Download Annual Report 2003 - Mühlbauer Group

Download Annual Report 2003 - Mühlbauer Group

Download Annual Report 2003 - Mühlbauer Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

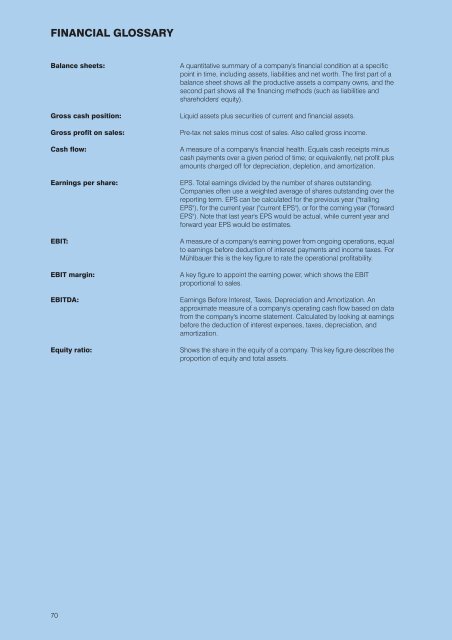

FINANCIAL GLOSSARY<br />

Balance sheets:<br />

Gross cash position:<br />

Gross profit on sales:<br />

Cash flow:<br />

Earnings per share:<br />

EBIT:<br />

EBIT margin:<br />

EBITDA:<br />

Equity ratio:<br />

A quantitative summary of a company's financial condition at a specific<br />

point in time, including assets, liabilities and net worth. The first part of a<br />

balance sheet shows all the productive assets a company owns, and the<br />

second part shows all the financing methods (such as liabilities and<br />

shareholders' equity).<br />

Liquid assets plus securities of current and financial assets.<br />

Pre-tax net sales minus cost of sales. Also called gross income.<br />

A measure of a company's financial health. Equals cash receipts minus<br />

cash payments over a given period of time; or equivalently, net profit plus<br />

amounts charged off for depreciation, depletion, and amortization.<br />

EPS. Total earnings divided by the number of shares outstanding.<br />

Companies often use a weighted average of shares outstanding over the<br />

reporting term. EPS can be calculated for the previous year ("trailing<br />

EPS"), for the current year ("current EPS"), or for the coming year ("forward<br />

EPS"). Note that last year's EPS would be actual, while current year and<br />

forward year EPS would be estimates.<br />

A measure of a company's earning power from ongoing operations, equal<br />

to earnings before deduction of interest payments and income taxes. For<br />

Mühlbauer this is the key figure to rate the operational profitability.<br />

A key figure to appoint the earning power, which shows the EBIT<br />

proportional to sales.<br />

Earnings Before Interest, Taxes, Depreciation and Amortization. An<br />

approximate measure of a company's operating cash flow based on data<br />

from the company's income statement. Calculated by looking at earnings<br />

before the deduction of interest expenses, taxes, depreciation, and<br />

amortization.<br />

Shows the share in the equity of a company. This key figure describes the<br />

proportion of equity and total assets.<br />

70