EBA Long Report - European Banking Authority - Europa

EBA Long Report - European Banking Authority - Europa

EBA Long Report - European Banking Authority - Europa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Asset deleverage is an element of<br />

your strategy.<br />

a. If yes:<br />

i. It was required or suggested by<br />

national supervisors.<br />

ii. It is part of the EU State Aid<br />

conditions.<br />

iii. It was decided by your bank<br />

independently.<br />

More severe deleveraging has been occurring this year in financially-stressed countries and this trend<br />

is set to continue, as local banks have been facing funding shortages (including in some cases<br />

negative deposit flows) and especially weak credit demand stemming from recessionary economies.<br />

On a selective basis, some banks which have been unable to adjust their business models and<br />

balance sheets (including levels of capital) to the new realities have started deleveraging.<br />

As long as EU economies remain either in recession or modest growth, it is unlikely that bank lending<br />

will resume to higher levels. At the same time, if credit demand revives, economies cannot be<br />

expected to pick up sustainable growth without more vigorous bank lending. Breaking this negative<br />

loop is a function of restored market confidence and better regulatory clarity (the former being to some<br />

extent a function of the latter), which will enable banks to resume normal funding for growth and target<br />

the appropriate strategies to that effect.<br />

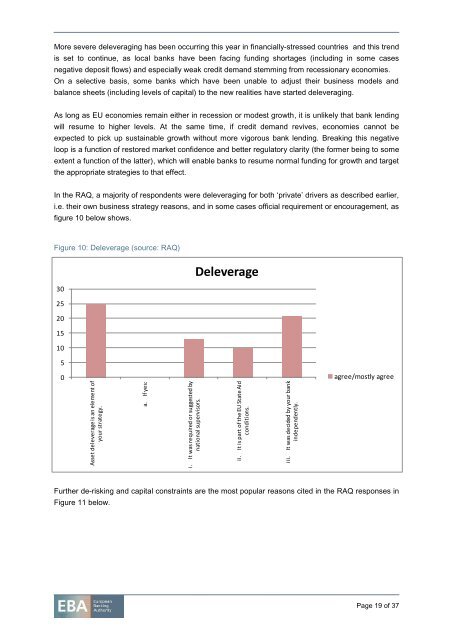

In the RAQ, a majority of respondents were deleveraging for both ‘private’ drivers as described earlier,<br />

i.e. their own business strategy reasons, and in some cases official requirement or encouragement, as<br />

figure 10 below shows.<br />

Figure 10: Deleverage (source: RAQ)<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

Deleverage<br />

0<br />

agree/mostly agree<br />

Further de-risking and capital constraints are the most popular reasons cited in the RAQ responses in<br />

Figure 11 below.<br />

Page 19 of 37