Download Annual Report 2003 - Mühlbauer Group

Download Annual Report 2003 - Mühlbauer Group

Download Annual Report 2003 - Mühlbauer Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Preface Security with a System The Share Management<br />

<strong>Report</strong><br />

Consolidated<br />

Financial<br />

Statements<br />

Independent<br />

Auditor’s<br />

<strong>Report</strong><br />

<strong>Report</strong> of the<br />

Supervisory Board<br />

Glossary<br />

The tax relief on the earnings share of the personally<br />

liable shareholder originates due to the fact that<br />

corporation tax and the solidarity tax on the earnings<br />

share of the personally liable shareholder must not be<br />

indicated in the company financial statement. These<br />

taxes are allocated directly to the personally liable<br />

shareholder and are paid by him separately -<br />

independent of the applicable tax rates for the company.<br />

The percentage of the tax expenditure before tax<br />

reduction from the earnings share of the personally liable<br />

shareholder (38.1 percent) is therefore the same as the<br />

effective rate of taxation to be applied to the profits to be<br />

allocated to the limited liability shareholders. In the<br />

previous year this was 45.3 percent.<br />

In calculating the foreign deferred taxes, the local<br />

applicable tax rate was used. For deferred taxes in<br />

Germany, the following tax rates were used:<br />

• 14.76% 1)<br />

• 26.38%<br />

for trade tax<br />

for corporation tax and corresponding solidarity tax (5.50 percent)<br />

1) Average tax rate of national operational facilities<br />

The total tax burden of the report year contains a taxation<br />

expense for previous years of 330 TEUR. The total tax<br />

burden was reduced by the return of previously paid<br />

taxes amounting to 86 TEUR. Tax losses carried forward<br />

are treated as tax reductions and are included in the<br />

determination of the deferred taxes. These tax losses<br />

carried forward (1,129 TEUR) – notwithstanding changes<br />

in legislation – can be carried forward without limitations.<br />

In previous year they totaled 414 TEUR.<br />

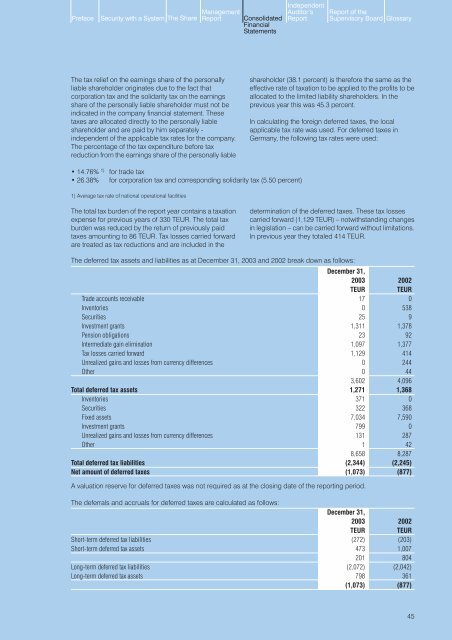

The deferred tax assets and liabilities as at December 31, <strong>2003</strong> and 2002 break down as follows:<br />

December 31,<br />

<strong>2003</strong>2002<br />

TEUR TEUR<br />

Trade accounts receivable 17 0<br />

Inventories 0 538<br />

Securities 25 9<br />

Investment grants 1,311 1,378<br />

Pension obligations 23 92<br />

Intermediate gain elimination 1,097 1,377<br />

Tax losses carried forward 1,129 414<br />

Unrealized gains and losses from currency differences 0 244<br />

Other 0 44<br />

3,602 4,096<br />

Total deferred tax assets 1,271 1,368<br />

Inventories 371 0<br />

Securities 322 368<br />

Fixed assets 7,034 7,590<br />

Investment grants 799 0<br />

Unrealized gains and losses from currency differences 131 287<br />

Other 1 42<br />

8,658 8,287<br />

Total deferred tax liabilities (2,344) (2,245)<br />

Net amount of deferred taxes (1,073) (877)<br />

A valuation reserve for deferred taxes was not required as at the closing date of the reporting period.<br />

The deferrals and accruals for deferred taxes are calculated as follows:<br />

December 31,<br />

<strong>2003</strong>2002<br />

TEUR TEUR<br />

Short-term deferred tax liabilities (272) (203)<br />

Short-term deferred tax assets 473 1,007<br />

201 804<br />

Long-term deferred tax liabilities (2,072) (2,042)<br />

Long-term deferred tax assets 798 361<br />

(1,073) (877)<br />

45