NBAA 2011 Tactics to Avoid and Survive an IRS Audit

NBAA 2011 Tactics to Avoid and Survive an IRS Audit

NBAA 2011 Tactics to Avoid and Survive an IRS Audit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

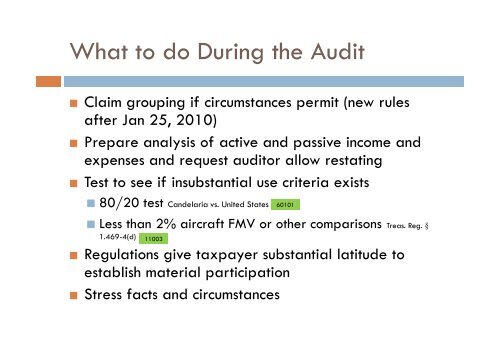

What <strong>to</strong> do During the <strong>Audit</strong><br />

• Claim grouping if circumst<strong>an</strong>ces permit (new rules<br />

after J<strong>an</strong> 25, 2010)<br />

• Prepare <strong>an</strong>alysis of active <strong><strong>an</strong>d</strong> passive income <strong><strong>an</strong>d</strong><br />

expenses <strong><strong>an</strong>d</strong> request audi<strong>to</strong>r allow restating<br />

• Test <strong>to</strong> see if insubst<strong>an</strong>tial use criteria exists<br />

• 80/20 test C<strong><strong>an</strong>d</strong>elaria vs. United States<br />

60101<br />

• Less th<strong>an</strong> 2% aircraft FMV or other comparisons Treas. Reg. §<br />

1.469-4(d)<br />

11003<br />

• Regulations give taxpayer subst<strong>an</strong>tial latitude <strong>to</strong><br />

establish material participation<br />

• Stress facts <strong><strong>an</strong>d</strong> circumst<strong>an</strong>ces