Form 20-F - Gerdau

Form 20-F - Gerdau

Form 20-F - Gerdau

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

of investments in that country, in conjunction with current high levels of inventory. Despite the fact that it purchases<br />

its main inputs in the domestic market, the Company believes that prices in Brazil will follow this trend, albeit while<br />

admitting the possibility of an increase in the price of inputs until the end of the year, in the event that Chinese<br />

demand returns to the level of the first quarter.<br />

At a macroeconomic level, <strong>Gerdau</strong> believes that movements in exchange rates will offset inflation for the<br />

year and that conditions exist that favor additional cuts in interest rates.<br />

Its North American operations showed a strong improvement in first quarter results due to the recovery of<br />

the American economy and, hence, to the increase in sales volume for the period. Sales volumes for the first quarter<br />

of <strong>20</strong>04 increased by 7.3% compared to the last quarter of <strong>20</strong>03, with highly favorable prices that generated good<br />

operating margins in that market. The steel industry as a whole expects that these prices will be maintained for at least<br />

another quarter due to the strong demand, which, together with reduced pressure on input prices, point to a positive<br />

outlook for the rest of the year.<br />

With higher demand, imports to the United States are also increasing, albeit unlike in previous years,<br />

products are traded at market prices. The Company believes this fact will not affect its businesses adversely, since if<br />

demand returns to lower levels, these imports will be redirected to other markets on account of a weakening of the<br />

U.S. dollar American currency, high international prices and freight costs.<br />

Due to the higher capacity utilization rates in the North American mills (all working at over 95% of capacity)<br />

and the reduction of scrap prices in that region, the Company estimates that its costs may also fall, on account of<br />

factors such as lower yield loss costs.<br />

The outlook for the Company’s South American operations is also positive. In Uruguay estimates for the<br />

economy are being revised with positive GDP growth forecasts for <strong>20</strong>04. In Chile, the most stable country in the<br />

region where <strong>Gerdau</strong> operates, GDP is expected to grow, resulting in increasing demand for steel products.<br />

E. OFF-BALANCE SHEET ARRANGEMENTS<br />

The Registrant does not have any off-balance sheet arrangements that have or are reasonably likely to have a<br />

current or future effect on the company’s financial condition, changes in financial condition, revenues or expenses,<br />

results of operations, liquidity, capital expenditures or capital resources other than the ones described below.<br />

As detailed in Note 25 to the consolidated financial statements (Item 19), <strong>Gerdau</strong> has guaranteed 51.82% of<br />

the debt of Dona Francisca Energética S.A., a non-public corporation which owns and operates a hydroelectric power<br />

plant, known as Usina Hidroelétrica Dona Francisca, amounting to R$ 103.452 million (equivalent to $ 35.806<br />

million at the year-end exchange rate). The percentage of this guarantee corresponds to <strong>Gerdau</strong>’s 51.82% stake in<br />

Dona Francisca Energética, corresponding to the extent to which the Company has issued guarantees to the creditors.<br />

There is no indication to date that this guarantee will be executed by lenders, which would occur in the event of<br />

default by Dona Francisca Energética S.A. In addition, the Company has issued guarantees to Banco <strong>Gerdau</strong> S.A. for<br />

$ 13.891 million relating to loans by Banco <strong>Gerdau</strong> S.A. to the Company’s customers which were used to purchase<br />

the Company’s products.<br />

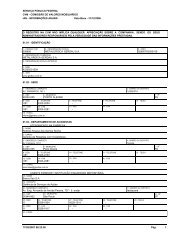

F. DISCLOSURE OF CONTRACTUAL OBLIGATIONS<br />

Contractual Obligations<br />

Total<br />

Payments due by period<br />

Less than<br />

1 year 1-3 years 3-5 years<br />

More<br />

than 5<br />

years<br />

Long-Term Debt Obligations including<br />

Debentures 1,607,807 319,958 328,127 329,422 630,300<br />

Operating Lease Obligations<br />

66,449 9,248 13,914 9,764 33,523<br />

Total<br />

1,674,256 329,<strong>20</strong>6 342,041 339,186 663,823<br />

38