thank you for shopping with us - The Dixons Stores Group Image ...

thank you for shopping with us - The Dixons Stores Group Image ...

thank you for shopping with us - The Dixons Stores Group Image ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

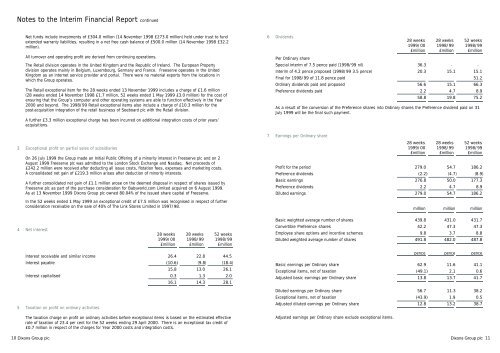

Notes to the Interim Financial Report continued<br />

Net funds include investments of £304.0 million (14 November 1998 £273.0 million) held under tr<strong>us</strong>t to fund<br />

extended warranty liabilities, resulting in a net free cash balance of £500.0 million (14 November 1998 £32.2<br />

million).<br />

All turnover and operating profit are derived from continuing operations.<br />

<strong>The</strong> Retail division operates in the United Kingdom and the Republic of Ireland. <strong>The</strong> European Property<br />

division operates mainly in Belgium, Luxembourg, Germany and France. Freeserve operates in the United<br />

Kingdom as an internet service provider and portal. <strong>The</strong>re were no material exports from the locations in<br />

which the <strong>Group</strong> operates.<br />

<strong>The</strong> Retail exceptional item <strong>for</strong> the 28 weeks ended 13 November 1999 includes a charge of £1.6 million<br />

(28 weeks ended 14 November 1998 £1.7 million, 52 weeks ended 1 May 1999 £3.0 million) <strong>for</strong> the cost of<br />

ensuring that the <strong>Group</strong>’s computer and other operating systems are able to function effectively in the Year<br />

2000 and beyond. <strong>The</strong> 1998/99 Retail exceptional items also include a charge of £10.3 million <strong>for</strong> the<br />

post-acquisition integration of the retail b<strong>us</strong>iness of Seeboard plc <strong>with</strong> the Retail division.<br />

A further £3.3 million exceptional charge has been incurred on additional integration costs of prior years’<br />

acquisitions.<br />

3 Exceptional profit on partial sales of subsidiaries<br />

On 26 July 1999 the <strong>Group</strong> made an Initial Public Offering of a minority interest in Freeserve plc and on 2<br />

Aug<strong>us</strong>t 1999 Freeserve plc was admitted to the London Stock Exchange and Nasdaq. Net proceeds of<br />

£242.2 million were received after deducting all issue costs, flotation fees, expenses and marketing costs.<br />

A consolidated net gain of £219.3 million arises after deduction of minority interests.<br />

A further consolidated net gain of £1.1 million arose on the deemed disposal in respect of shares issued by<br />

Freeserve plc as part of the purchase consideration <strong>for</strong> Babyworld.com Limited acquired on 6 Aug<strong>us</strong>t 1999.<br />

As at 13 November 1999 <strong>Dixons</strong> <strong>Group</strong> plc owned 80.04% of the issued share capital of Freeserve.<br />

In the 52 weeks ended 1 May 1999 an exceptional credit of £7.5 million was recognised in respect of further<br />

consideration receivable on the sale of 40% of <strong>The</strong> Link <strong>Stores</strong> Limited in 1997/98.<br />

6 Dividends<br />

Per Ordinary share<br />

Special interim of 7.5 pence paid (1998/99 nil) 36.3 - -<br />

Interim of 4.2 pence proposed (1998/99 3.5 pence) 20.3 15.1 15.1<br />

Final <strong>for</strong> 1998/99 of 11.8 pence paid 51.2<br />

Ordinary dividends paid and proposed 56.6 15.1 66.3<br />

Preference dividends paid 2.2 4.7 8.9<br />

58.8 19.8 75.2<br />

As a result of the conversion of the Preference shares into Ordinary shares the Preference dividend paid on 31<br />

July 1999 will be the final such payment.<br />

7 Earnings per Ordinary share<br />

28 weeks<br />

1999/00<br />

£million<br />

28 weeks<br />

1999/00<br />

£million<br />

28 weeks<br />

1998/99<br />

£million<br />

28 weeks<br />

1998/99<br />

£million<br />

52 weeks<br />

1998/99<br />

£million<br />

52 weeks<br />

1998/99<br />

£million<br />

Profit <strong>for</strong> the period 279.0 54.7 186.2<br />

Preference dividends (2.2) (4.7) (8.9)<br />

Basic earnings 276.8 50.0 177.3<br />

Preference dividends 2.2 4.7 8.9<br />

Diluted earnings 279.0 54.7 186.2<br />

million million million<br />

Basic weighted average number of shares 439.8 431.0 431.7<br />

4 Net interest<br />

28 weeks<br />

1999/00<br />

£million<br />

28 weeks<br />

1998/99<br />

£million<br />

52 weeks<br />

1998/99<br />

£million<br />

Convertible Preference shares 42.2 47.3 47.3<br />

Employee share options and incentive schemes 9.8 3.7 8.8<br />

Diluted weighted average number of shares 491.8 482.0 487.8<br />

Interest receivable and similar income 26.4 22.8 44.5<br />

Interest payable (10.6) (9.8) (18.4)<br />

15.8 13.0 26.1<br />

Interest capitalised 0.3 1.3 2.0<br />

5 Taxation on profit on ordinary activities<br />

16.1 14.3 28.1<br />

<strong>The</strong> taxation charge on profit on ordinary activities be<strong>for</strong>e exceptional items is based on the estimated effective<br />

rate of taxation of 23.4 per cent <strong>for</strong> the 52 weeks ending 29 April 2000. <strong>The</strong>re is an exceptional tax credit of<br />

£0.7 million in respect of the charges <strong>for</strong> Year 2000 costs and integration costs.<br />

pence pence pence<br />

Basic earnings per Ordinary share 62.9 11.6 41.1<br />

Exceptional items, net of taxation (49.1) 2.1 0.6<br />

Adj<strong>us</strong>ted basic earnings per Ordinary share 13.8 13.7 41.7<br />

Diluted earnings per Ordinary share 56.7 11.3 38.2<br />

Exceptional items, net of taxation (43.9) 1.9 0.5<br />

Adj<strong>us</strong>ted diluted earnings per Ordinary share 12.8 13.2 38.7<br />

Adj<strong>us</strong>ted earnings per Ordinary share exclude exceptional items.<br />

10 <strong>Dixons</strong> <strong>Group</strong> plc<br />

<strong>Dixons</strong> <strong>Group</strong> plc 11