Annual Report & Accounts 2007 - Euromoney Institutional Investor ...

Annual Report & Accounts 2007 - Euromoney Institutional Investor ...

Annual Report & Accounts 2007 - Euromoney Institutional Investor ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Activities<br />

Financial Publishing<br />

Financial publishing includes an extensive portfolio of titles<br />

covering the international capital markets as well as a number<br />

of specialist financial titles. Products include magazines,<br />

newsletters, journals, surveys and research, directories, and<br />

books. A selection of the company’s leading brands includes:<br />

<strong>Euromoney</strong>, <strong>Institutional</strong> <strong>Investor</strong>, Euroweek, Latin Finance,<br />

Asiamoney, Global <strong>Investor</strong>, Project Finance, Futures & Options<br />

World, Total Derivatives and the hedge fund titles EuroHedge,<br />

InvestHedge, AsiaHedge, Absolute Return and Alpha.<br />

Business Publishing<br />

The business publishing division produces specialist<br />

magazines and other publications covering the metals<br />

and mining, energy and legal sectors. Its leading brands<br />

include: Metal Bulletin, American Metal Market, Petroleum<br />

Economist, World Oil, Hydrocarbon Processing, International<br />

Financial Law Review, International Tax Review and<br />

Managing Intellectual Property.<br />

Training<br />

The Training businesses run a comprehensive range of<br />

banking, finance and legal courses, both public and in-house,<br />

under the <strong>Euromoney</strong> and DC Gardner brands. Courses<br />

are run all over the world for both financial institutions<br />

and corporates. In addition the company’s Boston-based<br />

subsidiary, MIS, runs a wide range of courses for the audit<br />

and information security market.<br />

Turnover (£m)<br />

Conferences and Seminars<br />

The company runs a large number of sponsored conferences<br />

and seminars for the international financial markets, mostly<br />

under the <strong>Euromoney</strong>, <strong>Institutional</strong> <strong>Investor</strong>, Metal Bulletin<br />

and IMN brands. Many of these conferences are the leading<br />

annual events in their sector and provide sponsors with<br />

a high quality program and speakers, and outstanding<br />

networking opportunities. Such events include: The<br />

<strong>Euromoney</strong> Forum and The <strong>Euromoney</strong> Bond <strong>Investor</strong>s<br />

Congress; the MARHedge Global Hedge Fund Summit;<br />

the European Air Finance conference; the Islamic Finance<br />

Summit; the Super Bowl of Indexing®; and Global ABS<br />

and ABS East for the asset-backed securities market. In the<br />

energy sector, the group runs the world’s leading annual<br />

coal conference, Coaltrans; and MIS runs the leading event<br />

for the information security sector in the US, InfoSec World.<br />

Databases and Information Services<br />

The company provides a number of subscription-based<br />

database and electronic information services for financial<br />

markets. Montreal-based BCA is one of the world’s<br />

leading independent providers of global investment<br />

research. The company’s US subsidiary, Internet Securities,<br />

Inc. (“ISI”) provides the world’s most comprehensive service<br />

for news and data on global emerging markets, and<br />

includes CEIC, one of the leading providers of time-series<br />

macro-economic data for Asia. The company also offers<br />

global capital market databases through a joint venture<br />

with its AIM-listed partner, Dealogic.<br />

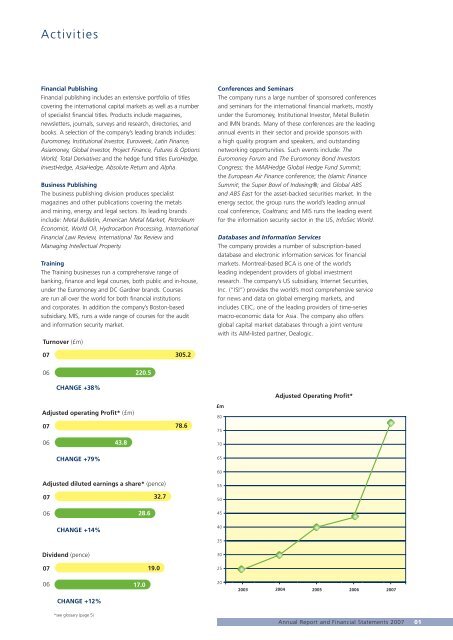

07 305.2<br />

06 220.5<br />

CHANGE +38%<br />

Adjusted operating Profit* (£m)<br />

07 78.6<br />

06 43.8<br />

£m<br />

80<br />

75<br />

70<br />

Adjusted Operating Profit*<br />

CHANGE +79%<br />

65<br />

Adjusted diluted earnings a share* (pence)<br />

07 32.7<br />

06 28.6<br />

60<br />

55<br />

50<br />

45<br />

CHANGE +14%<br />

40<br />

35<br />

Dividend (pence)<br />

07 19.0<br />

30<br />

25<br />

20<br />

06 17.0<br />

2003 2004 2005 2006 <strong>2007</strong><br />

* Operating profit before acquired intangible amortisation, share option expense, exceptional items and share of results in associates and joint ventures.<br />

CHANGE +12%<br />

*see glossary (page 5)<br />

<strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2007</strong> 01