An Economic Analysis of GRDC Investment in the - Grains Research ...

An Economic Analysis of GRDC Investment in the - Grains Research ...

An Economic Analysis of GRDC Investment in the - Grains Research ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Attribution<br />

Benefits delivered from rust<br />

resistance control <strong>in</strong> absence <strong>of</strong><br />

ACRCP<br />

Benefits attributed to ACRCP as<br />

a proportion <strong>of</strong> total benefits<br />

delivered by all rust resistance<br />

activities<br />

50% Agtrans assumption after<br />

discussions with ACRCP<br />

50% Agtrans assumption after<br />

discussions with ACRCP<br />

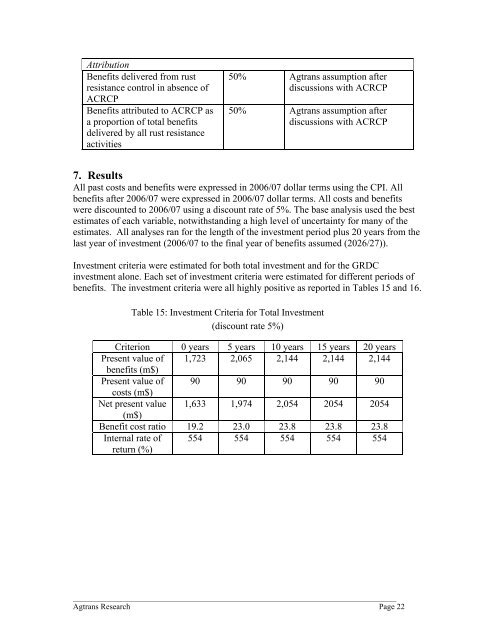

7. Results<br />

All past costs and benefits were expressed <strong>in</strong> 2006/07 dollar terms us<strong>in</strong>g <strong>the</strong> CPI. All<br />

benefits after 2006/07 were expressed <strong>in</strong> 2006/07 dollar terms. All costs and benefits<br />

were discounted to 2006/07 us<strong>in</strong>g a discount rate <strong>of</strong> 5%. The base analysis used <strong>the</strong> best<br />

estimates <strong>of</strong> each variable, notwithstand<strong>in</strong>g a high level <strong>of</strong> uncerta<strong>in</strong>ty for many <strong>of</strong> <strong>the</strong><br />

estimates. All analyses ran for <strong>the</strong> length <strong>of</strong> <strong>the</strong> <strong>in</strong>vestment period plus 20 years from <strong>the</strong><br />

last year <strong>of</strong> <strong>in</strong>vestment (2006/07 to <strong>the</strong> f<strong>in</strong>al year <strong>of</strong> benefits assumed (2026/27)).<br />

<strong>Investment</strong> criteria were estimated for both total <strong>in</strong>vestment and for <strong>the</strong> <strong>GRDC</strong><br />

<strong>in</strong>vestment alone. Each set <strong>of</strong> <strong>in</strong>vestment criteria were estimated for different periods <strong>of</strong><br />

benefits. The <strong>in</strong>vestment criteria were all highly positive as reported <strong>in</strong> Tables 15 and 16.<br />

Table 15: <strong>Investment</strong> Criteria for Total <strong>Investment</strong><br />

(discount rate 5%)<br />

Criterion 0 years 5 years 10 years 15 years 20 years<br />

Present value <strong>of</strong> 1,723 2,065 2,144 2,144 2,144<br />

benefits (m$)<br />

Present value <strong>of</strong> 90 90 90 90 90<br />

costs (m$)<br />

Net present value 1,633 1,974 2,054 2054 2054<br />

(m$)<br />

Benefit cost ratio 19.2 23.0 23.8 23.8 23.8<br />

Internal rate <strong>of</strong><br />

return (%)<br />

554 554 554 554 554<br />

________________________________________________________________________________<br />

Agtrans <strong>Research</strong> Page 22