Gilbert + tobin - Gilbert and Tobin

Gilbert + tobin - Gilbert and Tobin

Gilbert + tobin - Gilbert and Tobin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

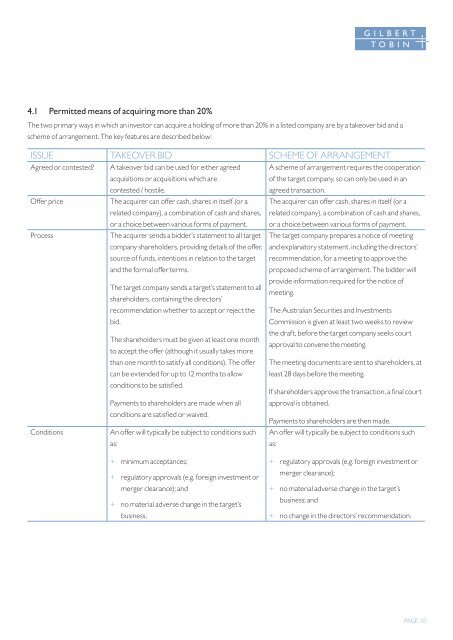

4.1 Permitted means of acquiring more than 20%<br />

The two primary ways in which an investor can acquire a holding of more than 20% in a listed company are by a takeover bid <strong>and</strong> a<br />

scheme of arrangement. The key features are described below:<br />

Issue Takeover bid Scheme of arrangement<br />

Agreed or contested A takeover bid can be used for either agreed<br />

acquisitions or acquisitions which are<br />

contested / hostile.<br />

A scheme of arrangement requires the cooperation<br />

of the target company, so can only be used in an<br />

agreed transaction.<br />

Offer price<br />

The acquirer can offer cash, shares in itself (or a<br />

related company), a combination of cash <strong>and</strong> shares,<br />

or a choice between various forms of payment.<br />

The acquirer can offer cash, shares in itself (or a<br />

related company), a combination of cash <strong>and</strong> shares,<br />

or a choice between various forms of payment.<br />

Process<br />

The acquirer sends a bidder’s statement to all target<br />

company shareholders, providing details of the offer,<br />

source of funds, intentions in relation to the target<br />

<strong>and</strong> the formal offer terms.<br />

The target company prepares a notice of meeting<br />

<strong>and</strong> explanatory statement, including the directors’<br />

recommendation, for a meeting to approve the<br />

proposed scheme of arrangement. The bidder will<br />

provide information required for the notice of<br />

The target company sends a target’s statement to all<br />

meeting.<br />

shareholders, containing the directors’<br />

recommendation whether to accept or reject the<br />

bid.<br />

The Australian Securities <strong>and</strong> Investments<br />

Commission is given at least two weeks to review<br />

the draft, before the target company seeks court<br />

The shareholders must be given at least one month<br />

approval to convene the meeting.<br />

to accept the offer (although it usually takes more<br />

than one month to satisfy all conditions). The offer<br />

can be extended for up to 12 months to allow<br />

conditions to be satisfied.<br />

Payments to shareholders are made when all<br />

conditions are satisfied or waived.<br />

The meeting documents are sent to shareholders, at<br />

least 28 days before the meeting.<br />

If shareholders approve the transaction, a final court<br />

approval is obtained.<br />

Payments to shareholders are then made.<br />

Conditions<br />

An offer will typically be subject to conditions such<br />

as:<br />

An offer will typically be subject to conditions such<br />

as:<br />

+ + minimum acceptances;<br />

+ + regulatory approvals (e.g. foreign investment or<br />

merger clearance); <strong>and</strong><br />

+ + no material adverse change in the target’s<br />

business.<br />

+ + regulatory approvals (e.g. foreign investment or<br />

merger clearance);<br />

+ + no material adverse change in the target’s<br />

business; <strong>and</strong><br />

+ + no change in the directors’ recommendation.<br />

PAGE 10