Financial Report - Veresen Inc.

Financial Report - Veresen Inc.

Financial Report - Veresen Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

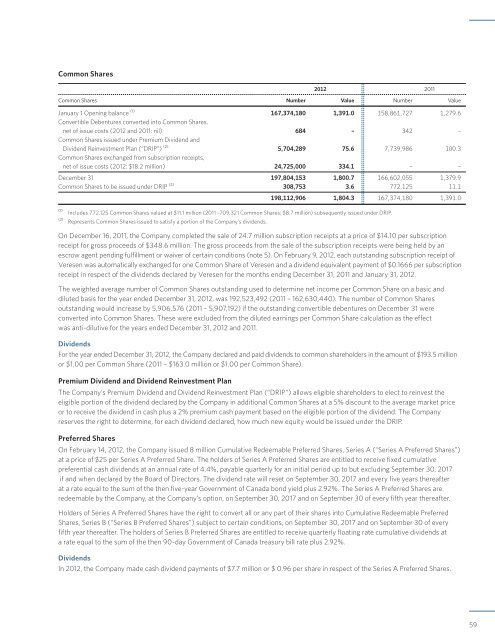

Common Shares<br />

2012 2011<br />

Common Shares Number Value Number Value<br />

January 1 Opening balance (1) 167,374,180 1,391.0 158,861,727 1,279.6<br />

Convertible Debentures converted into Common Shares,<br />

net of issue costs (2012 and 2011: nil) 684 – 342 –<br />

Common Shares issued under Premium Dividend and<br />

Dividend Reinvestment Plan (“DRIP”) (2) 5,704,289 75.6 7,739,986 100.3<br />

Common Shares exchanged from subscription receipts,<br />

net of issue costs (2012: $18.2 million) 24,725,000 334.1 – –<br />

December 31 197,804,153 1,800.7 166,602,055 1,379.9<br />

Common Shares to be issued under DRIP (2) 308,753 3.6 772,125 11.1<br />

198,112,906 1,804.3 167,374,180 1,391.0<br />

(1)<br />

(2)<br />

<strong>Inc</strong>ludes 772,125 Common Shares valued at $11.1 million (2011 –709,321 Common Shares; $8.7 million) subsequently issued under DRIP.<br />

Represents Common Shares issued to satisfy a portion of the Company’s dividends.<br />

On December 16, 2011, the Company completed the sale of 24.7 million subscription receipts at a price of $14.10 per subscription<br />

receipt for gross proceeds of $348.6 million. The gross proceeds from the sale of the subscription receipts were being held by an<br />

escrow agent pending fulfillment or waiver of certain conditions (note 5). On February 9, 2012, each outstanding subscription receipt of<br />

<strong>Veresen</strong> was automatically exchanged for one Common Share of <strong>Veresen</strong> and a dividend equivalent payment of $0.1666 per subscription<br />

receipt in respect of the dividends declared by <strong>Veresen</strong> for the months ending December 31, 2011 and January 31, 2012.<br />

The weighted average number of Common Shares outstanding used to determine net income per Common Share on a basic and<br />

diluted basis for the year ended December 31, 2012, was 192,523,492 (2011 – 162,630,440). The number of Common Shares<br />

outstanding would increase by 5,906,576 (2011 – 5,907,192) if the outstanding convertible debentures on December 31 were<br />

converted into Common Shares. These were excluded from the diluted earnings per Common Share calculation as the effect<br />

was anti-dilutive for the years ended December 31, 2012 and 2011.<br />

Dividends<br />

For the year ended December 31, 2012, the Company declared and paid dividends to common shareholders in the amount of $193.5 million<br />

or $1.00 per Common Share (2011 – $163.0 million or $1.00 per Common Share).<br />

Premium Dividend and Dividend Reinvestment Plan<br />

The Company’s Premium Dividend and Dividend Reinvestment Plan (“DRIP”) allows eligible shareholders to elect to reinvest the<br />

eligible portion of the dividend declared by the Company in additional Common Shares at a 5% discount to the average market price<br />

or to receive the dividend in cash plus a 2% premium cash payment based on the eligible portion of the dividend. The Company<br />

reserves the right to determine, for each dividend declared, how much new equity would be issued under the DRIP.<br />

Preferred Shares<br />

On February 14, 2012, the Company issued 8 million Cumulative Redeemable Preferred Shares, Series A (“Series A Preferred Shares”)<br />

at a price of $25 per Series A Preferred Share. The holders of Series A Preferred Shares are entitled to receive fixed cumulative<br />

preferential cash dividends at an annual rate of 4.4%, payable quarterly for an initial period up to but excluding September 30, 2017<br />

if and when declared by the Board of Directors. The dividend rate will reset on September 30, 2017 and every five years thereafter<br />

at a rate equal to the sum of the then five-year Government of Canada bond yield plus 2.92%. The Series A Preferred Shares are<br />

redeemable by the Company, at the Company’s option, on September 30, 2017 and on September 30 of every fifth year thereafter.<br />

Holders of Series A Preferred Shares have the right to convert all or any part of their shares into Cumulative Redeemable Preferred<br />

Shares, Series B (“Series B Preferred Shares”) subject to certain conditions, on September 30, 2017 and on September 30 of every<br />

fifth year thereafter. The holders of Series B Preferred Shares are entitled to receive quarterly floating rate cumulative dividends at<br />

a rate equal to the sum of the then 90-day Government of Canada treasury bill rate plus 2.92%.<br />

Dividends<br />

In 2012, the Company made cash dividend payments of $7.7 million or $ 0.96 per share in respect of the Series A Preferred Shares.<br />

59