FirstCaribbean International Bank (Bahamas) Limited

FirstCaribbean International Bank (Bahamas) Limited

FirstCaribbean International Bank (Bahamas) Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

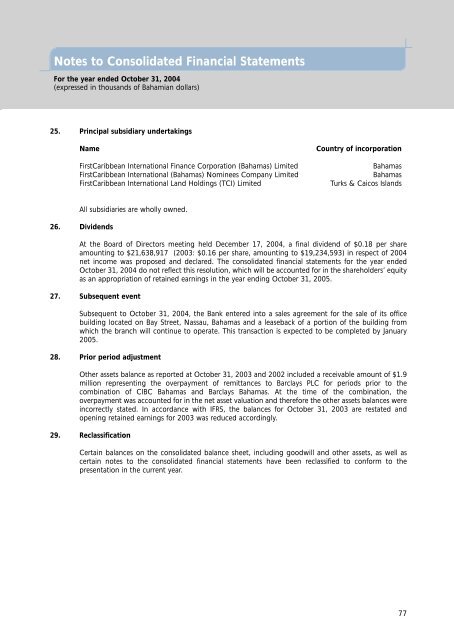

Notes to Consolidated Financial Statements<br />

For the year ended October 31, 2004<br />

(expressed in thousands of Bahamian dollars)<br />

25. Principal subsidiary undertakings<br />

Name<br />

<strong>FirstCaribbean</strong> <strong>International</strong> Finance Corporation (<strong>Bahamas</strong>) <strong>Limited</strong><br />

<strong>FirstCaribbean</strong> <strong>International</strong> (<strong>Bahamas</strong>) Nominees Company <strong>Limited</strong><br />

<strong>FirstCaribbean</strong> <strong>International</strong> Land Holdings (TCI) <strong>Limited</strong><br />

Country of incorporation<br />

<strong>Bahamas</strong><br />

<strong>Bahamas</strong><br />

Turks & Caicos Islands<br />

All subsidiaries are wholly owned.<br />

26. Dividends<br />

At the Board of Directors meeting held December 17, 2004, a final dividend of $0.18 per share<br />

amounting to $21,638,917 (2003: $0.16 per share, amounting to $19,234,593) in respect of 2004<br />

net income was proposed and declared. The consolidated financial statements for the year ended<br />

October 31, 2004 do not reflect this resolution, which will be accounted for in the shareholders’ equity<br />

as an appropriation of retained earnings in the year ending October 31, 2005.<br />

27. Subsequent event<br />

Subsequent to October 31, 2004, the <strong>Bank</strong> entered into a sales agreement for the sale of its office<br />

building located on Bay Street, Nassau, <strong>Bahamas</strong> and a leaseback of a portion of the building from<br />

which the branch will continue to operate. This transaction is expected to be completed by January<br />

2005.<br />

28. Prior period adjustment<br />

Other assets balance as reported at October 31, 2003 and 2002 included a receivable amount of $1.9<br />

million representing the overpayment of remittances to Barclays PLC for periods prior to the<br />

combination of CIBC <strong>Bahamas</strong> and Barclays <strong>Bahamas</strong>. At the time of the combination, the<br />

overpayment was accounted for in the net asset valuation and therefore the other assets balances were<br />

incorrectly stated. In accordance with IFRS, the balances for October 31, 2003 are restated and<br />

opening retained earnings for 2003 was reduced accordingly.<br />

29. Reclassification<br />

Certain balances on the consolidated balance sheet, including goodwill and other assets, as well as<br />

certain notes to the consolidated financial statements have been reclassified to conform to the<br />

presentation in the current year.<br />

77