Download Annual Report 2003 - Mühlbauer Group

Download Annual Report 2003 - Mühlbauer Group

Download Annual Report 2003 - Mühlbauer Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Preface Security with a System The Share Management<br />

<strong>Report</strong><br />

Consolidated<br />

Financial<br />

Statements<br />

Independent<br />

Auditor’s<br />

<strong>Report</strong><br />

<strong>Report</strong> of the<br />

Supervisory Board<br />

Glossary<br />

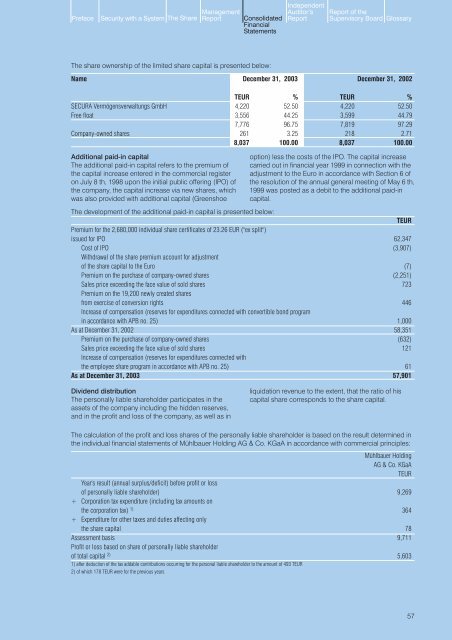

The share ownership of the limited share capital is presented below:<br />

Name December 31, <strong>2003</strong> December 31, 2002<br />

TEUR % TEUR %<br />

SECURA Vermögensverwaltungs GmbH 4,220 52.50 4,220 52.50<br />

Free float 3,556 44.25 3,599 44.79<br />

7,776 96.75 7,819 97.29<br />

Company-owned shares 261 3.25 218 2.71<br />

8,037 100.00 8,037 100.00<br />

Additional paid-in capital<br />

The additional paid-in capital refers to the premium of<br />

the capital increase entered in the commercial register<br />

on July 8 th, 1998 upon the initial public offering (IPO) of<br />

the company, the capital increase via new shares, which<br />

was also provided with additional capital (Greenshoe<br />

option) less the costs of the IPO. The capital increase<br />

carried out in financial year 1999 in connection with the<br />

adjustment to the Euro in accordance with Section 6 of<br />

the resolution of the annual general meeting of May 6 th,<br />

1999 was posted as a debit to the additional paid-in<br />

capital.<br />

The development of the additional paid-in capital is presented below:<br />

TEUR<br />

Premium for the 2,680,000 individual share certificates of 23.26 EUR ("ex split")<br />

issued for IPO 62,347<br />

Cost of IPO (3,907)<br />

Withdrawal of the share premium account for adjustment<br />

of the share capital to the Euro (7)<br />

Premium on the purchase of company-owned shares (2,251)<br />

Sales price exceeding the face value of sold shares 723<br />

Premium on the 19,200 newly created shares<br />

from exercise of conversion rights 446<br />

Increase of compensation (reserves for expenditures connected with convertible bond program<br />

in accordance with APB no. 25) 1,000<br />

As at December 31, 2002 58,351<br />

Premium on the purchase of company-owned shares (632)<br />

Sales price exceeding the face value of sold shares 121<br />

Increase of compensation (reserves for expenditures connected with<br />

the employee share program in accordance with APB no. 25) 61<br />

As at December 31, <strong>2003</strong> 57,901<br />

Dividend distribution<br />

The personally liable shareholder participates in the<br />

assets of the company including the hidden reserves,<br />

and in the profit and loss of the company, as well as in<br />

liquidation revenue to the extent, that the ratio of his<br />

capital share corresponds to the share capital.<br />

The calculation of the profit and loss shares of the personally liable shareholder is based on the result determined in<br />

the individual financial statements of Mühlbauer Holding AG & Co. KGaA in accordance with commercial principles:<br />

Mühlbauer Holding<br />

AG & Co. KGaA<br />

TEUR<br />

Year's result (annual surplus/deficit) before profit or loss<br />

of personally liable shareholder) 9,269<br />

+ Corporation tax expenditure (including tax amounts on<br />

the corporation tax) 1) 364<br />

+ Expenditure for other taxes and duties affecting only<br />

the share capital 78<br />

Assessment basis 9,711<br />

Profit or loss based on share of personally liable shareholder<br />

of total capital 2) 5,603<br />

1) after deduction of the tax addable contributions occurring for the personal liable shareholder to the amount of 493 TEUR<br />

2) of which 178 TEUR were for the previous years<br />

57