Gilbert + tobin - Gilbert and Tobin

Gilbert + tobin - Gilbert and Tobin

Gilbert + tobin - Gilbert and Tobin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3. Establishing a business presence<br />

in Australia<br />

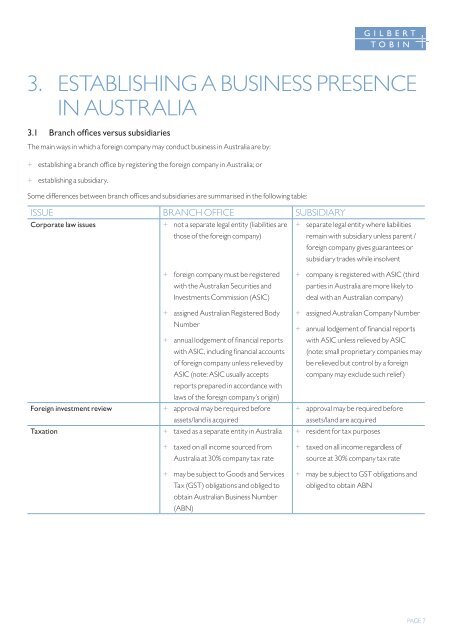

3.1 Branch offices versus subsidiaries<br />

The main ways in which a foreign company may conduct business in Australia are by:<br />

+ + establishing a branch office by registering the foreign company in Australia; or<br />

+ + establishing a subsidiary.<br />

Some differences between branch offices <strong>and</strong> subsidiaries are summarised in the following table:<br />

Issue Branch office Subsidiary<br />

Corporate law issues + + not a separate legal entity (liabilities are<br />

those of the foreign company)<br />

+ + separate legal entity where liabilities<br />

remain with subsidiary unless parent /<br />

foreign company gives guarantees or<br />

subsidiary trades while insolvent<br />

+ + foreign company must be registered<br />

with the Australian Securities <strong>and</strong><br />

Investments Commission (ASIC)<br />

+ + assigned Australian Registered Body<br />

Number<br />

+ + annual lodgement of financial reports<br />

with ASIC, including financial accounts<br />

of foreign company unless relieved by<br />

ASIC (note: ASIC usually accepts<br />

reports prepared in accordance with<br />

laws of the foreign company’s origin)<br />

Foreign investment review + + approval may be required before<br />

assets/l<strong>and</strong> is acquired<br />

Taxation + + taxed as a separate entity in Australia<br />

+ + taxed on all income sourced from<br />

Australia at 30% company tax rate<br />

+ + may be subject to Goods <strong>and</strong> Services<br />

Tax (GST) obligations <strong>and</strong> obliged to<br />

obtain Australian Business Number<br />

(ABN)<br />

+ + company is registered with ASIC (third<br />

parties in Australia are more likely to<br />

deal with an Australian company)<br />

+ + assigned Australian Company Number<br />

+ + annual lodgement of financial reports<br />

with ASIC unless relieved by ASIC<br />

(note: small proprietary companies may<br />

be relieved but control by a foreign<br />

company may exclude such relief)<br />

+ + approval may be required before<br />

assets/l<strong>and</strong> are acquired<br />

+ + resident for tax purposes<br />

+ + taxed on all income regardless of<br />

source at 30% company tax rate<br />

+ + may be subject to GST obligations <strong>and</strong><br />

obliged to obtain ABN<br />

PAGE 7