- Page 1: COLLECTIVE AGREEMENTS with respect

- Page 4 and 5: PREAMBLE 1. The purpose of these Ag

- Page 6 and 7: CENTRAL WORKING CONDITIONS AND EMPL

- Page 8 and 9: Termination of Employment 43 Pregna

- Page 10 and 11: Appendix 34 - Letter of Understandi

- Page 12 and 13: of the request. 1.6 No position or

- Page 14 and 15: ange except where permitted by sala

- Page 16 and 17: practice in each ministry. 9.4 The

- Page 18 and 19: Entitlement under Article UN13.2 or

- Page 20 and 21: • in the same classification; and

- Page 22 and 23: 5000 or more 0 12.3.2 Distance from

- Page 24 and 25: than nine (9) months and shall comm

- Page 26 and 27: 20.2 NOTICE AND PAY IN LIEU 20.2.1

- Page 28 and 29: 20.4.1.9 The surplus employee must

- Page 30 and 31: 20.8.4 Surplus employees who are oc

- Page 32 and 33: 20.15.2An employee who, pursuant to

- Page 34 and 35: 22.9 INSURED BENEFITS GRIEVANCE 22.

- Page 36 and 37: the grievance in an expeditious and

- Page 38 and 39: employee will be absent at one time

- Page 40 and 41: 29.1 Union Trustees of the OPSEU Pe

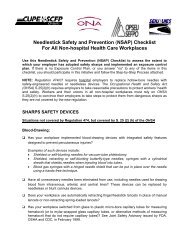

- Page 42 and 43: 31A.11 HEALTH AND SAFETY 31A.11.1 T

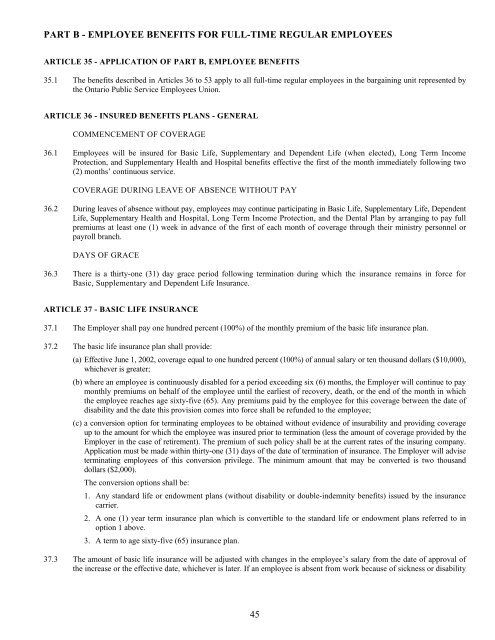

- Page 44 and 45: within thirty-seven (37) weeks of t

- Page 46 and 47: 32.11 DENTAL PLAN 32.11.1 The Emplo

- Page 50 and 51: on the date an increase in insuranc

- Page 52 and 53: each visit to an annual maximum of

- Page 54 and 55: (b) The Employer shall pay the full

- Page 56 and 57: employee was receiving on December

- Page 58 and 59: 44.9 Where, for reasons of health,

- Page 60 and 61: spouse, mother, father, mother-in-l

- Page 62 and 63: any negotiated or amended wage rate

- Page 64 and 65: (b) any part of a month that is fif

- Page 66 and 67: 56.1.2 Notwithstanding Article 56.1

- Page 68 and 69: which is adjustable in height, a ba

- Page 70 and 71: take effect until the employee retu

- Page 72 and 73: pair; 67.2.8 Rentals of wheel chair

- Page 74 and 75: etween the ages of six (6) and eigh

- Page 76 and 77: was receiving on December 31, 2010

- Page 78 and 79: work or on leave with pay. 72.3 An

- Page 80 and 81: 76.3.1 An employee entitled to preg

- Page 82 and 83: (3) dismissal for certain reasons u

- Page 84 and 85: PART E - APPENDICES APPENDIX 1 June

- Page 86 and 87: APPENDIX 3 USE OF PRIVATELY OWNED A

- Page 88 and 89: The Committee will also meet every

- Page 90 and 91: APPENDIX 6 Revised June 24, 2005 SA

- Page 92 and 93: APPENDIX 8 LETTER OF UNDERSTANDING

- Page 94 and 95: subtract: (i) the employee’s six

- Page 96 and 97: APPENDIX 10 Revised June 24, 2005 A

- Page 98 and 99:

APPENDIX 12 Revised February 26, 20

- Page 100 and 101:

November 16, 1998 Tom Wood Chief Ne

- Page 102 and 103:

APPENDIX 15 Revised February 26, 20

- Page 104 and 105:

APPENDIX 17 Revised February 26, 20

- Page 106 and 107:

Crown to a municipality or hospital

- Page 108 and 109:

commence employment with the receiv

- Page 110 and 111:

6.2.1 In the event that a receiving

- Page 112 and 113:

6C.5 Employees included in the RFP

- Page 114 and 115:

Subject to Article 7.0 Including bu

- Page 116 and 117:

1. Include the non-trivial work of

- Page 118 and 119:

APPENDIX 21 ENHANCED RECRUITMENT IN

- Page 120 and 121:

APPENDIX 22 RECOGNITION FUND May 5,

- Page 122 and 123:

APPENDIX 24 FIXED-TERM SENIORITY CO

- Page 124 and 125:

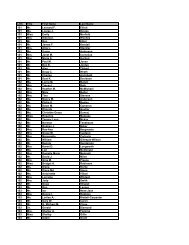

120 APPENDIX 26 SALARIES - UNCLASSI

- Page 126 and 127:

APPENDIX 28 BENEFIT PLAN May 5, 200

- Page 128 and 129:

MINISTRY EMPLOYEE RELATIONS COMMITT

- Page 130 and 131:

APPENDIX 30 June 24, 2005 WORKLOAD

- Page 132 and 133:

APPENDIX 32 Revised February 26, 20

- Page 134 and 135:

4. APPLICABLE COLLECTIVE AGREEMENT

- Page 136 and 137:

132 APPENDIX 33 UNCLASSIFIED EMPLOY

- Page 138 and 139:

4. The parties shall attempt to rea

- Page 140 and 141:

APPENDIX 36 June 24, 2005 REASONABL

- Page 142 and 143:

APPENDIX 38 February 26, 2009 INFOR

- Page 144 and 145:

(b) (c) (d) (e) (f) (g) (h) With re

- Page 146 and 147:

APPENDIX 40 February 26, 2009 EMPLO

- Page 148 and 149:

c. The Employer will support Minist

- Page 150 and 151:

A procedure for the prompt and equi

- Page 152 and 153:

APPENDIX 42 February 26, 2009 FLEXI

- Page 154 and 155:

APPENDIX 44 February 26, 2009 LEARN

- Page 156 and 157:

APPENDIX 45 February 26, 2009 UNION

- Page 158 and 159:

UNIFIED BARGAINING UNIT COLLECTIVE

- Page 160 and 161:

her basic hourly rate shall be adju

- Page 162 and 163:

all of his or her compensating leav

- Page 164 and 165:

UN 12.7 Costs of meals will not be

- Page 166 and 167:

PART C - SALARY AND TERM ARTICLE UN

- Page 168 and 169:

) will be given reasonable notice,

- Page 170 and 171:

APPENDIX UN 3 TRAINING AND DEVELOPM

- Page 172 and 173:

APPENDIX UN 6 Applicable to the IHC

- Page 174 and 175:

10. The salary rates for all steps

- Page 176 and 177:

are required to possess both a Clas

- Page 178 and 179:

Technical Classification Group G 22

- Page 180 and 181:

40180 897.66 910.90 926.08 953.85 0

- Page 182 and 183:

05925 CHIEF INSPECTOR OF THEATRES 6

- Page 184 and 185:

02281 ECONOMIST 1 (BARGAINING UNIT)

- Page 186 and 187:

01/01/12 1,362.16 1,428.05 1,502.92

- Page 188 and 189:

20205 FINANCIAL OFFICER 1 (BARGAINI

- Page 190 and 191:

13994 FORESTER 2B A(36¼) 01/01/09

- Page 192 and 193:

12120 INDUSTRIAL DEVELOPMENT OFFICE

- Page 194 and 195:

01/01/12 1,200.94 1,250.38 1,301.71

- Page 196 and 197:

40910 1,348.15 03896 NORTHERN AFFAI

- Page 198 and 199:

01/01/09 1,113.80 1,135.81 1,169.89

- Page 200 and 201:

01/01/11 922.19 942.33 964.24 986.1

- Page 202 and 203:

01/01/11 1,182.96 1,240.95 1,291.93

- Page 204 and 205:

01/01/10 1,378.79 1,449.53 1,517.79

- Page 206 and 207:

01/01/12 1,226.53 1,271.38 1,321.86

- Page 208 and 209:

51084 TRAVEL COUNSELLOR 3 3 - 7 01/

- Page 210 and 211:

INSTITUTIONAL AND HEALTH CARE CLASS

- Page 212 and 213:

01/01/10 943.57 961.52 981.13 1,010

- Page 214 and 215:

17400 E.E.G. TECHNICIAN 1 3 - 7 01/

- Page 216 and 217:

01/01/09 800.33 822.63 844.90 867.1

- Page 218 and 219:

01/01/11 995.86 1,020.51 1,048.59 1

- Page 220 and 221:

50050 NURSE 1, GENERAL (G24 SALARY

- Page 222 and 223:

50124 NURSE 3, PUBLIC HEALTH 3 - 7

- Page 224 and 225:

01/01/10 839.08 858.31 878.11 900.3

- Page 226 and 227:

01/01/11 21.66 22.03 22.71 01/01/12

- Page 228 and 229:

OFFICE ADMINISTRATION CLASSIFICATIO

- Page 230 and 231:

01/01/12 766.79 785.41 805.82 826.2

- Page 232 and 233:

01/01/12 20.53 20.97 21.41 21.87 22

- Page 234 and 235:

01/01/12 1,060.59 1,097.27 1,136.50

- Page 236 and 237:

OPERATIONAL AND MAINTENANCE CLASSIF

- Page 238 and 239:

01/01/12 20.09 20.47 21.09 50640 BU

- Page 240 and 241:

01/01/09 954.71 992.50 1,031.80 1,0

- Page 242 and 243:

SA 01/01/09 18.32 18.63 19.19 01/01

- Page 244 and 245:

50604 PARKING ATTENDANT 4 - 7 SA 01

- Page 246 and 247:

40110 STEAM PLANT ENGINEER 1 4 - 7

- Page 248 and 249:

TECHNICAL CLASSIFICATION GROUP The

- Page 250 and 251:

01/01/12 953.52 980.68 1,007.77 1,0

- Page 252 and 253:

01/01/10 951.27 975.65 1,000.10 1,0

- Page 254 and 255:

95603 ENGINEERING & SURVEYING SUPPO

- Page 256 and 257:

799.79 01/01/11 736.65 746.10 754.0

- Page 258 and 259:

01/01/10 843.33 866.21 889.17 913.7

- Page 260 and 261:

01/01/10 27.42 28.12 28.97 01/01/11

- Page 262 and 263:

93070 MAINTENANCE STEAMFITTER 4 - 7

- Page 264 and 265:

01/01/12 773.36 784.79 797.85 810.9

- Page 266 and 267:

01/01/10 978.11 1,005.14 1,033.09 1

- Page 268 and 269:

01/01/12 20.36 20.80 21.42 41100 RE

- Page 270 and 271:

01/01/12 953.17 980.50 1,007.74 1,0

- Page 272 and 273:

01/01/12 20.24 20.67 21.28 93082 SI

- Page 274 and 275:

01/01/10 916.04 945.94 979.29 1,010

- Page 276 and 277:

752.59 775.17 16072 TECHNICIAN 2, P

- Page 278 and 279:

01/01/12 687.10 701.79 718.07 734.4

- Page 280 and 281:

01/01/10 737.72 755.61 774.21 792.8

- Page 282 and 283:

01/01/10 14.09 14.50 01/01/11 14.37

- Page 284 and 285:

ADDENDUM 1 TRADES APPRENTICE RATES

- Page 286 and 287:

THIS COLLECTIVE AGREEMENT made on t

- Page 288 and 289:

PART A - WORKING CONDITIONS ARTICLE

- Page 290 and 291:

COR6.4 COR6.5 Shift premium shall n

- Page 292 and 293:

ARTICLE COR12 - MEAL ALLOWANCE (FXT

- Page 294 and 295:

COR14.3.3 Shall be deemed to have b

- Page 296 and 297:

PART B - REGULAR PART-TIME EMPLOYEE

- Page 298 and 299:

PART C - SALARY AND TERM ARTICLE CO

- Page 300 and 301:

Hours Worked Over Annual Requiremen

- Page 302 and 303:

APPENDIX COR3 PROBATION OFFICERS’

- Page 304 and 305:

grievances at Stage Two of the grie

- Page 306 and 307:

5.1.4 Notwithstanding the reference

- Page 308 and 309:

APPENDIX COR5 CLASSIFICATION ADJUST

- Page 310 and 311:

APPENDIX COR7 March 12, 2009 SPECIA

- Page 312 and 313:

APPENDIX COR8 March 12, 2009 PROVIN

- Page 314 and 315:

APPENDIX COR10 March 12, 2009 SUSPE

- Page 316 and 317:

APPENDIX COR12 March 12, 2009 PROBA

- Page 318 and 319:

CORRECTIONAL SALARY SCHEDULE SALARY

- Page 320 and 321:

09480 OBSERVATION AND DETENTION HOM

- Page 322 and 323:

07554 TRADE INSTRUCTOR 3 4 - 7 01/0

- Page 324:

50592 18 PROGRAM ANALYSIS 3 - 7 01/