FirstCaribbean International Bank (Bahamas) Limited

FirstCaribbean International Bank (Bahamas) Limited

FirstCaribbean International Bank (Bahamas) Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to Consolidated Financial Statements<br />

For the year ended October 31, 2004<br />

(expressed in thousands of Bahamian dollars)<br />

18. Employee post-retirement obligations (continued)<br />

During the year Barclays <strong>Bank</strong> PLC transferred to the <strong>FirstCaribbean</strong> plan assets sufficient to fully fund a<br />

ten-year contribution holiday in respect of the employees of the former Barclays <strong>Bank</strong>. The fair value of the<br />

plan assets included in these consolidated financial statements includes the amount that Barclays <strong>Bank</strong> PLC<br />

transferred to the <strong>FirstCaribbean</strong> plan which was determined on the basis of an actuarial valuation.<br />

The present value of funded obligations has been calculated on the basis that non-active members remain<br />

in the Barclays plan, which will continue to fund all pension payments for these members. The pension<br />

obligation to non-active members was not transferred into <strong>FirstCaribbean</strong> <strong>International</strong> <strong>Bank</strong> (<strong>Bahamas</strong>)<br />

<strong>Limited</strong>, so this obligation is not reflected in these consolidated financial statements.<br />

19. Related party transactions<br />

Interest income includes $17.5 million (2003: $17.2 million) and interest expense includes $3.9 million<br />

(2003: $4.4 million) earned from and paid to related entities.<br />

In the normal course of business the parent companies provide banking and support services, for which<br />

$2.3 million (2003: $3.3 million) was charged during the period.<br />

Deposits maintained with other CIBC and Barclays entities amounted to $699 million (2003: $1,028<br />

million).<br />

Non-interest income includes $10 million (2003: $10 million) from Barclays <strong>Bank</strong> PLC as an incentive for<br />

the <strong>Bank</strong> to retain its placement balance with Barclays Capital.<br />

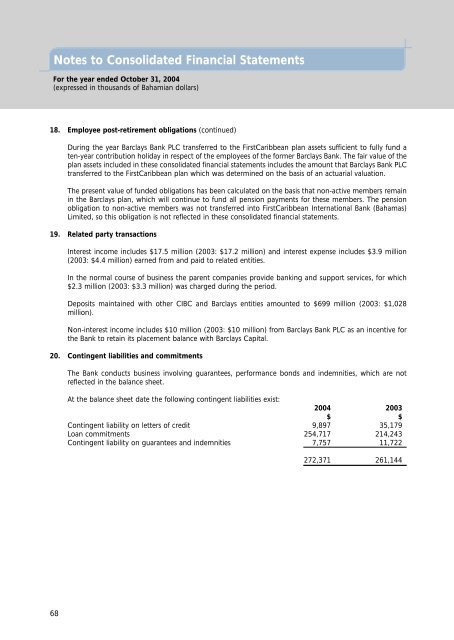

20. Contingent liabilities and commitments<br />

The <strong>Bank</strong> conducts business involving guarantees, performance bonds and indemnities, which are not<br />

reflected in the balance sheet.<br />

At the balance sheet date the following contingent liabilities exist:<br />

2004 2003<br />

$ $<br />

Contingent liability on letters of credit 9,897 35,179<br />

Loan commitments 254,717 214,243<br />

Contingent liability on guarantees and indemnities 7,757 11,722<br />

272,371 261,144<br />

68