thank you for shopping with us - The Dixons Stores Group Image ...

thank you for shopping with us - The Dixons Stores Group Image ...

thank you for shopping with us - The Dixons Stores Group Image ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

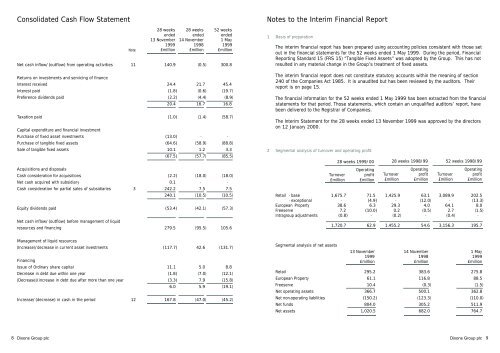

Consolidated Cash Flow Statement<br />

Net cash inflow/(outflow) from operating activities 11 140.9 (0.5) 300.8<br />

Returns on investments and servicing of finance<br />

Interest received 24.4 21.7 45.4<br />

Interest paid (1.8) (0.6) (19.7)<br />

Preference dividends paid (2.2) (4.4) (8.9)<br />

Note<br />

20.4 16.7 16.8<br />

Taxation paid (1.0) (1.4) (58.7)<br />

Capital expenditure and financial investment<br />

Purchase of fixed asset investments (13.0) - -<br />

Purchase of tangible fixed assets (64.6) (58.9) (88.8)<br />

Sale of tangible fixed assets 10.1 1.2 3.3<br />

Acquisitions and disposals<br />

(67.5) (57.7) (85.5)<br />

Cash consideration <strong>for</strong> acquisitions (2.2) (18.0) (18.0)<br />

Net cash acquired <strong>with</strong> subsidiary 0.1 - -<br />

Cash consideration <strong>for</strong> partial sales of subsidiaries 3 242.2 7.5 7.5<br />

240.1 (10.5) (10.5)<br />

Equity dividends paid (53.4) (42.1) (57.3)<br />

Net cash inflow/(outflow) be<strong>for</strong>e management of liquid<br />

28 weeks<br />

ended<br />

13 November<br />

1999<br />

£million<br />

28 weeks<br />

ended<br />

14 November<br />

1998<br />

£million<br />

52 weeks<br />

ended<br />

1 May<br />

1999<br />

£million<br />

resources and financing 279.5 (95.5) 105.6<br />

Notes to the Interim Financial Report<br />

1 Basis of preparation<br />

<strong>The</strong> interim financial report has been prepared <strong>us</strong>ing accounting policies consistent <strong>with</strong> those set<br />

out in the financial statements <strong>for</strong> the 52 weeks ended 1 May 1999. During the period, Financial<br />

Reporting Standard 15 (FRS 15) “Tangible Fixed Assets” was adopted by the <strong>Group</strong>. This has not<br />

resulted in any material change in the <strong>Group</strong>’s treatment of fixed assets.<br />

<strong>The</strong> interim financial report does not constitute statutory accounts <strong>with</strong>in the meaning of section<br />

240 of the Companies Act 1985. It is unaudited but has been reviewed by the auditors. <strong>The</strong>ir<br />

report is on page 15.<br />

<strong>The</strong> financial in<strong>for</strong>mation <strong>for</strong> the 52 weeks ended 1 May 1999 has been extracted from the financial<br />

statements <strong>for</strong> that period. Those statements, which contain an unqualified auditors’ report, have<br />

been delivered to the Registrar of Companies.<br />

<strong>The</strong> Interim Statement <strong>for</strong> the 28 weeks ended 13 November 1999 was approved by the directors<br />

on 12 January 2000.<br />

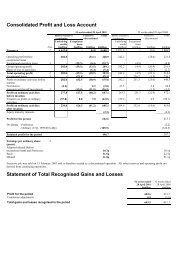

2 Segmental analysis of turnover and operating profit<br />

28 weeks 1999/00<br />

Turnover<br />

£million<br />

Operating<br />

profit<br />

£million<br />

Turnover<br />

£million<br />

28 weeks 1998/99<br />

Operating<br />

profit<br />

£million<br />

Turnover<br />

£million<br />

52 weeks 1998/99<br />

Operating<br />

profit<br />

£million<br />

Retail - base 1,675.7 71.5 1,425.9 63.1 3,089.9 202.5<br />

- exceptional - (4.9) - (12.0) - (13.3)<br />

European Property 38.6 6.3 29.3 4.0 64.1 8.0<br />

Freeserve 7.2 (10.0) 0.2 (0.5) 2.7 (1.5)<br />

Intragroup adj<strong>us</strong>tments (0.8) - (0.2) - (0.4) -<br />

1,720.7 62.9 1,455.2 54.6 3,156.3 195.7<br />

Management of liquid resources<br />

(Increase)/decrease in current asset investments (117.7) 42.6 (131.7)<br />

Financing<br />

Issue of Ordinary share capital 11.1 5.0 8.8<br />

Decrease in debt due <strong>with</strong>in one year (1.8) (7.0) (12.1)<br />

(Decrease)/increase in debt due after more than one year (3.3) 7.9 (15.8)<br />

6.0 5.9 (19.1)<br />

Increase/(decrease) in cash in the period 12 167.8 (47.0) (45.2)<br />

Segmental analysis of net assets<br />

13 November<br />

1999<br />

£million<br />

14 November<br />

1998<br />

£million<br />

1 May<br />

1999<br />

£million<br />

Retail 295.2 383.6 275.8<br />

European Property 61.1 116.8 88.5<br />

Freeserve 10.4 (0.3) (1.5)<br />

Net operating assets 366.7 500.1 362.8<br />

Net non-operating liabilities (150.2) (123.3) (110.0)<br />

Net funds 804.0 305.2 511.9<br />

Net assets 1,020.5 682.0 764.7<br />

8 <strong>Dixons</strong> <strong>Group</strong> plc<br />

<strong>Dixons</strong> <strong>Group</strong> plc 9