Vol 10, No 3 - Financial Planning Association of Malaysia

Vol 10, No 3 - Financial Planning Association of Malaysia

Vol 10, No 3 - Financial Planning Association of Malaysia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

INDUSTRY<br />

July - September 20<strong>10</strong><br />

Bullet Pro<strong>of</strong> Your<br />

Retirement Plan (Part II)<br />

We have established in the<br />

previous article that investing<br />

is for the medium- to longterm<br />

and what is key to accumulate your<br />

retirement fund is to be discipline and<br />

consistent. Through this approach and<br />

cost averaging you will be able to lower<br />

your total cost <strong>of</strong> investing. Make this<br />

habit your second nature because you<br />

stand to benefit!<br />

So now that you know the recommended<br />

approach to take in accumulating your<br />

retirement pool, consider the next few<br />

questions: How much is enough? How<br />

best to determine what you need?<br />

Through proper planning you will be<br />

able to determine how much you actually<br />

need and whether your current wealth<br />

accumulation method is effective. Four<br />

simple steps have been outlined below<br />

for you to follow when planning your<br />

retirement:<br />

Step 1:<br />

Set realistic goals on the retirement<br />

lifestyle you are aiming for<br />

• By setting clear goals and having a<br />

plan to help you achieve your goals,<br />

you will be able to start making<br />

progress, in big or small consistent<br />

steps, towards your retirement goal<br />

and financial independence.<br />

• Apply a strategy and stick with it.<br />

• Make adjustments along the way.<br />

Step 2:<br />

Determine your financial requirements<br />

based on your desired retirement lifestyle<br />

• Make allowances for your daily<br />

expenses, foreign vacations and big<br />

item purchases or expenses.<br />

• You should also take into<br />

consideration the effects <strong>of</strong> inflation<br />

on the value <strong>of</strong> your money, children’s<br />

education, clearing your debts,<br />

miscellaneous expenses such as<br />

health and living costs, or expenses<br />

related to unforeseen incidences.<br />

Step 3:<br />

Make an inventory <strong>of</strong> all your financial<br />

assets and liabilities<br />

debts like housing loans, car loans,<br />

personal loans, credit card debt, etc.<br />

• Get a clear picture <strong>of</strong> your financial<br />

status which will determine the kind<br />

<strong>of</strong> financial plan needed to secure<br />

your future. Be honest!<br />

Step 4:<br />

Determine the amounts for cash savings,<br />

investments and the rate <strong>of</strong> return you are<br />

comfortable with.<br />

• This will help you choose the type<br />

<strong>of</strong> investments that will help you<br />

achieve your goals.<br />

• Start early, reinvest your gains and<br />

benefit from the compounded rate<br />

<strong>of</strong> return. You will be amazed at how<br />

a small amount <strong>of</strong> capital invested on<br />

a monthly basis over a period <strong>of</strong> time<br />

will enable you to live your dream<br />

retirement life!<br />

• Use the rule <strong>of</strong> 72 to determine how<br />

many years it will take to double the<br />

value <strong>of</strong> your investment, assuming all<br />

gains are reinvested. Take 72 divided<br />

by the returns you are receiving per<br />

annum. The answer indicates the<br />

number <strong>of</strong> years it takes to double<br />

your investment. Better still, through<br />

smart investing plans, you can<br />

possibly enjoy an early retirement!<br />

<strong>No</strong>w, let us apply the four steps to<br />

retirement planning to Jacob’s case and<br />

evaluate whether his retirement plans are<br />

achievable. If not then, how to rectify the<br />

situation?<br />

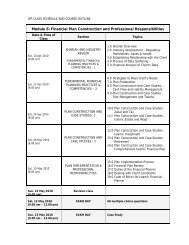

Jacob - 33 years old and is the sole breadwinner <strong>of</strong> the family <strong>of</strong> four. He<br />

has two children, a one-year-old and three-year-old and is just starting<br />

to plan for both his retirement and his wife’s retirement.<br />

Current Situation<br />

• Current household income: RM<strong>10</strong>,000 monthly / RM120,000 annually<br />

• Current Retirement Saving: RM150,000<br />

• Current investment type and return: Regular saving / investments amounting<br />

to RM1,000 monthly with an average return <strong>of</strong> <strong>10</strong> percent per annum<br />

• Expected Increase in household Income annually: 4 percent<br />

• Expected rate <strong>of</strong> Inflation annually: 3 percent<br />

Retirement Plans<br />

• Goal: To retire at the age <strong>of</strong> 55 (22 years to retirement)<br />

• Estimated life expectancy after retirement: 22 years<br />

• Desired lifestyle during retirement: <strong>No</strong>t have to work and to go for overseas<br />

holidays yearly<br />

• Estimated annual cost <strong>of</strong> living post-retirement: 90 percent <strong>of</strong> current expenses<br />

equivalent to RM9,000 monthly/ RM<strong>10</strong>8,000 annually<br />

• <strong>Financial</strong> and economic challenges: Inflation and family commitments<br />

TOTAL INVESTMENT VALUE at 55 Years Old: RM2,175,305.72<br />

Retirement Fund (RM)<br />

2,500,000<br />

2,000,000<br />

1,500,000<br />

1,000,000<br />

500,000<br />

Balance<br />

Retirement Fund<br />

• Do a simple exercise <strong>of</strong> summarising<br />

all your income sources, investments,<br />

insurance coverage and deduct your<br />

0<br />

34<br />

39 44 49 54 55 60 65 70 75<br />

Age<br />

12 The 4E Journal