Life Sciences Outlook 2012 Dutch biotech companies ... - NautaDutilh

Life Sciences Outlook 2012 Dutch biotech companies ... - NautaDutilh

Life Sciences Outlook 2012 Dutch biotech companies ... - NautaDutilh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2. Investing.<br />

At the point that a scientific discovery or an innovative<br />

idea has been nurtured sufficiently to reach the ‘proof<br />

of concept’ stage, and once a business plan has<br />

been written, a management team assembled and<br />

some initial funding secured, the young company has<br />

in fact only taken its first baby steps. In an age where<br />

the development of a new drug can easily take ten<br />

years and can cost upwards of €1 billion, what lies<br />

ahead is the long march through the proverbial ‘valley<br />

of death’. Many promising <strong>biotech</strong> <strong>companies</strong> that<br />

have set out on this journey have not survived, due to<br />

a lack of intermediate funding. The bad news is that<br />

the climate is becoming even harsher than before.<br />

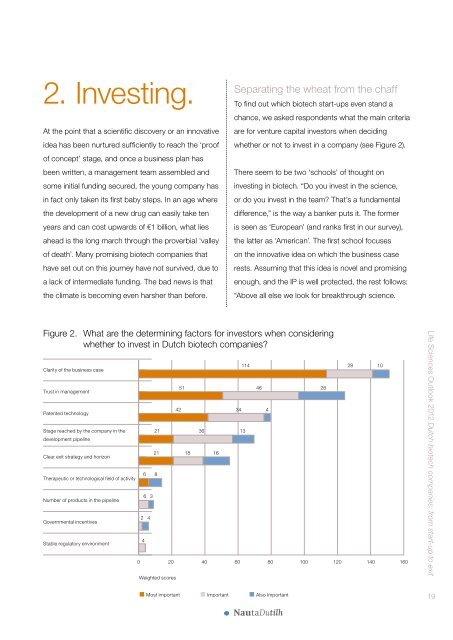

Separating the wheat from the chaff<br />

To find out which <strong>biotech</strong> start-ups even stand a<br />

chance, we asked respondents what the main criteria<br />

are for venture capital investors when deciding<br />

whether or not to invest in a company (see Figure 2).<br />

There seem to be two ‘schools’ of thought on<br />

investing in <strong>biotech</strong>. “Do you invest in the science,<br />

or do you invest in the team? That’s a fundamental<br />

difference,” is the way a banker puts it. The former<br />

is seen as ‘European’ (and ranks first in our survey),<br />

the latter as ‘American’. The first school focuses<br />

on the innovative idea on which the business case<br />

rests. Assuming that this idea is novel and promising<br />

enough, and the IP is well protected, the rest follows:<br />

“Above all else we look for breakthrough science.<br />

Figure 2. What are the determining factors for investors when considering<br />

whether to invest in <strong>Dutch</strong> <strong>biotech</strong> <strong>companies</strong>?<br />

Clarity of the business case<br />

Trust in management<br />

Patented technology<br />

Stage reached by the company in the<br />

development pipeline<br />

Clear exit strategy and horizon<br />

Therapeutic or technological field of activity<br />

Number of products in the pipeline<br />

Governmental incentives<br />

Stable regulatory environment<br />

2<br />

6<br />

4<br />

6 3<br />

4<br />

0 20 40 60 80 100 120 140 160<br />

Weighted scores<br />

114<br />

51 46<br />

28<br />

42 34 4<br />

21 36<br />

13<br />

21<br />

8<br />

18<br />

16<br />

28<br />

10<br />

<strong>Life</strong> <strong>Sciences</strong> <strong>Outlook</strong> <strong>2012</strong> <strong>Dutch</strong> <strong>biotech</strong> <strong>companies</strong>: from start-up to exit<br />

■ Most important ■ Important ■ Also Important<br />

19