Form 20-F - Gerdau

Form 20-F - Gerdau

Form 20-F - Gerdau

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

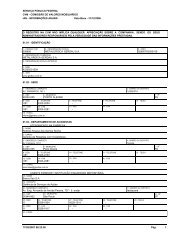

Shareholder<br />

Common<br />

Shares<br />

% Preferred<br />

Shares<br />

Metalúrgica <strong>Gerdau</strong> S.A. 42,897,<strong>20</strong>8 83.35 22,509,988 23.23<br />

BNDES Participações S.A. – BNDESPAR 3,801,058 7.39 1,971,391 2.03<br />

Santa Felicidade Com. Imp. Exp. Prod. Sid.<br />

Ltda. * 1,218,034 2.37 4,913,618 5.07<br />

Gersul Empreendimentos Imobiliários S.A. * 971,379 1.89 - -<br />

Grupo <strong>Gerdau</strong> Empreendimentos Ltda. * 712,148 1.38 12,261 0.01<br />

Members of the Board of Directors and<br />

Executive Officers as a group (16 members) 7,897 0.02 112,905 0.12<br />

* Controlled by or affiliated with Metalúrgica <strong>Gerdau</strong> S.A.<br />

Metalúrgica <strong>Gerdau</strong> S.A. and its subsidiaries hold 90.78% of the voting capital of <strong>Gerdau</strong> S.A. and thus have<br />

the ability to control the Company’s Board of Directors as well as its management and operations.<br />

%<br />

B. RELATED-PARTY TRANSACTIONS<br />

Transactions of the Company with related parties consist of (i) loans and (ii) commercial operations with<br />

subsidiaries and related parties.<br />

(i)<br />

(ii)<br />

<strong>Gerdau</strong> S.A. maintains loans with some of its subsidiaries and other affiliates by means of loan<br />

contracts, which are repaid under conditions similar to those prevailing in the open market. Contracts<br />

between related parties and subsidiaries in Brazil incur interest at the average market rate Contracts<br />

with the Group’s foreign companies incur interest at LIBOR + 3%/year and are subject to indexation<br />

based on variations in the exchange rate.<br />

Commercial operations between <strong>Gerdau</strong> S.A. and its subsidiaries or related parties basically consist of<br />

transactions involving the purchase and sale of inputs and products. These transactions are carried out<br />

under the same conditions and terms as those of transactions with non-related third parties. The<br />

commercial operations also include payments for the use of the <strong>Gerdau</strong> brand and payments relating to<br />

loan guarantees.<br />

On April 16 th , <strong>20</strong>04, <strong>Gerdau</strong> Ameristeel sold 26,800,000 common shares to its majority shareholder, <strong>Gerdau</strong> S.A. at a<br />

price of Cdn$ 4.90 per share, the closing price of the Company’s common shares on the Toronto Stock Exchange on<br />

March 31, <strong>20</strong>04. As a result of the transaction, <strong>Gerdau</strong> increased its stake in <strong>Gerdau</strong> Ameristeel from 68.6% to 72.3%.<br />

<strong>Gerdau</strong> Ameristeel intends to use the total net proceeds of approximately US$100 million for general<br />

corporate purposes, which may include funding capital equipment or working capital and repayment of debt.<br />

C. INTERESTS OF EXPERTS AND COUNSEL<br />

Not applicable.<br />

ITEM 8.<br />

FINANCIAL INFORMATION<br />

A. CONSOLIDATED STATEMENTS AND OTHER FINANCIAL INFORMATION<br />

The Company’s financial statements are included in Item 18.<br />

Legal Proceedings<br />

Like other Brazilian company’s, <strong>Gerdau</strong> S.A. is a party to claims with respect to tax, labor and civil law,<br />

most of them arising in the regular course of business. Management believes, based in part on advice from legal<br />

counsel, that the reserve for contingencies is sufficient to meet probable and reasonably estimable losses in the event<br />

of unfavorable rulings, and that the ultimate resolution will not have a significant effect on its consolidated financial<br />

position as of December 31, <strong>20</strong>03. The most significant legal and administrative disputes (involving amounts<br />

48