ANNUAL REPORT 2001 - Prudential plc

ANNUAL REPORT 2001 - Prudential plc

ANNUAL REPORT 2001 - Prudential plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BUSINESS REVIEW<br />

CONTINUED<br />

UNITED STATES<br />

OVER THE LAST FIVE YEARS, JACKSON NATIONAL LIFE<br />

HAS MADE SIGNIFICANT PROGRESS IN WIDENING ITS<br />

PRODUCT RANGE, ENABLING US TO SELL PROFITABLE<br />

PRODUCTS IN ALMOST ANY ECONOMIC ENVIRONMENT.<br />

The markets in the United States witnessed<br />

a year of unprecedented uncertainty in <strong>2001</strong>,<br />

with equity markets suffering significant<br />

declines and bond defaults reaching record<br />

levels. No one in the US was immune from<br />

these difficult market conditions and Jackson<br />

National Life (JNL) was no exception.<br />

However, long-term demographic trends<br />

in the US are favourable and we have<br />

continued to develop and enhance our<br />

product range and distribution channels<br />

to ensure that we are well placed to benefit<br />

from the anticipated growth in the US<br />

financial services market.<br />

Our emphasis has been and will continue<br />

to be on profitable growth. Historical results<br />

demonstrate our ability to grow sales while<br />

maintaining pricing discipline, and in the<br />

last four years we have consistently earned<br />

above-industry rates of return (as measured<br />

by US GAAP operating return on capital).<br />

This reflects our key strengths in distribution,<br />

product design and cost. In addition, initiatives<br />

to expand product lines and distribution<br />

channels have resulted in more diversified,<br />

higher quality earnings.<br />

Against this background, JNL recorded total<br />

sales of £4.6 billion during the year, down<br />

only marginally on the record figure set<br />

in 2000. Sales of fixed annuities reached<br />

record levels, up 80 per cent to £1.9 billion.<br />

Despite declining interest rates in <strong>2001</strong>,<br />

investors sought the safety of fixed annuities<br />

resulting in record industry sales.<br />

New business achieved profits fell to<br />

£167 million from £221 million in 2000,<br />

principally due to the adoption of revised<br />

achieved profits assumptions and a five per<br />

cent reduction in total sales. In force profits<br />

were affected by £369 million (US$532<br />

million) of net losses relating to JNL’s bond<br />

holdings, resulting in a £74 million charge<br />

against current year profits on a five-year<br />

averaging basis. These losses equated to<br />

1.4 per cent of JNL’s total invested assets and<br />

default experience appears to be broadly in<br />

line with that of our major competitors.<br />

<br />

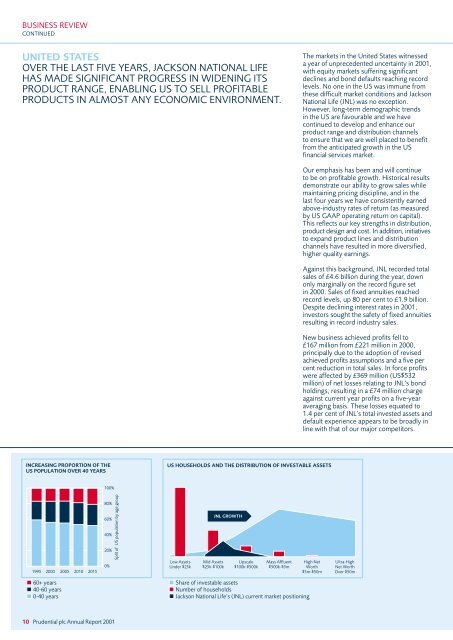

INCREASING PROPORTION OF THE<br />

US POPULATION OVER 40 YEARS<br />

US HOUSEHOLDS AND THE DISTRIBUTION OF INVESTABLE ASSETS<br />

<br />

100%<br />

1995 2000 2005 2010 2015<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

Split of US population by age group<br />

<br />

Low Assets<br />

Under $25k<br />

JNL GROWTH<br />

Mid Assets<br />

$25k-$100k<br />

Upscale<br />

$100k-$500k<br />

Mass Affluent<br />

$500k-$5m<br />

High Net<br />

Worth<br />

$5m-$50m<br />

Ultra-High<br />

Net Worth<br />

Over $50m<br />

60+ years<br />

40-60 years<br />

0-40 years<br />

Share of investable assets<br />

Number of households<br />

Jackson National Life’s (JNL) current market positioning<br />

10 <strong>Prudential</strong> <strong>plc</strong> Annual Report <strong>2001</strong>