Financial Report - Veresen Inc.

Financial Report - Veresen Inc.

Financial Report - Veresen Inc.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

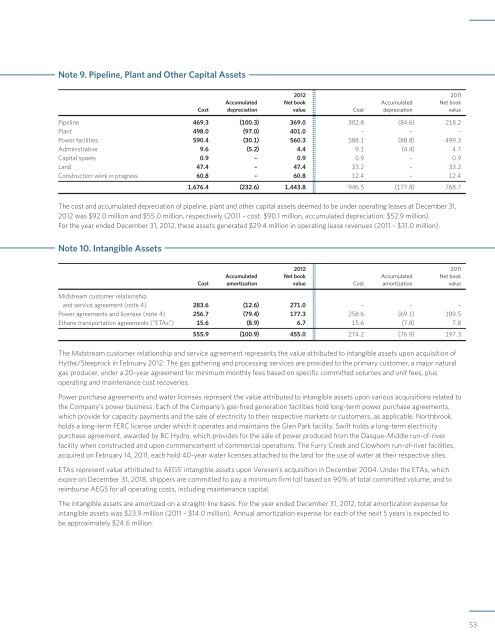

Note 9. Pipeline, Plant and Other Capital Assets<br />

2012 2011<br />

Accumulated Net book Accumulated Net book<br />

Cost depreciation value Cost depreciation value<br />

Pipeline 469.3 (100.3) 369.0 302.8 (84.6) 218.2<br />

Plant 498.0 (97.0) 401.0 – – –<br />

Power facilities 590.4 (30.1) 560.3 588.1 (88.8) 499.3<br />

Administrative 9.6 (5.2) 4.4 9.1 (4.4) 4.7<br />

Capital spares 0.9 – 0.9 0.9 – 0.9<br />

Land 47.4 – 47.4 33.2 – 33.2<br />

Construction work in progress 60.8 – 60.8 12.4 – 12.4<br />

1,676.4 (232.6) 1,443.8 946.5 (177.8) 768.7<br />

The cost and accumulated depreciation of pipeline, plant and other capital assets deemed to be under operating leases at December 31,<br />

2012 was $92.0 million and $55.0 million, respectively (2011 – cost: $90.1 million, accumulated depreciation: $52.9 million).<br />

For the year ended December 31, 2012, these assets generated $29.4 million in operating lease revenues (2011 – $31.0 million).<br />

Note 10. Intangible Assets<br />

2012 2011<br />

Accumulated Net book Accumulated Net book<br />

Cost amortization value Cost amortization value<br />

Midstream customer relationship<br />

and service agreement (note 4) 283.6 (12.6) 271.0 – – –<br />

Power agreements and licenses (note 4) 256.7 (79.4) 177.3 258.6 (69.1) 189.5<br />

Ethane transportation agreements (“ETAs”) 15.6 (8.9) 6.7 15.6 (7.8) 7.8<br />

555.9 (100.9) 455.0 274.2 (76.9) 197.3<br />

The Midstream customer relationship and service agreement represents the value attributed to intangible assets upon acquisition of<br />

Hythe/Steeprock in February 2012. The gas gathering and processing services are provided to the primary customer, a major natural<br />

gas producer, under a 20-year agreement for minimum monthly fees based on specific committed volumes and unit fees, plus<br />

operating and maintenance cost recoveries.<br />

Power purchase agreements and water licenses represent the value attributed to intangible assets upon various acquisitions related to<br />

the Company’s power business. Each of the Company’s gas-fired generation facilities hold long-term power purchase agreements,<br />

which provide for capacity payments and the sale of electricity to their respective markets or customers, as applicable. Northbrook<br />

holds a long-term FERC license under which it operates and maintains the Glen Park facility. Swift holds a long-term electricity<br />

purchase agreement, awarded by BC Hydro, which provides for the sale of power produced from the Dasque-Middle run-of-river<br />

facility when constructed and upon commencement of commercial operations. The Furry Creek and Clowhom run-of-river facilities,<br />

acquired on February 14, 2011, each hold 40-year water licenses attached to the land for the use of water at their respective sites.<br />

ETAs represent value attributed to AEGS’ intangible assets upon <strong>Veresen</strong>’s acquisition in December 2004. Under the ETAs, which<br />

expire on December 31, 2018, shippers are committed to pay a minimum firm toll based on 90% of total committed volume, and to<br />

reimburse AEGS for all operating costs, including maintenance capital.<br />

The intangible assets are amortized on a straight-line basis. For the year ended December 31, 2012, total amortization expense for<br />

intangible assets was $23.9 million (2011 – $14.0 million). Annual amortization expense for each of the next 5 years is expected to<br />

be approximately $24.6 million.<br />

53