EBA Long Report - European Banking Authority - Europa

EBA Long Report - European Banking Authority - Europa

EBA Long Report - European Banking Authority - Europa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

You envisage making<br />

material changes to your<br />

bank’s business model going<br />

forward.<br />

a. Your business model has been<br />

witnessing some material adjustments<br />

in recent years, both due to the initial<br />

financial crisis and to the …<br />

1. Secondary markets:<br />

i. Changes in market structure and<br />

dynamics.<br />

2. Investment<br />

banking/trading across the<br />

board.<br />

ii. Regulatory changes (e.g., Basel<br />

2.5/CRD 3).<br />

3. Trade finance.<br />

iii. National supervisory<br />

recommendations.<br />

4. Other wholesale lending<br />

(international leasing,<br />

shipping, etc.).<br />

iv. Funding challenges.<br />

5. Non-domestic activities<br />

outside the EU.<br />

v. Capital constraints.<br />

6. Non-domestic activities<br />

within the EU.<br />

vi. Earnings pressure.<br />

7. Project finance/public<br />

sector.<br />

vii. Some or all the above.<br />

8. Domestic:<br />

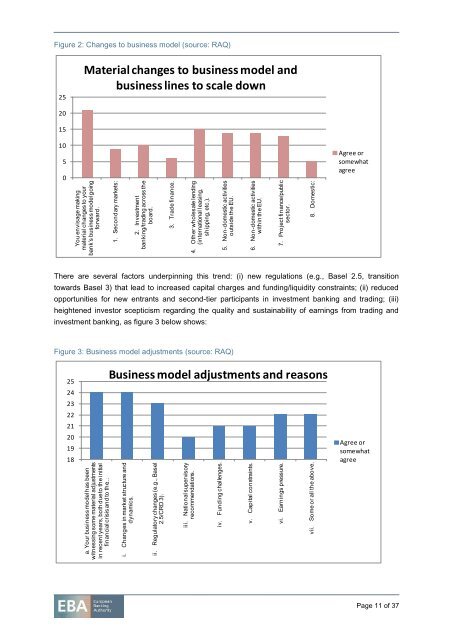

Figure 2: Changes to business model (source: RAQ)<br />

25<br />

Material changes to business model and<br />

business lines to scale down<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Agree or<br />

somewhat<br />

agree<br />

There are several factors underpinning this trend: (i) new regulations (e.g., Basel 2.5, transition<br />

towards Basel 3) that lead to increased capital charges and funding/liquidity constraints; (ii) reduced<br />

opportunities for new entrants and second-tier participants in investment banking and trading; (iii)<br />

heightened investor scepticism regarding the quality and sustainability of earnings from trading and<br />

investment banking, as figure 3 below shows:<br />

Figure 3: Business model adjustments (source: RAQ)<br />

25<br />

24<br />

23<br />

22<br />

21<br />

20<br />

19<br />

18<br />

Business model adjustments and reasons<br />

Agree or<br />

somewhat<br />

agree<br />

Page 11 of 37