PUNJAB NATIONAL BANK HRDD CIR NO. 438 Date ... - Pnbnet.net.in

PUNJAB NATIONAL BANK HRDD CIR NO. 438 Date ... - Pnbnet.net.in

PUNJAB NATIONAL BANK HRDD CIR NO. 438 Date ... - Pnbnet.net.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>PUNJAB</strong> <strong>NATIONAL</strong> <strong>BANK</strong><br />

HUMAN RESOURCES DEVELOPMENT DIVISION<br />

HO : 7, Bhikhiji Cama Place, New Delhi – 110066<br />

<strong>HRDD</strong><br />

<strong>CIR</strong> <strong>NO</strong>. <strong>438</strong><br />

<strong>Date</strong>: 30.11.2007<br />

TO ALL OFFICES<br />

HRD DIVISION <strong>CIR</strong>CULAR <strong>NO</strong>. <strong>438</strong><br />

REG: RENEWAL OF PNB MEDI-CLAIM INSURANCE SCHEME<br />

FOR RETIRED EMPLOYEES OF THE <strong>BANK</strong><br />

Bank had <strong>in</strong>troduced a PNB Medi-Claim Insurance Scheme for<br />

Retired Employees through the New India Assurance Co. Ltd. as<br />

circulated vide HRD Circular No. 220 dated 14.09.2004. The<br />

scheme was renewed through The Oriental Insurance Co. Ltd. for<br />

the year 2006. Further, the scheme was renewed with The New<br />

India Assurance Co. Ltd. for the year 2007 and circulated vide HRD<br />

Circular No. 362 dated 30.11.2006.<br />

2. We have taken up the matter for renewal of the scheme with<br />

four <strong>in</strong>surance companies. Three <strong>in</strong>surance companies have<br />

expressed their <strong>in</strong>ability to renew the scheme except The New India<br />

Assurance Company Ltd. who after negotiations have agreed to<br />

renew the scheme with enhanced premium. Details of premium to<br />

be paid is available at Annexure I. Broadly, the terms and<br />

conditions as circulated through Annexure I of HRD Circular 362<br />

dated 30.11.2006 rema<strong>in</strong> unchanged.<br />

3. All exist<strong>in</strong>g members of the above scheme are requested to<br />

send their revised premium as conta<strong>in</strong>ed <strong>in</strong> Annexure I for<br />

renewal of their membership to Chief Manager–HR, Punjab<br />

National Bank, Head Office, 7 Bhikhaiji Cama Place, New Delhi<br />

110066 on or before 26 th December 2007, by way of CBS<br />

Cheque/ DD drawn <strong>in</strong> favour of PNB Mediclaim Insurance<br />

1

Scheme for Retired Employees, payable at Delhi by mention<strong>in</strong>g<br />

their name and enrolment number on the back of the<br />

<strong>in</strong>strument.<br />

4. Retired employees/officers who are currently not members<br />

of the scheme but wish to opt for the same, may send their<br />

consent on the proforma available at Annexure II, alongwith<br />

the commensurate premium amount as per the details available<br />

<strong>in</strong> Anneuxre I by way of CBS Cheque/DD drawn <strong>in</strong> favour of<br />

PNB Mediclaim Insurance Scheme for Retired Employees<br />

payable at Delhi, and send the same to Chief Manager –HR,<br />

Punjab National Bank, Head Office, 7 Bhikhaiji Cama Place,<br />

New Delhi 110066 on or before 26 th December 2007.<br />

5. In case the m<strong>in</strong>imum group size rema<strong>in</strong>s less than the required<br />

numbers, as envisaged by the Insurance Company, the scheme may<br />

be withdrawn, and <strong>in</strong> that eventuality the premium received shall<br />

be refunded/returned without <strong>in</strong>terest.<br />

6. All claims under the above scheme are to be submitted to the<br />

TPA i.e. M/s Raksha TPA Pvt. Ltd., 15/5 Mathura Road, Faridabad<br />

– 121003 directly and under no circumstances the same will be<br />

routed through the bank.<br />

7. Copy of this circular is available on website “pnb<strong>net</strong>.<strong>net</strong>.<strong>in</strong>”<br />

8. All the offices/branches are advised to get this circular noted<br />

from the retired employees who have retired from their offices or are<br />

draw<strong>in</strong>g their pensions from the branches. A copy of this circular be<br />

also displayed on the Notice Board.<br />

CHIEF MANAGER-HR<br />

2

ANNEXURE I<br />

1. TITLE :<br />

The Scheme shall be called PNB Mediclaim Insurance Scheme for Retired<br />

Employees.<br />

2. ELIGIBILITY :<br />

a) Officers and employees retired from the Bank’s service<br />

i. On atta<strong>in</strong><strong>in</strong>g the age of superannuation<br />

ii. Under the bank’s voluntary retirement scheme.<br />

b) Employees retired on medical ground are not eligible.<br />

c) Retir<strong>in</strong>g officers and employees can opt for the scheme at the time<br />

of their retirement.<br />

d) In case of the death of an employee dur<strong>in</strong>g his/her service period or<br />

after his/her retirement, the option to jo<strong>in</strong> the membership of the PNB<br />

Medi-claim Insurance Scheme for Retired Employees shall rema<strong>in</strong> open<br />

for the spouse of the said employee.<br />

e) Officers/employees who have been discharged/ dismissed/ removed<br />

from service/ compulsorily retired or term<strong>in</strong>ated on grounds of<br />

misconduct will <strong>NO</strong>T be eligible.<br />

3. WHEN TO OPT FOR THE SCHEME<br />

Membership to the scheme is optional subject to the fulfillment of the<br />

eligibility criteria stated under po<strong>in</strong>t no. 2 above.<br />

Membership is permitted only at the time of renewal of the scheme each<br />

year which is valid separately for each calendar year.<br />

Membership to the scheme cannot be opted for dur<strong>in</strong>g the currency of a<br />

policy dur<strong>in</strong>g the year, except for those employees who retire dur<strong>in</strong>g that<br />

year and opt for membership of the scheme for the rema<strong>in</strong><strong>in</strong>g part of the<br />

year.<br />

3

4. PERSONS COVERED UNDER THE SCHEME<br />

The benefits of the scheme is allowable only to the ex employees and his/her<br />

spouse.<br />

5. AGE LIMIT<br />

There is no lower / upper age limit for jo<strong>in</strong><strong>in</strong>g the scheme. However, the<br />

premium required to be paid for membership to the scheme is related to the<br />

age of the beneficiaries.<br />

6. OBJECTIVE :<br />

The scheme has been floated with a view to provide assistance to the retired<br />

employees of the Bank and their spouses, which makes them eligible to seek<br />

reimbursement of hospitalisation expenses <strong>in</strong>curred anywhere <strong>in</strong> India at<br />

any time dur<strong>in</strong>g the currency of the scheme. Beneficiaries under the scheme<br />

are covered for <strong>in</strong>cidents/eventualities that may result <strong>in</strong> <strong>in</strong>jury or disease/<br />

illness lead<strong>in</strong>g to hospitalisation <strong>in</strong>clud<strong>in</strong>g admission to a nurs<strong>in</strong>g home.<br />

Expenses with respect to pre-hospitalisation and post hospitalization are<br />

also covered under the scheme as per details below.<br />

7. OPERATION OF THE SCHEME<br />

The medical <strong>in</strong>surance cover under the scheme shall commence from 1 st<br />

January 2008 and would be valid upto 31 st December 2008. Details of the<br />

premium to be paid is available at po<strong>in</strong>t no. 10 .<br />

8. DEFINITIONS<br />

The follow<strong>in</strong>g words, terms or expressions wherever they may appear <strong>in</strong><br />

this Scheme or even otherwise shall be deemed to have mean<strong>in</strong>g expressed<br />

hereunder:-<br />

a) Member : Shall mean a member of PNB Mediclaim Insurance Scheme<br />

for Retired Employees.<br />

4

) Hospital/Nurs<strong>in</strong>g Home : Would mean any <strong>in</strong>stitution <strong>in</strong> India<br />

Established for Indoor care and treatment of sickness and <strong>in</strong>juries and<br />

which has been registered as a Hospital or Nurs<strong>in</strong>g Home with the local<br />

authorities and is under supervision of a Registered and qualified Medical<br />

Practitioner. The Hospital or Nurs<strong>in</strong>g Home shall not <strong>in</strong>clude an<br />

establishment which is a place of rest, a place for the aged, a place for<br />

drug-addicts or place of alcoholics, a hotel or a similar place.<br />

c) Surgical Operation : Would mean manual and / or operative procedures<br />

for correction of deformities and defects, repair of <strong>in</strong>juries, diagnosis and<br />

cure of disease, relief of suffer<strong>in</strong>g and prolongation of life.<br />

d) M<strong>in</strong>imum Period : Shall mean Expenses on Hospitalisation for m<strong>in</strong>imum<br />

period of 24 hours are admissible. However, this time limit is not applied<br />

to specific treatments i.e. Dialysis, Chemotheraphy, Radio therapy, Eye<br />

Surgery, Lithotripsy (Kidney stone removal), D & C. Tonsillectomy, if<br />

taken <strong>in</strong> the Hospital/Nurs<strong>in</strong>g Home and the Insured is discharged on the<br />

same day; the treatment will be considered to be taken under<br />

Hospitalisation Benefit.<br />

d) Period of Hospitalisation : Shall <strong>in</strong>clude a maximum period of 7 days<br />

as pre-hospitalisation and maximum period of 7 days as post<br />

hospitalization period.<br />

e) Disease : Shall mean any illness, disease or <strong>in</strong>jury requir<strong>in</strong>g<br />

hospitalisation.<br />

The follow<strong>in</strong>g diseases/surgical measures are to be treated as special<br />

operations:<br />

i. Nephritis of any Aetiology plus Bacterial renal failure requir<strong>in</strong>g Kidney<br />

Transplantation and / or Dialysis.<br />

ii. Cerebral or Vascular Strokes.<br />

iii. Open and Close Heart Surgery (<strong>in</strong>clusive of C.A.B.G. <strong>in</strong>clusive cost of<br />

valves, PTCA, Heart Failure.<br />

iv. Malignancy disease which were confirmed on Histopathological report.<br />

v. Encephalitis (Viral)<br />

vi. Neuro Surgery<br />

vii. Total Replacement of jo<strong>in</strong>ts.<br />

viii. Liver disorder (Hepatitis B & C) associated with complications like<br />

Cirrhosis of liver (exclud<strong>in</strong>g caused by Alcohol).<br />

5

ix.<br />

Grievous <strong>in</strong>jury <strong>in</strong>clud<strong>in</strong>g multiple fracture of long bones, head-<strong>in</strong>jury<br />

lead<strong>in</strong>g to unconsciousness, burns of more than 40%, <strong>in</strong>jury requir<strong>in</strong>g<br />

artificial ventilatory support plus Vertebral Column <strong>in</strong>jury.<br />

9. Domiciliary and Non Hospitalisation : Not covered<br />

(Except Chemotherphy/Radiotherphy/<br />

Dialysis)<br />

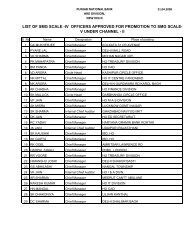

10. PREMIUM :<br />

Sum<br />

<strong>in</strong>sured<br />

Proposed<br />

Premium<br />

Upto 70 Yrs<br />

Proposed<br />

Premium<br />

71-80 Yrs<br />

Proposed<br />

Premium<br />

Above 80 Yrs<br />

Rs. 1 lac 5252 5776 6302<br />

Rs. 2 lacs 10482 11530 12579<br />

Rs. 3 lacs 15096 16606 18115<br />

The above premium amounts is <strong>in</strong>clusive of Service Tax.<br />

The amount of premium is negotiated afresh each year and may vary<br />

from year to year.<br />

11. COVERAGE UNDER THE SCHEME :<br />

For employees & Officers upto:<br />

Sum Insured<br />

Scale II - - Rs. 1 lacs<br />

Scale III to Scale V - Rs. 2 lacs<br />

Scale VI & above - Rs. 3 lacs<br />

‣ Insurance Company has agreed for <strong>in</strong>sured amount of Rs. 1 lac for<br />

all categories of employees and officers.<br />

‣ Officers who have retired <strong>in</strong> Scale III to V can opt for <strong>in</strong>surance<br />

cover of Rs. 2 lacs.<br />

‣ However, officers who have retired <strong>in</strong> Scale VI & above can opt<br />

for coverage of Rs. 3 lacs.<br />

11.1 The Scheme which covers the member and his/her spouse provides as<br />

under:<br />

6

Rs. 1 lac on floater cover basis for the member and his/her spouse<br />

subject to a maximum ceil<strong>in</strong>g as under:<br />

‣ Hospitalization expenses for treatment of special ailments as<br />

<strong>in</strong>door patient as specified <strong>in</strong> the scheme on production of<br />

orig<strong>in</strong>al bills/cash memos etc. – Max. Rs. 70000/-<br />

‣ Non surgical hospitalization expenses as <strong>in</strong>door patient on<br />

production of orig<strong>in</strong>al bills/cash memos etc. – Max. Rs.<br />

10000/.<br />

‣ Hospitalisation expenses for surgical <strong>in</strong>terference as <strong>in</strong>door<br />

patient on production of orig<strong>in</strong>al bills/cash memos etc. –<br />

Max. Rs.20000/- (<strong>in</strong>clud<strong>in</strong>g the cost of any surgical<br />

implant)<br />

‣ However, this sub limit <strong>in</strong> case of cataract operation<br />

<strong>in</strong>clud<strong>in</strong>g I.O.L. is maximum of Rs.5000/- only.<br />

‣ In case of cataract operation, sticker of lens used must be<br />

accompanied with claims.<br />

‣ The sub limits enumerated would be applicable directly <strong>in</strong><br />

proportion to the sum <strong>in</strong>sured <strong>in</strong> multiples of Rs. 1 lac.<br />

‣ 7 days pre hospitalization and 7 days post hospitalization<br />

expenses are covered.<br />

‣ Pre exist<strong>in</strong>g disease allowed.<br />

‣ Hospitalisation / Admission on or after the date of<br />

commencement of the scheme is permissible. Persons<br />

already admitted at the time of commencement of the<br />

scheme/policy, especially for that particular illness shall not<br />

be covered.<br />

11.2. SUB LIMITS<br />

(Amt. <strong>in</strong> Rs.)<br />

Sum Insured 1,00,000 2,00,000 3,00,000<br />

Room Rent<br />

500 750 1000<br />

Maximum Per day<br />

ICU<br />

1500 2000 2500<br />

(Maximum Per day)<br />

Cataract Operation 5000 7500 10000<br />

11.3 Package charges for specialized treatment subject to <strong>in</strong>surance cover with<br />

details.<br />

7

12. EXCLUSIONS :<br />

The Company shall not be liable to make any payment under this policy <strong>in</strong><br />

respect of any expenses whatsoever <strong>in</strong>curred by any Insured Persons <strong>in</strong><br />

connection with or <strong>in</strong> respect of:<br />

a) Injury or Disease directly or <strong>in</strong>directly caused by or aris<strong>in</strong>g from or<br />

attributable to War, Invasion, Act of Foreign Enemy, War like<br />

operations (whether war be declared or not).<br />

b) Circumcision unless necessary for treatment of a disease not excluded<br />

hereunder or as may be necessitated due to an accident, vacc<strong>in</strong>ation or<br />

<strong>in</strong>oculation or change of life or cosmetic or aesthetic treatment of any<br />

description, plastic surgery other than as may be necessitated due to<br />

an accident or as a part of any illness.<br />

c) Cost of spectacles and contact lenses, hear<strong>in</strong>g aids.<br />

d) Any dental treatment or surgery which is a corrective cosmetic or<br />

aesthetic procedure, <strong>in</strong>clud<strong>in</strong>g wear and tear, unless aris<strong>in</strong>g from<br />

disease or <strong>in</strong>jury and which requires hospitalization for treatment.<br />

e) Convalescence, general debility, “Run-down” condition or rest cure,<br />

congenital external disease or defects or anomalies, sterility, venereal<br />

disease, <strong>in</strong>tentional self-<strong>in</strong>jury and use of <strong>in</strong>toxicat<strong>in</strong>g drugs/alcohol.<br />

f) All expenses aris<strong>in</strong>g out of any condition directly or <strong>in</strong>directly caused<br />

to or associated with Human T – Cell Lymphotropic Virus type III<br />

(HTLB-III) or Lymphad<strong>in</strong>opathy Associated Virus (LAV) or the<br />

Mutants Derivative or Variations Deficiency Syndrome or any<br />

Syndrome or condition of a similar k<strong>in</strong>d commonly referred to as<br />

AIDS.<br />

g) Charges <strong>in</strong>curred at Hospital or Nurs<strong>in</strong>g Home primarily for<br />

diagnostic, X –ray or laboratory exam<strong>in</strong>ations not consistent with or<br />

<strong>in</strong>cidental to the diagnosis and treatment of the positive existence or<br />

presence of any ailment, sickness or <strong>in</strong>jury, for which conf<strong>in</strong>ement is<br />

required at a Hospital/Nurs<strong>in</strong>g Home.<br />

h) Expenses on vitam<strong>in</strong>s and tonics unless form<strong>in</strong>g part of treatment for<br />

<strong>in</strong>jury or disease as certified by the attend<strong>in</strong>g Physician.<br />

i) Injury or Disease directly or <strong>in</strong>directly caused by or contributed to by<br />

nuclear weapons/material.<br />

8

j) Treatment aris<strong>in</strong>g from or traceable to pregnancy childbirth,<br />

miscarriage, abortion or complications of any of this, <strong>in</strong>clud<strong>in</strong>g<br />

caesarian section.<br />

k) Naturopathy treatment.<br />

13. PROCEDURE FOR MEMBERSHIP<br />

a) The eligible retired employees and officers as well as their spouses<br />

desirous to become member of the scheme shall submit their duly filled<br />

application <strong>in</strong> the format (Annexure II) latest by 26 th December 2007<br />

alongwith a prescribed yearly premium <strong>in</strong> the form of DD payable at<br />

Delhi favour<strong>in</strong>g PNB Mediclaim Insurance Scheme for Retired<br />

Employees. Applications received without necessary amount and<br />

prescribed format duly filled <strong>in</strong> and signed will not be enterta<strong>in</strong>ed. Those<br />

who are retir<strong>in</strong>g they must send their application alongwith prescribed<br />

yearly premium immediately on their retirement.<br />

b) Annual <strong>in</strong>surance premium for the subsequent years as per the prescribed<br />

rate to be deiced by the Bank <strong>in</strong> negotiation with <strong>in</strong>surance company will<br />

cont<strong>in</strong>ue to be paid <strong>in</strong> advance every year.<br />

14. MODE OF SETTLEMENT OF CLAIM<br />

a) Settlement of claims lodged by the members will be made by the<br />

Insurance Company through M/s Raksha TPA on the basis of claims<br />

made by the retired officers and retired employees/legal heirs as the<br />

case may be, whose decision is f<strong>in</strong>al and b<strong>in</strong>d<strong>in</strong>g. All claims shall be<br />

settled by the Insurance Company through its office as The New India<br />

Assurance Co. Ltd., Divisional Office 311100, Bhandari House, 3 rd<br />

Floor, 91, Nehru Place, New Delhi – 110019.<br />

b) The application/enrolment forms for membership will be available at<br />

HRD Division, HO New Delhi besides be<strong>in</strong>g available at all Zonal<br />

/Regional/Branch Offices of the Bank.<br />

All claims must be accompanied by Discharge Certificate and details/ break<br />

up of hospitalization expenses.<br />

9

15. FALSE CLAIM / INFORMATION:<br />

In case any false claim / <strong>in</strong>formation is found to have been submitted by any<br />

member at any stage, his/her membership shall be cancelled for all times and<br />

he/she shall not be eligible for re-enrollment. Subscription paid will<br />

automatically be forfeited and claim preferred if any will not be reimbursed. In<br />

such cases, any reimbursement already received by the member under the scheme<br />

will have to be refunded to the <strong>in</strong>surance company.<br />

16. GENERAL<br />

a) The operation of the Scheme subject to availability of m<strong>in</strong>imum required<br />

number of retired officers and employees. The Bank has discretion to<br />

discont<strong>in</strong>ue the scheme at any po<strong>in</strong>t of time.<br />

b) Mid term <strong>in</strong>clusion to the membership of the scheme is applicable <strong>in</strong> case of<br />

retir<strong>in</strong>g employees only any time dur<strong>in</strong>g the year, on the payment of pro rata<br />

premium on half yearly basis. In such cases <strong>in</strong>surance coverage would be<br />

available upto 31 st December dur<strong>in</strong>g the currency of the scheme.<br />

c) Modification/Amendment to the scheme is the sole discretion of the bank.<br />

d) Fresh enrolment form need not be submitted for exist<strong>in</strong>g members who wish<br />

to renew their membership.<br />

e) For renewal of membership, remittance of membership fee with<strong>in</strong> the<br />

stipulated alongwith exist<strong>in</strong>g enrolment number by way of DD shall be<br />

sufficient.<br />

10

ANNEXURE II<br />

APPLICATION/ENROLMENT FORM FOR PNB MEDI CLAIM INSURANCE<br />

SCHEME FOR RETIRED EMPLOYEES<br />

(To be sent latest by 26.12.2007 <strong>in</strong> case of retired employees and or immediately at<br />

the time of retirement for retir<strong>in</strong>g employees.<br />

The Chief Manager-HRD,<br />

Punjab National Bank, HRD Division<br />

Head Office, 7 Bhikhaiji Cama Place,<br />

New Delhi.-110066<br />

For Office use only<br />

Enrolment No., _____<br />

Dear Sir/Madam, Please affix jo<strong>in</strong>t<br />

photograph of self and<br />

spouse<br />

Please enrol me as Member of the above scheme to which I hereby opt. I have gone<br />

through the rules and regulations of the scheme and agree to abide by the rules and<br />

regulations of the same as may be modified / amended from time to time . Particulars<br />

about myself and my spouse are given below:<br />

1. Name of Officer/Employee ________________________ 2. P.F No.____________<br />

(In Block Letters)<br />

3. Name of Spouse _________________________<br />

4. PPO No. _____________ 5. Name of the Pension Pay<strong>in</strong>g Branch _______________<br />

6. Father's/Husband 's Name_____________________________________________<br />

(In Block Letters)<br />

7. <strong>Date</strong> of Birth a) Self ______________ b) Spouse___________<br />

8. <strong>Date</strong> of retirement ___________________<br />

9. Office from which retired _____________________________<br />

Under RO____________________________<br />

(Write the name) ZO/HO________________________<br />

10. Designation & Scale at the time of Retirement _________________<br />

11. Sum Insured opted :<br />

(Applicable for officers retired/retir<strong>in</strong>g <strong>in</strong> Scale III & above)<br />

11

12. Address for Communication : ______________________<br />

_____________________<br />

_________________________<br />

_____________________________<br />

13. Telephone No. _______________ Mobile No. ________________<br />

14. Type of retirement : (i) Superannuation (iii) Medical Ground (iii) Dismissed (iv)<br />

Compulsorily retired (v) Voluntarily retired under Officers’ Service Regulation (vi)<br />

Voluntarily retired under Pension Regulations) (viii) Any other<br />

(Attach documentary proof)<br />

15. I am enclos<strong>in</strong>g herewith a Draft No. __________________dated__________for<br />

Rs __________only favour<strong>in</strong>g PNB Mediclaim Insurance Scheme for Retired<br />

Employees issued by the BO ___________________ _ (D. No _________ ) drawn on<br />

Delhi. be<strong>in</strong>g my premium to the Scheme .<br />

16. DECLARATION<br />

(i) I have read and understood the PNB Mediclaim Insurance Scheme for Retired<br />

Employees and agree to abide by the terms and conditions mentioned there<strong>in</strong>.<br />

(ii) The <strong>in</strong>formation given above by me is true to the best of my knowledge.<br />

(iii). I also undertake that if at any po<strong>in</strong>t of time, dur<strong>in</strong>g the currency of my<br />

membership of the scheme, the <strong>in</strong>formation submitted by me, either <strong>in</strong> relation<br />

to application form or hospitalisation claim preferred by me, is found to be<br />

false/mislead<strong>in</strong>g, my membership to the scheme will be term<strong>in</strong>ated without any<br />

notice to me. The amount deposited by me towards my subscription of the<br />

scheme will stand forfeited and I will not be eligible to become member of the<br />

scheme aga<strong>in</strong>.<br />

(iv) I will <strong>in</strong>form the change of my address to the Bank immediately by Registered<br />

Post.<br />

v) Discrepancy/query reported after 30 days from the date of receipt of<br />

sanction/rejection will not be enterta<strong>in</strong>ed.<br />

Place_____________<br />

<strong>NO</strong>TE:<br />

_____________<br />

SIGNATURE OF<br />

RETIRED EMPLOYEE<br />

_______________<br />

SIGNATURE /T.I .OF<br />

SPOUSE<br />

1. Application form complete <strong>in</strong> all respects, must be sent to HO directly.<br />

2. Strike off whichever is not applicable.<br />

12

3. Cheque will not be accepted.<br />

13