2012 Financial Statements - Workers' Compensation Board

2012 Financial Statements - Workers' Compensation Board

2012 Financial Statements - Workers' Compensation Board

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

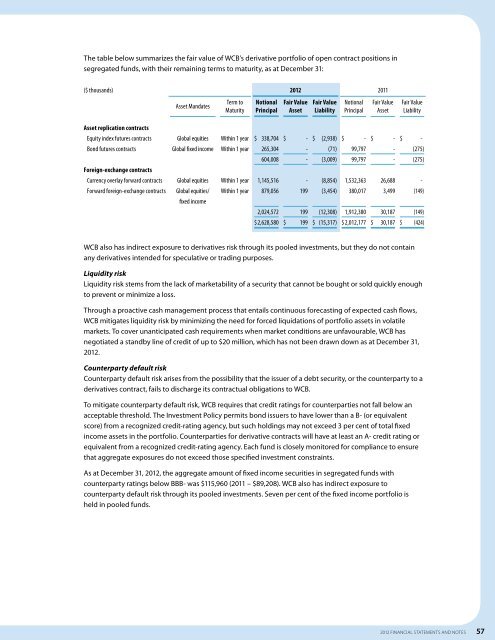

The table below summarizes the fair value of WCB’s derivative portfolio of open contract positions in<br />

segregated funds, with their remaining terms to maturity, as at December 31:<br />

($ thousands) . <strong>2012</strong> 2011<br />

Asset Mandates<br />

Term to<br />

Maturity<br />

Notional<br />

Principal<br />

Fair Value<br />

Asset<br />

Fair Value<br />

Liability<br />

Notional<br />

Principal<br />

Fair Value<br />

Asset<br />

Fair Value<br />

Liability<br />

Asset replication contracts<br />

Equity index futures contracts<br />

Bond futures contracts<br />

Foreign-exchange contracts<br />

Currency overlay forward contracts<br />

Forward foreign-exchange contracts<br />

Global equities<br />

Global fixed income<br />

Global equities<br />

Global equities/<br />

fixed income<br />

Within 1 year<br />

Within 1 year<br />

Within 1 year<br />

Within 1 year<br />

$338,704<br />

265,304<br />

604,008<br />

1,145,516<br />

879,056<br />

2,024,572<br />

$2,628,580<br />

$(2,938)<br />

(71)<br />

(3,009)<br />

(8,854)<br />

(3,454)<br />

(12,308)<br />

$ (15,317)<br />

$-<br />

-<br />

-<br />

-<br />

199<br />

199<br />

$ 199<br />

$-<br />

99,797<br />

99,797<br />

1,532,363<br />

380,017<br />

1,912,380<br />

$2,012,177<br />

$-<br />

-<br />

-<br />

26,688<br />

3,499<br />

30,187<br />

$30,187<br />

$ -<br />

(275)<br />

(275)<br />

-<br />

(149)<br />

(149)<br />

$(424)<br />

WCB also has indirect exposure to derivatives risk through its pooled investments, but they do not contain<br />

any derivatives intended for speculative or trading purposes.<br />

Liquidity risk<br />

Liquidity risk stems from the lack of marketability of a security that cannot be bought or sold quickly enough<br />

to prevent or minimize a loss.<br />

Through a proactive cash management process that entails continuous forecasting of expected cash flows,<br />

WCB mitigates liquidity risk by minimizing the need for forced liquidations of portfolio assets in volatile<br />

markets. To cover unanticipated cash requirements when market conditions are unfavourable, WCB has<br />

negotiated a standby line of credit of up to $20 million, which has not been drawn down as at December 31,<br />

<strong>2012</strong>.<br />

Counterparty default risk<br />

Counterparty default risk arises from the possibility that the issuer of a debt security, or the counterparty to a<br />

derivatives contract, fails to discharge its contractual obligations to WCB.<br />

To mitigate counterparty default risk, WCB requires that credit ratings for counterparties not fall below an<br />

acceptable threshold. The Investment Policy permits bond issuers to have lower than a B- (or equivalent<br />

score) from a recognized credit-rating agency, but such holdings may not exceed 3 per cent of total fixed<br />

income assets in the portfolio. Counterparties for derivative contracts will have at least an A- credit rating or<br />

equivalent from a recognized credit-rating agency. Each fund is closely monitored for compliance to ensure<br />

that aggregate exposures do not exceed those specified investment constraints.<br />

As at December 31, <strong>2012</strong>, the aggregate amount of fixed income securities in segregated funds with<br />

counterparty ratings below BBB- was $115,960 (2011 – $89,208). WCB also has indirect exposure to<br />

counterparty default risk through its pooled investments. Seven per cent of the fixed income portfolio is<br />

held in pooled funds.<br />

<strong>2012</strong> FINANCIAL STATEMENTS and notes 57