English - BMI Bank

English - BMI Bank

English - BMI Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

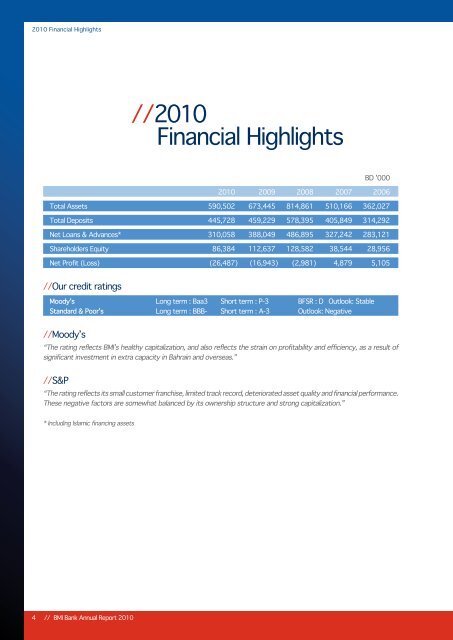

2010 Financial Highlights 2010 Financial Highlights<br />

//2010<br />

Financial Highlights<br />

BD ’000<br />

2010 2009 2008 2007 2006<br />

Total Assets 590,502 673,445 814,861 510,166 362,027<br />

//Financial highlights 31 December 2010<br />

1. Profitability<br />

2010 2009 2008 2007 2006<br />

Total Deposits 445,728 459,229 578,395 405,849 314,292<br />

Net Loans & Advances* 310,058 388,049 486,895 327,242 283,121<br />

Shareholders Equity 86,384 112,637 128,582 38,544 28,956<br />

Net Profit (Loss) (26,487) (16,943) (2,981) 4,879 5,105<br />

//Our credit ratings<br />

Moody’s Long term : Baa3 Short term : P-3 BFSR : D Outlook: Stable<br />

Standard & Poor’s Long term : BBB- Short term : A-3 Outlook: Negative<br />

//Moody’s<br />

“The rating reflects <strong>BMI</strong>’s healthy capitalization, and also reflects the strain on profitability and efficiency, as a result of<br />

significant investment in extra capacity in Bahrain and overseas.”<br />

//S&P<br />

“The rating reflects its small customer franchise, limited track record, deteriorated asset quality and financial performance.<br />

These negative factors are somewhat balanced by its ownership structure and strong capitalization.”<br />

Net Interest Margin 3.4% 2.9% 2.0% 2.1% 2.3%<br />

2. Capital<br />

Capital Adequacy (BIS Standard) 19.7% 21.8% 20.3% 13.1% 13.9%<br />

Shareholders Funds/Total Assets 14.6% 16.7% 15.8% 7.6% 8.0%<br />

3. Asset Quality<br />

Non-Performing Loans to Total Loans 18.6% 8.9% 2.0% 1.1% 0.8%<br />

Loan Loss Provision to Total NPL’s 76.2% 82.3% 88.1% 78.9% 88.4%<br />

4. Liquidity<br />

Net Loans to Total Deposits 69.6% 84.5% 84.2% 80.6% 90.1%<br />

Net Loans to Total Assets 52.5% 57.6% 59.8% 64.1% 78.2%<br />

Liquid Assets to Total Deposits 53.7% 49.3% 46.5% 40.8% 18.9%<br />

* Including Islamic financing assets<br />

4 // <strong>BMI</strong> <strong>Bank</strong> Annual Report 2010<br />

<strong>BMI</strong> <strong>Bank</strong> Annual Report 2010 // 5