2012 Financial Statements - Workers' Compensation Board

2012 Financial Statements - Workers' Compensation Board

2012 Financial Statements - Workers' Compensation Board

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

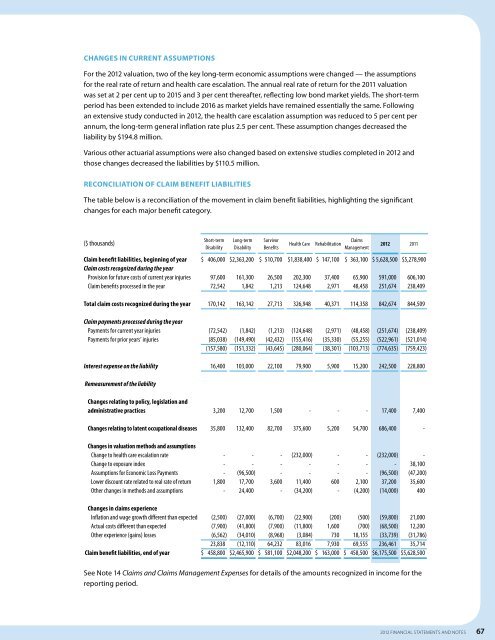

Changes in current assumptions<br />

For the <strong>2012</strong> valuation, two of the key long-term economic assumptions were changed — the assumptions<br />

for the real rate of return and health care escalation. The annual real rate of return for the 2011 valuation<br />

was set at 2 per cent up to 2015 and 3 per cent thereafter, reflecting low bond market yields. The short-term<br />

period has been extended to include 2016 as market yields have remained essentially the same. Following<br />

an extensive study conducted in <strong>2012</strong>, the health care escalation assumption was reduced to 5 per cent per<br />

annum, the long-term general inflation rate plus 2.5 per cent. These assumption changes decreased the<br />

liability by $194.8 million.<br />

Various other actuarial assumptions were also changed based on extensive studies completed in <strong>2012</strong> and<br />

those changes decreased the liabilities by $110.5 million.<br />

Reconciliation of claim benefit liabilities<br />

The table below is a reconciliation of the movement in claim benefit liabilities, highlighting the significant<br />

changes for each major benefit category.<br />

($ thousands)<br />

Short-term<br />

Disability<br />

Long-term<br />

Disability<br />

Survivor<br />

Benefits<br />

Health Care<br />

Rehabilitation<br />

Claims<br />

Management<br />

<strong>2012</strong> 2011<br />

Claim benefit liabilities, beginning of year<br />

Claim costs recognized during the year<br />

Provision for future costs of current year injuries<br />

Claim benefits processed in the year<br />

$ 406,000<br />

97,600<br />

72,542<br />

$ 2,363,200<br />

161,300<br />

1,842<br />

$ 510,700<br />

26,500<br />

1,213<br />

$ 1,838,400<br />

202,300<br />

124,648<br />

$ 147,100<br />

37,400<br />

2,971<br />

$ 363,100<br />

65,900<br />

48,458<br />

$ 5,628,500<br />

591,000<br />

251,674<br />

$ 5,278,900<br />

606,100<br />

238,409<br />

Total claim costs recognized during the year<br />

170,142<br />

163,142<br />

27,713<br />

326,948<br />

40,371<br />

114,358<br />

842,674<br />

844,509<br />

Claim payments processed during the year<br />

Payments for current year injuries<br />

Payments for prior years’ injuries<br />

(72,542)<br />

(85,038)<br />

(157,580)<br />

(1,842)<br />

(149,490)<br />

(151,332)<br />

(1,213)<br />

(42,432)<br />

(43,645)<br />

(124,648)<br />

(155,416)<br />

(280,064)<br />

(2,971)<br />

(35,330)<br />

(38,301)<br />

(48,458)<br />

(55,255)<br />

(103,713)<br />

(251,674)<br />

(522,961)<br />

(774,635)<br />

(238,409)<br />

(521,014)<br />

(759,423)<br />

Interest expense on the liability<br />

16,400<br />

103,000<br />

22,100<br />

79,900<br />

5,900<br />

15,200<br />

242,500<br />

228,800<br />

Remeasurement of the liability<br />

Changes relating to policy, legislation and<br />

administrative practices<br />

3,200<br />

12,700<br />

1,500<br />

-<br />

-<br />

-<br />

17,400<br />

7,400<br />

Changes relating to latent occupational diseases<br />

35,800<br />

132,400<br />

82,700<br />

375,600<br />

5,200<br />

54,700<br />

686,400<br />

-<br />

Changes in valuation methods and assumptions<br />

Change to health care escalation rate<br />

Change to exposure index<br />

Assumptions for Economic Loss Payments<br />

Lower discount rate related to real rate of return<br />

Other changes in methods and assumptions<br />

-<br />

-<br />

-<br />

1,800<br />

-<br />

-<br />

-<br />

(96,500)<br />

17,700<br />

24,400<br />

-<br />

-<br />

-<br />

3,600<br />

-<br />

(232,000)<br />

-<br />

-<br />

11,400<br />

(34,200)<br />

-<br />

-<br />

-<br />

600<br />

-<br />

-<br />

-<br />

-<br />

2,100<br />

(4,200)<br />

(232,000)<br />

-<br />

(96,500)<br />

37,200<br />

(14,000)<br />

-<br />

38,100<br />

(47,200)<br />

35,600<br />

400<br />

Changes in claims experience<br />

Inflation and wage growth different than expected<br />

Actual costs different than expected<br />

Other experience (gains) losses<br />

Claim benefit liabilities, end of year<br />

(2,500)<br />

(7,900)<br />

(6,562)<br />

23,838<br />

$ 458,800<br />

(27,000)<br />

(41,800)<br />

(34,010)<br />

(12,110)<br />

$ 2,465,900<br />

(6,700)<br />

(7,900)<br />

(8,968)<br />

64,232<br />

$ 581,100<br />

(22,900)<br />

(11,800)<br />

(3,084)<br />

83,016<br />

$ 2,048,200<br />

(200)<br />

1,600<br />

730<br />

7,930<br />

$ 163,000<br />

(500)<br />

(700)<br />

18,155<br />

69,555<br />

$ 458,500<br />

(59,800)<br />

(68,500)<br />

(33,739)<br />

236,461<br />

$ 6,175,500<br />

21,000<br />

12,200<br />

(31,786)<br />

35,714<br />

$ 5,628,500<br />

See Note 14 Claims and Claims Management Expenses for details of the amounts recognized in income for the<br />

reporting period.<br />

<strong>2012</strong> FINANCIAL STATEMENTS and notes 67