Equity Valuation and Analysis - Mark Moore

Equity Valuation and Analysis - Mark Moore

Equity Valuation and Analysis - Mark Moore

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

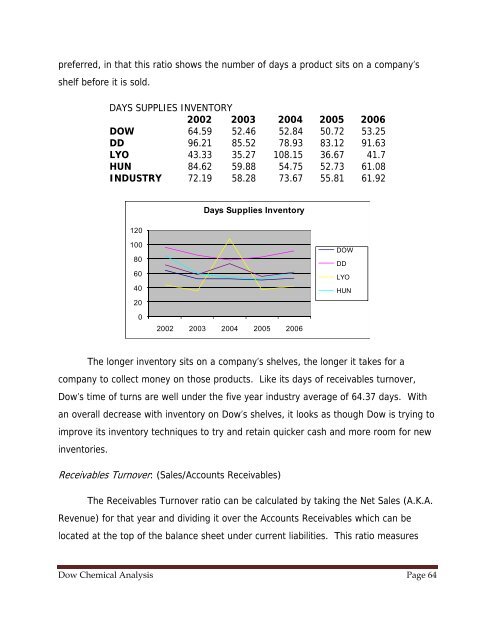

preferred, in that this ratio shows the number of days a product sits on a company’s<br />

shelf before it is sold.<br />

DAYS SUPPLIES INVENTORY<br />

2002 2003 2004 2005 2006<br />

DOW 64.59 52.46 52.84 50.72 53.25<br />

DD 96.21 85.52 78.93 83.12 91.63<br />

LYO 43.33 35.27 108.15 36.67 41.7<br />

HUN 84.62 59.88 54.75 52.73 61.08<br />

INDUSTRY 72.19 58.28 73.67 55.81 61.92<br />

120<br />

Days Supplies Inventory<br />

100<br />

80<br />

60<br />

40<br />

20<br />

DOW<br />

DD<br />

LYO<br />

HUN<br />

0<br />

2002 2003 2004 2005 2006<br />

The longer inventory sits on a company’s shelves, the longer it takes for a<br />

company to collect money on those products. Like its days of receivables turnover,<br />

Dow’s time of turns are well under the five year industry average of 64.37 days. With<br />

an overall decrease with inventory on Dow’s shelves, it looks as though Dow is trying to<br />

improve its inventory techniques to try <strong>and</strong> retain quicker cash <strong>and</strong> more room for new<br />

inventories.<br />

Receivables Turnover: (Sales/Accounts Receivables)<br />

The Receivables Turnover ratio can be calculated by taking the Net Sales (A.K.A.<br />

Revenue) for that year <strong>and</strong> dividing it over the Accounts Receivables which can be<br />

located at the top of the balance sheet under current liabilities. This ratio measures<br />

Dow Chemical <strong>Analysis</strong> Page 64