HERALD INVESTMENT TRUST plc ANNUAL REPORT ...

HERALD INVESTMENT TRUST plc ANNUAL REPORT ...

HERALD INVESTMENT TRUST plc ANNUAL REPORT ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

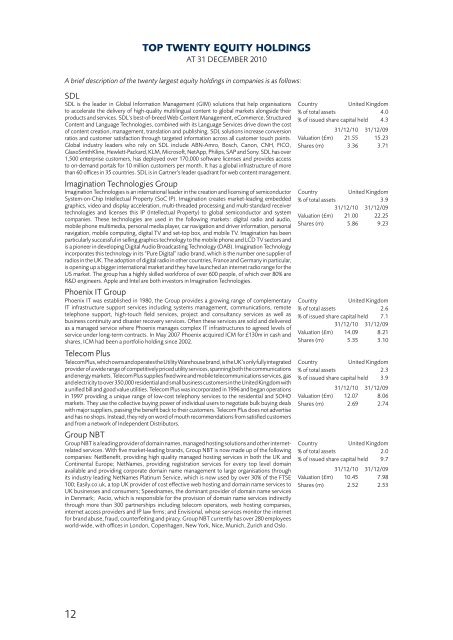

TOP TWENTY EQUITY HOLDINGS<br />

AT 31 DECEMBER 2010<br />

A brief description of the twenty largest equity holdings in companies is as follows:<br />

SDL<br />

SDL is the leader in Global Information Management (GIM) solutions that help organisations<br />

to accelerate the delivery of high-quality multilingual content to global markets alongside their<br />

products and services. SDL’s best-of-breed Web Content Management, eCommerce, Structured<br />

Content and Language Technologies, combined with its Language Services drive down the cost<br />

of content creation, management, translation and publishing. SDL solutions increase conversion<br />

ratios and customer satisfaction through targeted information across all customer touch points.<br />

Global industry leaders who rely on SDL include ABN-Amro, Bosch, Canon, CNH, FICO,<br />

GlaxoSmithKline, Hewlett-Packard, KLM, Microsoft, NetApp, Philips, SAP and Sony. SDL has over<br />

1,500 enterprise customers, has deployed over 170,000 software licenses and provides access<br />

to on-demand portals for 10 million customers per month. It has a global infrastructure of more<br />

than 60 offices in 35 countries. SDL is in Gartner’s leader quadrant for web content management.<br />

Imagination Technologies Group<br />

Imagination Technologies is an international leader in the creation and licensing of semiconductor<br />

System-on-Chip Intellectual Property (SoC IP). Imagination creates market-leading embedded<br />

graphics, video and display acceleration, multi-threaded processing and multi-standard receiver<br />

technologies and licenses this IP (Intellectual Property) to global semiconductor and system<br />

companies. These technologies are used in the following markets: digital radio and audio,<br />

mobile phone multimedia, personal media player, car navigation and driver information, personal<br />

navigation, mobile computing, digital TV and set-top box, and mobile TV. Imagination has been<br />

particularly successful in selling graphics technology to the mobile phone and LCD TV sectors and<br />

is a pioneer in developing Digital Audio Broadcasting Technology (DAB). Imagination Technology<br />

incorporates this technology in its “Pure Digital” radio brand, which is the number one supplier of<br />

radios in the UK. The adoption of digital radio in other countries, France and Germany in particular,<br />

is opening up a bigger international market and they have launched an internet radio range for the<br />

US market. The group has a highly skilled workforce of over 600 people, of which over 80% are<br />

R&D engineers. Apple and Intel are both investors in Imagination Technologies.<br />

Phoenix IT Group<br />

Phoenix IT was established in 1980, the Group provides a growing range of complementary<br />

IT infrastructure support services including systems management, communications, remote<br />

telephone support, high-touch field services, project and consultancy services as well as<br />

business continuity and disaster recovery services. Often these services are sold and delivered<br />

as a managed service where Phoenix manages complex IT infrastructures to agreed levels of<br />

service under long-term contracts. In May 2007 Phoenix acquired ICM for £130m in cash and<br />

shares, ICM had been a portfolio holding since 2002.<br />

Telecom Plus<br />

Telecom Plus, which owns and operates the Utility Warehouse brand, is the UK’s only fully integrated<br />

provider of a wide range of competitively priced utility services, spanning both the communications<br />

and energy markets. Telecom Plus supplies fixed wire and mobile telecommunications services, gas<br />

and electricity to over 350,000 residential and small business customers in the United Kingdom with<br />

a unified bill and good value utilities. Telecom Plus was incorporated in 1996 and began operations<br />

in 1997 providing a unique range of low-cost telephony services to the residential and SOHO<br />

markets. They use the collective buying power of individual users to negotiate bulk buying deals<br />

with major suppliers, passing the benefit back to their customers. Telecom Plus does not advertise<br />

and has no shops. Instead, they rely on word of mouth recommendations from satisfied customers<br />

and from a network of Independent Distributors.<br />

Group NBT<br />

Group NBT is a leading provider of domain names, managed hosting solutions and other internetrelated<br />

services. With five market-leading brands, Group NBT is now made up of the following<br />

companies: NetBenefit, providing high quality managed hosting services in both the UK and<br />

Continental Europe; NetNames, providing registration services for every top level domain<br />

available and providing corporate domain name management to large organisations through<br />

its industry leading NetNames Platinum Service, which is now used by over 30% of the FTSE<br />

100; Easily.co.uk, a top UK provider of cost effective web hosting and domain name services to<br />

UK businesses and consumers; Speednames, the dominant provider of domain name services<br />

in Denmark; Ascio, which is responsible for the provision of domain name services indirectly<br />

through more than 300 partnerships including telecom operators, web hosting companies,<br />

internet access providers and IP law firms; and Envisional, whose services monitor the internet<br />

for brand abuse, fraud, counterfeiting and piracy. Group NBT currently has over 280 employees<br />

world-wide, with offices in London, Copenhagen, New York, Nice, Munich, Zurich and Oslo.<br />

Country<br />

United Kingdom<br />

% of total assets 4.0<br />

% of issued share capital held 4.3<br />

31/12/10 31/12/09<br />

Valuation (£m) 21.55 15.23<br />

Shares (m) 3.36 3.71<br />

Country<br />

United Kingdom<br />

% of total assets 3.9<br />

31/12/10 31/12/09<br />

Valuation (£m) 21.00 22.25<br />

Shares (m) 5.86 9.23<br />

Country<br />

United Kingdom<br />

% of total assets 2.6<br />

% of issued share capital held 7.1<br />

31/12/10 31/12/09<br />

Valuation (£m) 14.09 8.21<br />

Shares (m) 5.35 3.10<br />

Country<br />

United Kingdom<br />

% of total assets 2.3<br />

% of issued share capital held 3.9<br />

31/12/10 31/12/09<br />

Valuation (£m) 12.07 8.06<br />

Shares (m) 2.69 2.74<br />

Country<br />

United Kingdom<br />

% of total assets 2.0<br />

% of issued share capital held 9.7<br />

31/12/10 31/12/09<br />

Valuation (£m) 10.45 7.98<br />

Shares (m) 2.52 2.53<br />

12