NBAA 2011 Tactics to Avoid and Survive an IRS Audit

NBAA 2011 Tactics to Avoid and Survive an IRS Audit

NBAA 2011 Tactics to Avoid and Survive an IRS Audit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

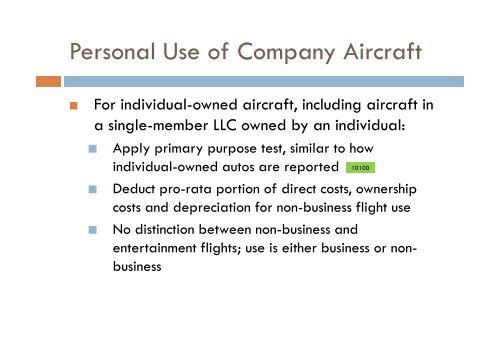

Personal Use of Comp<strong>an</strong>y Aircraft<br />

• For individual-owned aircraft, including aircraft in<br />

a single-member LLC owned by <strong>an</strong> individual:<br />

• Apply primary purpose test, similar <strong>to</strong> how<br />

individual-owned au<strong>to</strong>s are reported 10100<br />

• Deduct pro-rata portion of direct costs, ownership<br />

costs <strong><strong>an</strong>d</strong> depreciation for non-business flight use<br />

• No distinction between non-business <strong><strong>an</strong>d</strong><br />

entertainment flights; use is either business or nonbusiness