ANNUAL REPORT 2001 - Prudential plc

ANNUAL REPORT 2001 - Prudential plc

ANNUAL REPORT 2001 - Prudential plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

REMUNERATION <strong>REPORT</strong><br />

CONTINUED<br />

Directors’ Long-term Incentive Plans continued<br />

Details of awards under other long-term incentive schemes are set out below:<br />

Michael McLintock – long-term awards<br />

To reflect his role as Chief Executive of M&G, Michael McLintock also participates in a long-term incentive plan designed to provide a<br />

cash reward based on the economic and investment performance of M&G over a three-year period. Awards under the plan are made<br />

in the form of phantom share options and phantom restricted shares, vesting at the end of the performance period.<br />

He held awards for the year <strong>2001</strong> with face values of £225,000 in phantom restricted shares and £367,800 in phantom share options.<br />

Mark Tucker – long-term awards<br />

To reflect his role as Chief Executive, <strong>Prudential</strong> Asia, Mark Tucker also participates in a cash-based long-term incentive plan that<br />

provides rewards in respect of the Group’s Asian operations. This plan is designed to provide reward contingent upon the rate of<br />

growth in value of those operations over a three-year period. The threshold performance criteria under the plan is that the growth in<br />

value must be greater than 15 per cent per annum over the period. Any payment for performance above threshold is made following<br />

the end of the performance period. The on-target payout is 100 per cent of basic salary at the beginning of the period, for which an<br />

annual growth rate of 35 per cent is required. The payment for the 1999 award is included in the Directors’ Remuneration table.<br />

Mark Wood – share awards and long-term awards<br />

In order to secure the appointment of Mark Wood, on joining <strong>Prudential</strong> he was granted <strong>Prudential</strong> <strong>plc</strong> share awards expected to be<br />

released as follows: 71,569 shares (31 July 2002), 15,080 shares (31 July 2003) and 31,672 shares (31 December 2003).<br />

In addition, to reflect his role as Chief Executive UK & Europe, Mark Wood also participates in a long-term incentive plan designed to<br />

provide reward contingent upon the rate of growth in appraisal value of UK and Europe over a three-year period. The threshold<br />

performance criteria under the <strong>2001</strong> plan is that the growth in appraisal value must be greater than eight per cent per annum over the<br />

period. Any award above threshold performance is made following the end of the performance period. The on-target payout is 75 per<br />

cent of basic salary at the end of the period, for which an annual growth rate of 11.5 per cent per annum is required.<br />

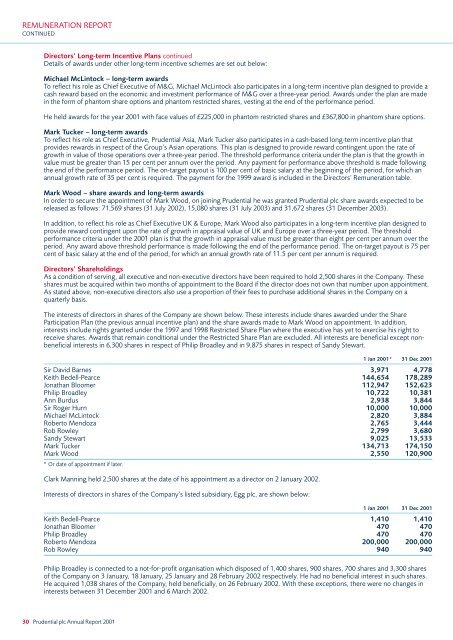

Directors’ Shareholdings<br />

As a condition of serving, all executive and non-executive directors have been required to hold 2,500 shares in the Company. These<br />

shares must be acquired within two months of appointment to the Board if the director does not own that number upon appointment.<br />

As stated above, non-executive directors also use a proportion of their fees to purchase additional shares in the Company on a<br />

quarterly basis.<br />

The interests of directors in shares of the Company are shown below. These interests include shares awarded under the Share<br />

Participation Plan (the previous annual incentive plan) and the share awards made to Mark Wood on appointment. In addition,<br />

interests include rights granted under the 1997 and 1998 Restricted Share Plan where the executive has yet to exercise his right to<br />

receive shares. Awards that remain conditional under the Restricted Share Plan are excluded. All interests are beneficial except nonbeneficial<br />

interests in 6,300 shares in respect of Philip Broadley and in 9,875 shares in respect of Sandy Stewart.<br />

1 Jan <strong>2001</strong>* 31 Dec <strong>2001</strong><br />

Sir David Barnes 3,971 4,778<br />

Keith Bedell-Pearce 144,654 178,289<br />

Jonathan Bloomer 112,947 152,623<br />

Philip Broadley 10,722 10,381<br />

Ann Burdus 2,938 3,844<br />

Sir Roger Hurn 10,000 10,000<br />

Michael McLintock 2,820 3,884<br />

Roberto Mendoza 2,765 3,444<br />

Rob Rowley 2,799 3,680<br />

Sandy Stewart 9,025 13,533<br />

Mark Tucker 134,713 174,150<br />

Mark Wood 2,550 120,900<br />

* Or date of appointment if later.<br />

Clark Manning held 2,500 shares at the date of his appointment as a director on 2 January 2002.<br />

Interests of directors in shares of the Company’s listed subsidiary, Egg <strong>plc</strong>, are shown below:<br />

1 Jan <strong>2001</strong> 31 Dec <strong>2001</strong><br />

Keith Bedell-Pearce 1,410 1,410<br />

Jonathan Bloomer 470 470<br />

Philip Broadley 470 470<br />

Roberto Mendoza 200,000 200,000<br />

Rob Rowley 940 940<br />

Philip Broadley is connected to a not-for-profit organisation which disposed of 1,400 shares, 900 shares, 700 shares and 3,300 shares<br />

of the Company on 3 January, 18 January, 25 January and 28 February 2002 respectively. He had no beneficial interest in such shares.<br />

He acquired 1,038 shares of the Company, held beneficially, on 26 February 2002. With these exceptions, there were no changes in<br />

interests between 31 December <strong>2001</strong> and 6 March 2002.<br />

30 <strong>Prudential</strong> <strong>plc</strong> Annual Report <strong>2001</strong>