Fortis Funds (Nederland) N.V. - BNP Paribas Investment Partners

Fortis Funds (Nederland) N.V. - BNP Paribas Investment Partners

Fortis Funds (Nederland) N.V. - BNP Paribas Investment Partners

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Fortis</strong> <strong>Funds</strong> (<strong>Nederland</strong>) N.V. Condensed Interim Report 2009<br />

30 June 2009 UNAUDITED<br />

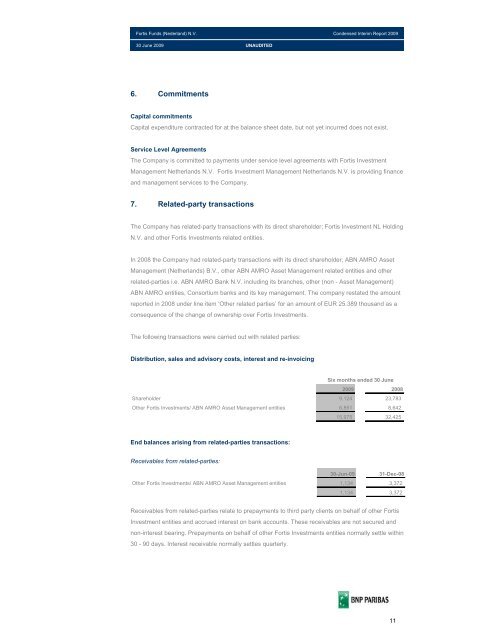

6. Commitments<br />

Capital commitments<br />

Capital expenditure contracted for at the balance sheet date, but not yet incurred does not exist.<br />

Service Level Agreements<br />

The Company is committed to payments under service level agreements with <strong>Fortis</strong> <strong>Investment</strong><br />

Management Netherlands N.V. <strong>Fortis</strong> <strong>Investment</strong> Management Netherlands N.V. is providing finance<br />

and management services to the Company.<br />

7. Related-party transactions<br />

The Company has related-party transactions with its direct shareholder; <strong>Fortis</strong> <strong>Investment</strong> NL Holding<br />

N.V. and other <strong>Fortis</strong> <strong>Investment</strong>s related entities.<br />

In 2008 the Company had related-party transactions with its direct shareholder; ABN AMRO Asset<br />

Management (Netherlands) B.V., other ABN AMRO Asset Management related entities and other<br />

related-parties i.e. ABN AMRO Bank N.V. including its branches, other (non - Asset Management)<br />

ABN AMRO entities, Consortium banks and its key management. The company restated the amount<br />

reported in 2008 under line item ‘Other related parties’ for an amount of EUR 25.389 thousand as a<br />

consequence of the change of ownership over <strong>Fortis</strong> <strong>Investment</strong>s.<br />

The following transactions were carried out with related parties:<br />

Distribution, sales and advisory costs, interest and re-invoicing<br />

Six months ended 30 June<br />

2009 2008<br />

Shareholder 9,124 23,783<br />

Other <strong>Fortis</strong> <strong>Investment</strong>s/ ABN AMRO Asset Management entities 6,851 8,642<br />

15,975 32,425<br />

End balances arising from related-parties transactions:<br />

Receivables from related-parties:<br />

30-Jun-09 31-Dec-08<br />

Other <strong>Fortis</strong> <strong>Investment</strong>s/ ABN AMRO Asset Management entities 1,134 3,372<br />

1,134 3,372<br />

Receivables from related-parties relate to prepayments to third party clients on behalf of other <strong>Fortis</strong><br />

<strong>Investment</strong> entities and accrued interest on bank accounts. These receivables are not secured and<br />

non-interest bearing. Prepayments on behalf of other <strong>Fortis</strong> <strong>Investment</strong>s entities normally settle within<br />

30 - 90 days. Interest receivable normally settles quarterly.<br />

11