have the option of reporting or<br />

omitting key provisions within its financial statement. Through the use of an aggressive<br />

accounting strategy, a firm can choose to exclude imperative information on how<br />

Dow Chemical <strong>Analysis</strong> Page 44