Download Annual Report 2003 - Mühlbauer Group

Download Annual Report 2003 - Mühlbauer Group

Download Annual Report 2003 - Mühlbauer Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Preface Security with a System The Share Management<br />

<strong>Report</strong><br />

Consolidated<br />

Financial<br />

Statements<br />

Independent<br />

Auditor’s<br />

<strong>Report</strong><br />

<strong>Report</strong> of the<br />

Supervisory Board<br />

Glossary<br />

company (no including incidental costs) must not<br />

exceed the price determined on the trading day by the<br />

opening auction in the XETRA system of the Deutsche<br />

Börse AG or another system replacing the XETRA<br />

system by more than 5 percent. The minimum price must<br />

not be more than 25 percent lower than that price.<br />

If the purchase of the shares takes place by means of a<br />

public offer of sale to all shareholders, the offered<br />

purchase price or the limits of the offered purchase price<br />

spread per share (not including incidental costs) must<br />

not exceed the closing price in the XETRA system of the<br />

Deutsche Börse AG or another system replacing the<br />

XETRA system on the third trading day before the day of<br />

publication of the offer of sale by more than 10 percent,<br />

and the minimum price must be no lower than 10<br />

percent below that price. The volume of the offer can be<br />

limited. As far as the entire application of the offer<br />

exceeds this volume, the acceptance must take place on<br />

a pro-rata basis. The privileged acceptance of a small<br />

quantity of up to 100 tendered shares of the<br />

shareholders is permissible.<br />

In the year <strong>2003</strong> the company exercised the<br />

authorization granted on April 26 th, 2002 to purchase a<br />

total of 18,647 shares from the market in the report year.<br />

Furthermore, in the year <strong>2003</strong> the company exercised<br />

the authorization granted on April 29 th, <strong>2003</strong> to<br />

purchase a total of 33,064 shares from the market. Of<br />

these, the company still owned 203,765 shares<br />

(previous year: 170,425) or 3.25 percent (previous year<br />

2.71 %) of the share capital as of December 31st, <strong>2003</strong>.<br />

The price for the shares purchases in the reported year<br />

totaled 697 TEUR. In the context of the sale of shares,<br />

144 TEUR were realized. The assessment of the own<br />

shares is based on the par value method. The<br />

development of the own shares is presented in note 24.<br />

D. FURTHER EXPLANATIONS<br />

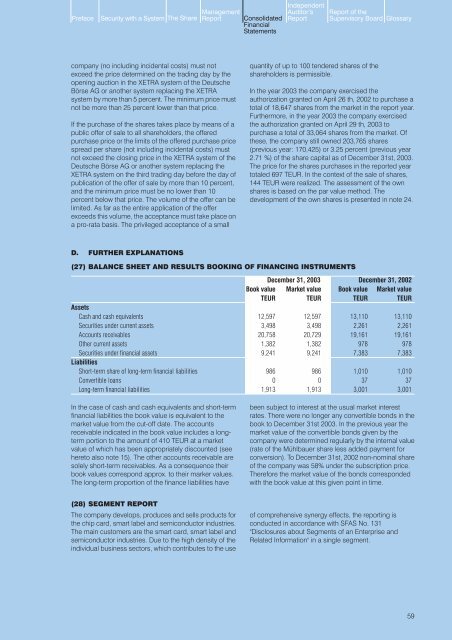

(27) BALANCE SHEET AND RESULTS BOOKING OF FINANCING INSTRUMENTS<br />

December 31, <strong>2003</strong> December 31, 2002<br />

Book value Market value Book value Market value<br />

TEUR TEUR TEUR TEUR<br />

Assets<br />

Cash and cash equivalents 12,597 12,597 13,110 13,110<br />

Securities under current assets 3,498 3,498 2,261 2,261<br />

Accounts receivables 20,758 20,729 19,161 19,161<br />

Other current assets 1,382 1,382 978 978<br />

Securities under financial assets 9,241 9,241 7,383 7,383<br />

Liabilities<br />

Short-term share of long-term financial liabilities 986 986 1,010 1,010<br />

Convertible loans 0 0 37 37<br />

Long-term financial liabilities 1,913 1,913 3,001 3,001<br />

In the case of cash and cash equivalents and short-term<br />

financial liabilities the book value is equivalent to the<br />

market value from the cut-off date. The accounts<br />

receivable indicated in the book value includes a longterm<br />

portion to the amount of 410 TEUR at a market<br />

value of which has been appropriately discounted (see<br />

hereto also note 15). The other accounts receivable are<br />

solely short-term receivables. As a consequence their<br />

book values correspond approx. to their marker values.<br />

The long-term proportion of the finance liabilities have<br />

been subject to interest at the usual market interest<br />

rates. There were no longer any convertible bonds in the<br />

book to December 31st <strong>2003</strong>. In the previous year the<br />

market value of the convertible bonds given by the<br />

company were determined regularly by the internal value<br />

(rate of the Mühlbauer share less added payment for<br />

conversion). To December 31st, 2002 non-nominal share<br />

of the company was 58% under the subscription price.<br />

Therefore the market value of the bonds corresponded<br />

with the book value at this given point in time.<br />

(28) SEGMENT REPORT<br />

The company develops, produces and sells products for<br />

the chip card, smart label and semiconductor industries.<br />

The main customers are the smart card, smart label and<br />

semiconductor industries. Due to the high density of the<br />

individual business sectors, which contributes to the use<br />

of comprehensive synergy effects, the reporting is<br />

conducted in accordance with SFAS No. 131<br />

"Disclosures about Segments of an Enterprise and<br />

Related Information" in a single segment.<br />

59