Annual Report & Accounts 2007 - Euromoney Institutional Investor ...

Annual Report & Accounts 2007 - Euromoney Institutional Investor ...

Annual Report & Accounts 2007 - Euromoney Institutional Investor ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Director’s Remuneration <strong>Report</strong> continued<br />

Service contracts continued<br />

* If the director’s contract is terminated and the respective director reaches retirement age before the expiration of their notice period then benefits<br />

will only be paid up to the date of retirement.<br />

** This also applies if the director gives less than their notice period to the company. If the contract is terminated for reasons of bankruptcy or serious<br />

misconduct it is terminated immediately without any payment in lieu of notice.<br />

(1) PM Fallon has a second service contract with a subsidiary of the group, <strong>Euromoney</strong> <strong>Institutional</strong> <strong>Investor</strong> (Jersey) Limited (EIIJ), dated April 1 2006.<br />

This service contract has the same terms as his contract with <strong>Euromoney</strong> <strong>Institutional</strong> <strong>Investor</strong> PLC. Any termination payment would include profit<br />

share based on EIIJ's results. In addition, if Mr Fallon be adjudicated bankrupt, he is entitled to 7 days salary and profit share from EIIJ.<br />

(2) NF Osborn has a second service contract with a subsidiary of the group, <strong>Euromoney</strong> Inc, dated January 4 1991 normally terminated by 12 months<br />

notice. In the event of termination Mr Osborn is entitled to 12 months base salary and pension, plus a prorated profit share to the date notice<br />

of termination is given. The company may also terminate his agreement due to incapacity giving 3 months notice and Mr Osborn would be<br />

entitled to 3 months salary, pension and pro-rated profit share.**<br />

(3) On termination, profit share is calculated as though the director has been employed for the full financial year and then pro-rated accordingly to<br />

the date of termination unless otherwise stated.<br />

(4) If employment is terminated due to a breach of contract and the company is judged to have breached RT Lamont's editorial independence, the<br />

company shall pay $87,500 to the United Way of Greater New York.<br />

(5) G Mueller's service agreement is with Internet Securities, Inc.<br />

(6) RT Lamont, D Alfano and MJ Carroll's service agreements are with <strong>Institutional</strong> <strong>Investor</strong>, Inc. If MJ Carroll's contract is terminated due to just cause<br />

he is entitled to his salary and pension up to the date of termination, but no profit share unless already paid.<br />

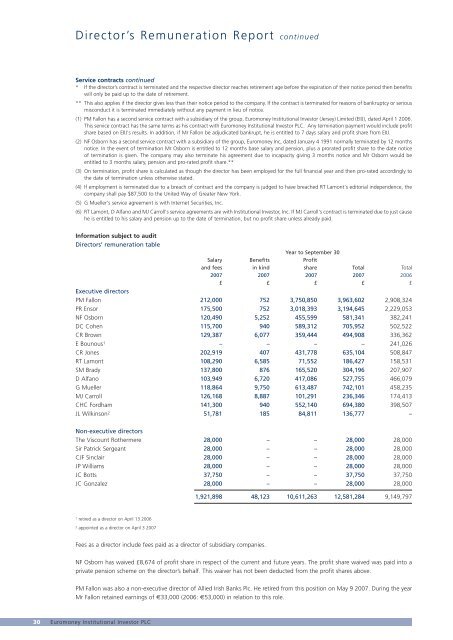

Information subject to audit<br />

Directors’ remuneration table<br />

Year to September 30<br />

Salary Benefits Profit<br />

and fees in kind share Total Total<br />

<strong>2007</strong> <strong>2007</strong> <strong>2007</strong> <strong>2007</strong> 2006<br />

£ £ £ £ £<br />

Executive directors<br />

PM Fallon 212,000 752 3,750,850 3,963,602 2,908,324<br />

PR Ensor 175,500 752 3,018,393 3,194,645 2,229,053<br />

NF Osborn 120,490 5,252 455,599 581,341 382,241<br />

DC Cohen 115,700 940 589,312 705,952 502,522<br />

CR Brown 129,387 6,077 359,444 494,908 336,362<br />

E Bounous 1 – – – – 241,026<br />

CR Jones 202,919 407 431,778 635,104 508,847<br />

RT Lamont 108,290 6,585 71,552 186,427 158,531<br />

SM Brady 137,800 876 165,520 304,196 207,907<br />

D Alfano 103,949 6,720 417,086 527,755 466,079<br />

G Mueller 118,864 9,750 613,487 742,101 458,235<br />

MJ Carroll 126,168 8,887 101,291 236,346 174,413<br />

CHC Fordham 141,300 940 552,140 694,380 398,507<br />

JL Wilkinson 2 51,781 185 84,811 136,777 –<br />

Non-executive directors<br />

The Viscount Rothermere 28,000 – – 28,000 28,000<br />

Sir Patrick Sergeant 28,000 – – 28,000 28,000<br />

CJF Sinclair 28,000 – – 28,000 28,000<br />

JP Williams 28,000 – – 28,000 28,000<br />

JC Botts 37,750 – – 37,750 37,750<br />

JC Gonzalez 28,000 – – 28,000 28,000<br />

1,921,898 48,123 10,611,263 12,581,284 9,149,797<br />

1 retired as a director on April 13 2006<br />

2 appointed as a director on April 3 <strong>2007</strong><br />

Fees as a director include fees paid as a director of subsidiary companies.<br />

NF Osborn has waived £8,674 of profit share in respect of the current and future years. The profit share waived was paid into a<br />

private pension scheme on the director’s behalf. This waiver has not been deducted from the profit shares above.<br />

PM Fallon was also a non-executive director of Allied Irish Banks Plc. He retired from this position on May 9 <strong>2007</strong>. During the year<br />

Mr Fallon retained earnings of €33,000 (2006: €53,000) in relation to this role.<br />

30 <strong>Euromoney</strong> <strong>Institutional</strong> <strong>Investor</strong> PLC