EBA Long Report - European Banking Authority - Europa

EBA Long Report - European Banking Authority - Europa

EBA Long Report - European Banking Authority - Europa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Your bank can operate on a longerterm<br />

basis with a return on equity<br />

(ROE):<br />

a. Below 10%.<br />

b. Between 10% and 15%.<br />

c. Above 15%.<br />

In your financial planning you<br />

estimate your bank’s cost of equity<br />

(COE).<br />

a. If yes, you estimate it at:<br />

i. Below 10%.<br />

ii. Between 10% and 12%.<br />

iii. Above 12%.<br />

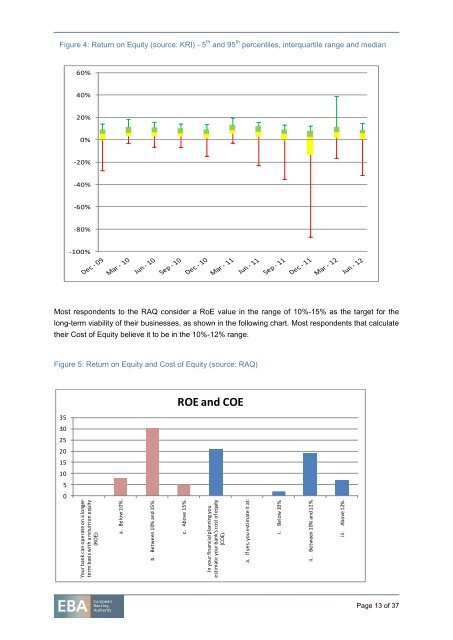

Figure 4: Return on Equity (source: KRI) - 5 th and 95 th percentiles, interquartile range and median<br />

60%<br />

40%<br />

20%<br />

0%<br />

-20%<br />

-40%<br />

-60%<br />

-80%<br />

-100%<br />

Most respondents to the RAQ consider a RoE value in the range of 10%-15% as the target for the<br />

long-term viability of their businesses, as shown in the following chart. Most respondents that calculate<br />

their Cost of Equity believe it to be in the 10%-12% range.<br />

Figure 5: Return on Equity and Cost of Equity (source: RAQ)<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

ROE and COE<br />

Page 13 of 37