NBAA 2011 Tactics to Avoid and Survive an IRS Audit

NBAA 2011 Tactics to Avoid and Survive an IRS Audit

NBAA 2011 Tactics to Avoid and Survive an IRS Audit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

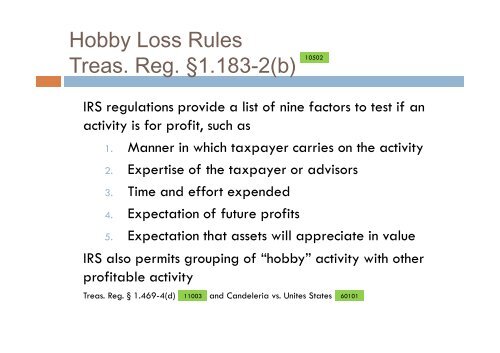

Hobby Loss Rules<br />

Treas. Reg. §1.183-2(b)<br />

10502<br />

<strong>IRS</strong> regulations provide a list of nine fac<strong>to</strong>rs <strong>to</strong> test if <strong>an</strong><br />

activity is for profit, such as<br />

1. M<strong>an</strong>ner in which taxpayer carries on the activity<br />

2. Expertise of the taxpayer or advisors<br />

3. Time <strong><strong>an</strong>d</strong> effort expended<br />

4. Expectation of future profits<br />

5. Expectation that assets will appreciate in value<br />

<strong>IRS</strong> also permits grouping of “hobby” activity with other<br />

profitable activity<br />

Treas. Reg. § 1.469-4(d)<br />

<strong><strong>an</strong>d</strong> C<strong><strong>an</strong>d</strong>eleria vs. Unites States<br />

11003 60101