Annual Report and Audited Financial Statements 2011 - The Kenya ...

Annual Report and Audited Financial Statements 2011 - The Kenya ...

Annual Report and Audited Financial Statements 2011 - The Kenya ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

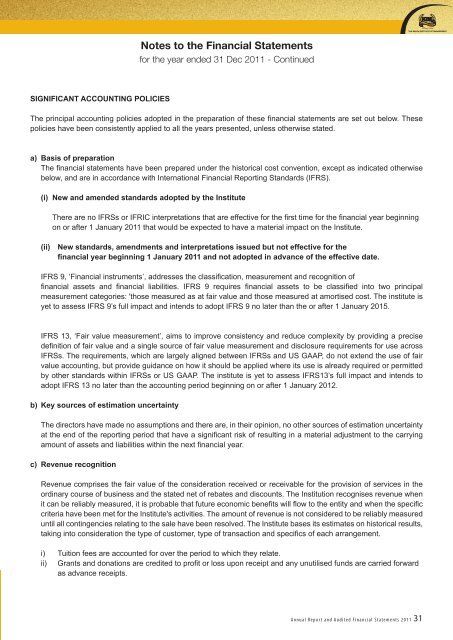

Notes to the <strong>Financial</strong> <strong>Statements</strong><br />

for the year ended 31 Dec <strong>2011</strong> - Continued<br />

SIGNIFICANT ACCOUNTING POLICIES<br />

<strong>The</strong> principal accounting policies adopted in the preparation of these financial statements are set out below. <strong>The</strong>se<br />

policies have been consistently applied to all the years presented, unless otherwise stated.<br />

a) Basis of preparation<br />

<strong>The</strong> financial statements have been prepared under the historical cost convention, except as indicated otherwise<br />

below, <strong>and</strong> are in accordance with International <strong>Financial</strong> <strong>Report</strong>ing St<strong>and</strong>ards (IFRS).<br />

(i) New <strong>and</strong> amended st<strong>and</strong>ards adopted by the Institute<br />

<strong>The</strong>re are no IFRSs or IFRIC interpretations that are effective for the first time for the financial year beginning<br />

on or after 1 January <strong>2011</strong> that would be expected to have a material impact on the Institute.<br />

(ii) New st<strong>and</strong>ards, amendments <strong>and</strong> interpretations issued but not effective for the<br />

financial year beginning 1 January <strong>2011</strong> <strong>and</strong> not adopted in advance of the effective date.<br />

IFRS 9, ‘<strong>Financial</strong> instruments’, addresses the classification, measurement <strong>and</strong> recognition of<br />

financial assets <strong>and</strong> financial liabilities. IFRS 9 requires financial assets to be classified into two principal<br />

measurement categories: 'those measured as at fair value <strong>and</strong> those measured at amortised cost. <strong>The</strong> institute is<br />

yet to assess IFRS 9’s full impact <strong>and</strong> intends to adopt IFRS 9 no later than the or after 1 January 2015.<br />

IFRS 13, ‘Fair value measurement’, aims to improve consistency <strong>and</strong> reduce complexity by providing a precise<br />

definition of fair value <strong>and</strong> a single source of fair value measurement <strong>and</strong> disclosure requirements for use across<br />

IFRSs. <strong>The</strong> requirements, which are largely aligned between IFRSs <strong>and</strong> US GAAP, do not extend the use of fair<br />

value accounting, but provide guidance on how it should be applied where its use is already required or permitted<br />

by other st<strong>and</strong>ards within IFRSs or US GAAP. <strong>The</strong> institute is yet to assess IFRS13’s full impact <strong>and</strong> intends to<br />

adopt IFRS 13 no later than the accounting period beginning on or after 1 January 2012.<br />

b) Key sources of estimation uncertainty<br />

<strong>The</strong> directors have made no assumptions <strong>and</strong> there are, in their opinion, no other sources of estimation uncertainty<br />

at the end of the reporting period that have a significant risk of resulting in a material adjustment to the carrying<br />

amount of assets <strong>and</strong> liabilities within the next financial year.<br />

c) Revenue recognition<br />

Revenue comprises the fair value of the consideration received or receivable for the provision of services in the<br />

ordinary course of business <strong>and</strong> the stated net of rebates <strong>and</strong> discounts. <strong>The</strong> Institution recognises revenue when<br />

it can be reliably measured, it is probable that future economic benefits will flow to the entity <strong>and</strong> when the specific<br />

criteria have been met for the Institute's activities. <strong>The</strong> amount of revenue is not considered to be reliably measured<br />

until all contingencies relating to the sale have been resolved. <strong>The</strong> Institute bases its estimates on historical results,<br />

taking into consideration the type of customer, type of transaction <strong>and</strong> specifics of each arrangement.<br />

i) Tuition fees are accounted for over the period to which they relate.<br />

ii) Grants <strong>and</strong> donations are credited to profit or loss upon receipt <strong>and</strong> any unutilised funds are carried forward<br />

as advance receipts.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong> 31