2012 Financial Statements - Workers' Compensation Board

2012 Financial Statements - Workers' Compensation Board

2012 Financial Statements - Workers' Compensation Board

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

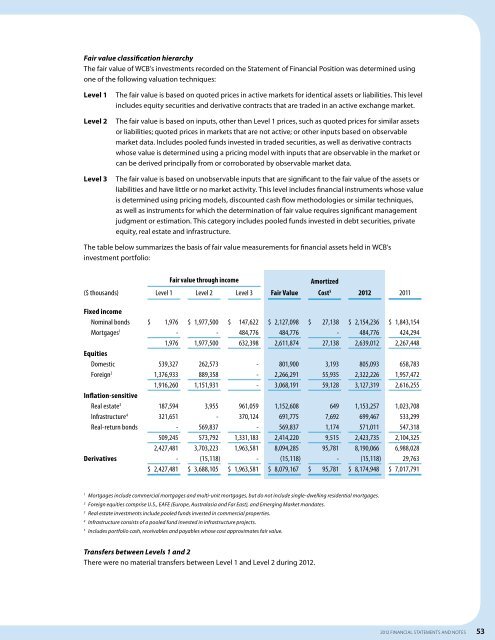

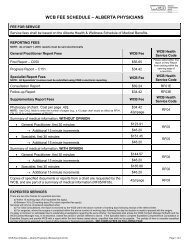

Fair value classification hierarchy<br />

The fair value of WCB’s investments recorded on the Statement of <strong>Financial</strong> Position was determined using<br />

one of the following valuation techniques:<br />

Level 1<br />

Level 2<br />

Level 3<br />

The fair value is based on quoted prices in active markets for identical assets or liabilities. This level<br />

includes equity securities and derivative contracts that are traded in an active exchange market.<br />

The fair value is based on inputs, other than Level 1 prices, such as quoted prices for similar assets<br />

or liabilities; quoted prices in markets that are not active; or other inputs based on observable<br />

market data. Includes pooled funds invested in traded securities, as well as derivative contracts<br />

whose value is determined using a pricing model with inputs that are observable in the market or<br />

can be derived principally from or corroborated by observable market data.<br />

The fair value is based on unobservable inputs that are significant to the fair value of the assets or<br />

liabilities and have little or no market activity. This level includes financial instruments whose value<br />

is determined using pricing models, discounted cash flow methodologies or similar techniques,<br />

as well as instruments for which the determination of fair value requires significant management<br />

judgment or estimation. This category includes pooled funds invested in debt securities, private<br />

equity, real estate and infrastructure.<br />

The table below summarizes the basis of fair value measurements for financial assets held in WCB’s<br />

investment portfolio:<br />

($ thousands)<br />

Fair value through income<br />

Level 1 Level 2 Level 3<br />

Fair Value<br />

Amortized<br />

Cost 5<br />

<strong>2012</strong><br />

2011<br />

Fixed income<br />

Nominal bonds<br />

Mortgages 1<br />

Equities<br />

Domestic<br />

Foreign 2<br />

Inflation-sensitive<br />

Real estate 3<br />

Infrastructure 4<br />

Real-return bonds<br />

Derivatives<br />

$ 1,976<br />

-<br />

1,976<br />

539,327<br />

1,376,933<br />

1,916,260<br />

187,594<br />

321,651<br />

-<br />

509,245<br />

2,427,481<br />

-<br />

$ 2,427,481<br />

$ 1,977,500<br />

-<br />

1,977,500<br />

262,573<br />

889,358<br />

1,151,931<br />

3,955<br />

-<br />

569,837<br />

573,792<br />

3,703,223<br />

(15,118)<br />

$ 3,688,105<br />

$ 147,622<br />

484,776<br />

632,398<br />

-<br />

-<br />

-<br />

961,059<br />

370,124<br />

-<br />

1,331,183<br />

1,963,581<br />

-<br />

$ 1,963,581<br />

$ 2,127,098<br />

484,776<br />

2,611,874<br />

801,900<br />

2,266,291<br />

3,068,191<br />

1,152,608<br />

691,775<br />

569,837<br />

2,414,220<br />

8,094,285<br />

(15,118)<br />

$ 8,079,167<br />

$ 27,138<br />

-<br />

27,138<br />

3,193<br />

55,935<br />

59,128<br />

649<br />

7,692<br />

1,174<br />

9,515<br />

95,781<br />

-<br />

$ 95,781<br />

$ 2,154,236<br />

484,776<br />

2,639,012<br />

805,093<br />

2,322,226<br />

3,127,319<br />

1,153,257<br />

699,467<br />

571,011<br />

2,423,735<br />

8,190,066<br />

(15,118)<br />

$ 8,174,948<br />

$ 1,843,154<br />

424,294<br />

2,267,448<br />

658,783<br />

1,957,472<br />

2,616,255<br />

1,023,708<br />

533,299<br />

547,318<br />

2,104,325<br />

6,988,028<br />

29,763<br />

$ 7,017,791<br />

1<br />

Mortgages include commercial mortgages and multi-unit mortgages, but do not include single-dwelling residential mortgages.<br />

2<br />

Foreign equities comprise U.S., EAFE (Europe, Australasia and Far East), and Emerging Market mandates.<br />

3<br />

Real estate investments include pooled funds invested in commercial properties.<br />

4<br />

Infrastructure consists of a pooled fund invested in infrastructure projects.<br />

5<br />

Includes portfolio cash, receivables and payables whose cost approximates fair value.<br />

Transfers between Levels 1 and 2<br />

There were no material transfers between Level 1 and Level 2 during <strong>2012</strong>.<br />

<strong>2012</strong> FINANCIAL STATEMENTS and notes 53