thank you for shopping with us - The Dixons Stores Group Image ...

thank you for shopping with us - The Dixons Stores Group Image ...

thank you for shopping with us - The Dixons Stores Group Image ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>The</strong> <strong>Group</strong> believes that software is a<br />

category in which on-line sales will capture<br />

a large share of the market. It is less clear<br />

how many c<strong>us</strong>tomers will be willing to<br />

purchase other products <strong>with</strong>out seeing<br />

them and obtaining appropriate advice and<br />

after sales back up. However, e-commerce<br />

will take a share of traditional retail sales<br />

<strong>with</strong>in an expanding retail market.<br />

C<strong>us</strong>tomers will <strong>us</strong>e the net to assist in<br />

making product decisions and <strong>for</strong> after<br />

sales service in<strong>for</strong>mation.<br />

<strong>The</strong> <strong>Group</strong> aims to be a market leader both<br />

in ‘bricks and mortar’ retailing and e-<br />

commerce. It will exploit the opportunities<br />

to provide enhanced c<strong>us</strong>tomer service and<br />

i n c rease market share through both<br />

mediums. <strong>The</strong> <strong>Group</strong> expects to invest in<br />

excess of £30 million over the next two<br />

years in developing its e-commerc e<br />

activities. <strong>The</strong> <strong>Group</strong>'s expertise, marketleading<br />

brands and links <strong>with</strong> Freeserve<br />

give it a unique position to cre a t e<br />

additional profit streams from e-<br />

commerce.<br />

Elkjøp<br />

Shortly after the end of the half-year, the<br />

<strong>Group</strong> acquired, <strong>for</strong> £444 million, Elkjøp<br />

ASA, the leading consumer electronics<br />

retailer in the Nordic region. Elkjøp is a<br />

profitable and fast growing company <strong>with</strong><br />

over 150 stores in 5 countries. We<br />

believe that this growth can be further<br />

enhanced as part of the <strong>Dixons</strong> <strong>Group</strong>.<br />

<strong>The</strong> acquisition represents a significant<br />

step in the <strong>Group</strong>'s European expansion<br />

strategy.<br />

Freeserve<br />

Freeserve strengthened its position as the<br />

UK's leading internet company. By the end<br />

of the period it had 1.575 million active<br />

<strong>us</strong>ers, an increase of almost 400,000<br />

since the beginning of the financial year.<br />

Total minutes on-line in the first half were<br />

4.1 billion. In line <strong>with</strong> Fre e s e rv e ' s<br />

strategy of building on its position as the<br />

UK's largest ISP to become the UK's<br />

leading internet portal, page impressions<br />

increased to 110 million in November, an<br />

increase of 72 per cent from the beginning<br />

of the half year. Total revenue was £7.2<br />

million, an increase of 184 per cent on the<br />

second half of last year. In line <strong>with</strong><br />

expectations, advertising and e-commerce<br />

have now grown to 50 per cent of total<br />

revenue.<br />

On 26 July 1999, the <strong>Group</strong> made an<br />

Initial Public Offering of a minority interest<br />

in Freeserve. Approximately 20 per cent<br />

of the shares were made available in the<br />

offer, <strong>with</strong> <strong>Dixons</strong> retaining 80 per cent. Of<br />

the £242 million raised net of fees and<br />

stamp duty, £123 million went directly to<br />

F re e s e rve to fund its growth and<br />

investment plans.<br />

European Property<br />

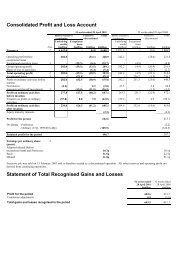

<strong>The</strong> European Property division made an<br />

operating profit of £6.3 million (£4.0<br />

million) on sales of £39 million (£29<br />

million). <strong>The</strong> 58 per cent increase in<br />

profits on lower operating assets reflects<br />

the success of the re-foc<strong>us</strong> of activity into<br />

Belgium, Luxembourg and France, where<br />

Codic has a strong record of successful<br />

projects.<br />

Financial position<br />

At the end of the period, net funds,<br />

excluding amounts held under tr<strong>us</strong>t to<br />

fund extended warranty liabilities and<br />

funds held by Fre e s e rve, were £403<br />

million (£32 million). <strong>The</strong> increase on last<br />

year reflects the funds raised <strong>for</strong> <strong>Dixons</strong><br />

<strong>Group</strong> plc from the flotation of Freeserve<br />

together <strong>with</strong> cash generated fro m<br />

operations. Working capital was tightly<br />

managed, <strong>with</strong> average stock weeks cover<br />

falling by 14 per cent, whilst stock<br />

availability improved.<br />

Net interest receivable increased to £16.1<br />

million (£14.3 million), reflecting the<br />

higher cash balances, largely offset by<br />

lower year on year interest rates.<br />

On 13 December 1999, the <strong>Group</strong> paid a<br />

special interim dividend of 7.5 pence per<br />

Ordinary share. In order to qualify <strong>for</strong> this<br />

dividend, over 75 per cent of the holders<br />

of the Convertible Pre f e rence share s<br />

elected to convert their holdings into<br />

O rd i n a ry shares. <strong>The</strong> balance has<br />

subsequently been converted resulting in<br />

the total conversion of 177 million<br />

C o n v e rtible Pre f e rence shares into 47<br />

million Ordinary shares.<br />

It was announced on 28 June 1999 that,<br />

following the flotation of Freeserve, <strong>Dixons</strong><br />

was considering a corporate restructuring<br />

to give greater strategic and financial<br />

flexibility and a capital structure more<br />

appropriate to its needs. It has now been<br />

decided to proceed. As part of the<br />

restructuring, the Board intends to return<br />

25 pence per Ord i n a ry share to<br />

shareholders, equivalent to £121 million<br />

in aggregate. <strong>The</strong>re will also be a share<br />

split.<br />

Year 2000<br />

<strong>The</strong> extensive programme, started in<br />

1997, to ensure that the <strong>Group</strong>'s systems<br />

and operations were Year 2000 compliant<br />

has cost approximately £10 million. No<br />

material problems or failures were<br />

identified over the New Year period.<br />

Christmas trading<br />

Over the Christmas period, the growth of<br />

digital technology and lower prices<br />

ensured sales remained strong, although<br />

there was a further reduction in gross<br />

margins. Retail sales <strong>for</strong> the first eight<br />

weeks of the second half to 8 January<br />

2000 increased by 15 per cent in total and<br />

5 per cent on a like <strong>for</strong> like basis.<br />

Maylands Avenue Sir Stanley Kalms<br />

Hemel Hempstead<br />

Chairman<br />

Hert<strong>for</strong>dshire HP2 7TG 12 January 2000<br />

4 <strong>Dixons</strong> <strong>Group</strong> plc<br />

<strong>Dixons</strong> <strong>Group</strong> plc 5