League Reaffirmation - Johnson County Community College

League Reaffirmation - Johnson County Community College

League Reaffirmation - Johnson County Community College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

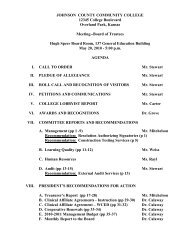

Finance<br />

For fiscal year 20062007, the college’s management<br />

budget, representing the actual amount available to spend<br />

in a year, was $168,446,734. It was composed of the<br />

operating budget, totaling $126,300,569, and the budgets<br />

for all other funds such as capital outlay, auxiliary and<br />

restricted funds, totaling $42,146,165.<br />

Because the college anticipated an increase in both state<br />

aid and assessed valuation in the county, the 20062007<br />

budget reflected a decrease in the mill levy of .1 mill,<br />

dropping it to 8.860 mills. This was the lowest the college’s<br />

mill levy had been since 2002. The reduction meant the<br />

average homeowner in <strong>Johnson</strong> <strong>County</strong> paid about<br />

$234 a year to support the college.<br />

In 20062007, about 58 percent of JCCC’s operating<br />

funding came from county taxes; the rest came from student<br />

tuition, motor vehicle taxes, state aid and outofdistrict tuition.<br />

20062007 GENERAL FUND REVENUES<br />

52% | Ad Valorem<br />

Taxes<br />

6% | Local Motor<br />

Vehicle Taxes<br />

16% | State Aid<br />

8% | Other<br />

18% | Tuition<br />

AAA rating<br />

According to a report published in<br />

October 2006 by Standard & Poor’s titled<br />

AAARated Credits in U.S. State & Local<br />

Government Finance, JCCC continues to<br />

maintain the highest bond ratings, AAA.<br />

Only 21 school districts in the nation,<br />

including five community college districts<br />

and one technical college district, had their<br />

government obligation debt rated AAA.<br />

According to the report, general<br />

characteristics of AAA districts include<br />

growing tax bases and proximity to<br />

economic centers, very high wealth<br />

indices, strong management practices<br />

with a focus on multiyear planning,<br />

strong financial position, management<br />

of debt burden and appropriate ratios<br />

and rankings for average overall net<br />

debt per capita, average per capita<br />

market value and average general fund<br />

balance as a percentage of operating<br />

expenditures.<br />

According to Standard & Poor’s, an<br />

organization rated BBB or higher is<br />

regarded as having financial security<br />

characteristics that outweigh any<br />

vulnerabilities and is highly likely<br />

to have the ability to meet financial<br />

commitments. An organization rated<br />

AAA has “extremely strong” financial<br />

security characteristics; AAA is the<br />

highest rating Standard & Poor’s assigns.<br />

20062007 GENERAL FUND EXPENDITURES<br />

68% | Salaries and<br />

Benefits<br />

20% | Current<br />

Operating<br />

12% | Capital<br />

In 20082009, students will likely see an increase in tuition<br />

of $2 per credit hour for instate students and $5 per credit<br />

hour for outofstate students. <strong>Johnson</strong> <strong>County</strong> residents will<br />

pay $65 a credit hour, Kansas residents outside the county<br />

will pay $80 a credit hour and nonKansas residents will<br />

pay $149 a credit hour.<br />

“These high ratings are testimony<br />

to JCCC’s financial responsibility.<br />

By funding capital projects now,<br />

we can take advantage of low<br />

interest rates and save the<br />

taxpayers money.”<br />

– Lynn Mitchelson,<br />

chair, JCCC board of trustees<br />

61