HERALD INVESTMENT TRUST plc ANNUAL REPORT ...

HERALD INVESTMENT TRUST plc ANNUAL REPORT ...

HERALD INVESTMENT TRUST plc ANNUAL REPORT ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

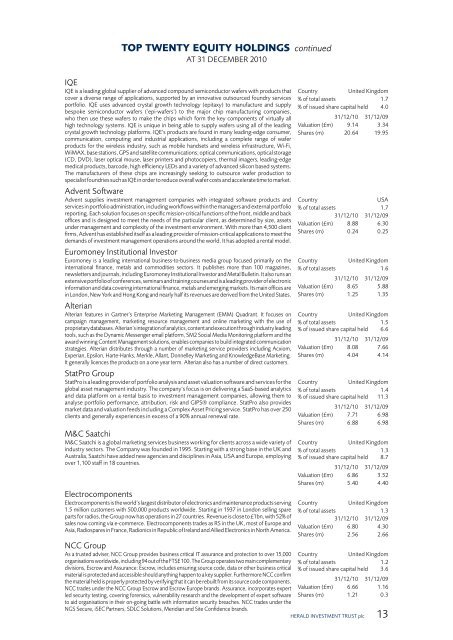

TOP TWENTY EQUITY HOLDINGS continued<br />

AT 31 DECEMBER 2010<br />

IQE<br />

IQE is a leading global supplier of advanced compound semiconductor wafers with products that<br />

cover a diverse range of applications, supported by an innovative outsourced foundry services<br />

portfolio. IQE uses advanced crystal growth technology (epitaxy) to manufacture and supply<br />

bespoke semiconductor wafers (‘epi-wafers’) to the major chip manufacturing companies,<br />

who then use these wafers to make the chips which form the key components of virtually all<br />

high technology systems. IQE is unique in being able to supply wafers using all of the leading<br />

crystal growth technology platforms. IQE’s products are found in many leading-edge consumer,<br />

communication, computing and industrial applications, including a complete range of wafer<br />

products for the wireless industry, such as mobile handsets and wireless infrastructure, Wi-Fi,<br />

WiMAX, base stations, GPS and satellite communications; optical communications, optical storage<br />

(CD, DVD), laser optical mouse, laser printers and photocopiers, thermal imagers, leading-edge<br />

medical products, barcode, high efficiency LEDs and a variety of advanced silicon based systems.<br />

The manufacturers of these chips are increasingly seeking to outsource wafer production to<br />

specialist foundries such as IQE in order to reduce overall wafer costs and accelerate time to market.<br />

Advent Software<br />

Advent supplies investment management companies with integrated software products and<br />

services in portfolio administration, including workflows within the managers and external portfolio<br />

reporting. Each solution focuses on specific mission-critical functions of the front, middle and back<br />

offices and is designed to meet the needs of the particular client, as determined by size, assets<br />

under management and complexity of the investment environment. With more than 4,500 client<br />

firms, Advent has established itself as a leading provider of mission-critical applications to meet the<br />

demands of investment management operations around the world. It has adopted a rental model.<br />

Euromoney Institutional Investor<br />

Euromoney is a leading international business-to-business media group focused primarily on the<br />

international finance, metals and commodities sectors. It publishes more than 100 magazines,<br />

newsletters and journals, including Euromoney Institutional Investor and Metal Bulletin. It also runs an<br />

extensive portfolio of conferences, seminars and training courses and is a leading provider of electronic<br />

information and data covering international finance, metals and emerging markets. Its main offices are<br />

in London, New York and Hong Kong and nearly half its revenues are derived from the United States.<br />

Alterian<br />

Alterian features in Gartner’s Enterprise Marketing Management (EMM) Quadrant. It focuses on<br />

campaign management, marketing resource management and online marketing with the use of<br />

proprietary databases. Alterian’s integration of analytics, content and execution through industry leading<br />

tools, such as the Dynamic Messenger email platform, SM2 Social Media Monitoring platform and the<br />

award winning Content Management solutions, enables companies to build integrated communication<br />

strategies. Alterian distributes through a number of marketing service providers including Acxiom,<br />

Experian, Epsilon, Harte-Hanks, Merkle, Allant, Donnelley Marketing and KnowledgeBase Marketing.<br />

It generally licences the products on a one year term. Alterian also has a number of direct customers.<br />

StatPro Group<br />

StatPro is a leading provider of portfolio analysis and asset valuation software and services for the<br />

global asset management industry. The company’s focus is on delivering a SaaS-based analytics<br />

and data platform on a rental basis to investment management companies, allowing them to<br />

analyse portfolio performance, attribution, risk and GIPS® compliance. StatPro also provides<br />

market data and valuation feeds including a Complex Asset Pricing service. StatPro has over 250<br />

clients and generally experiences in excess of a 90% annual renewal rate.<br />

M&C Saatchi<br />

M&C Saatchi is a global marketing services business working for clients across a wide variety of<br />

industry sectors. The Company was founded in 1995. Starting with a strong base in the UK and<br />

Australia, Saatchi have added new agencies and disciplines in Asia, USA and Europe, employing<br />

over 1,100 staff in 18 countries.<br />

Electrocomponents<br />

Electrocomponents is the world’s largest distributor of electronics and maintenance products serving<br />

1.5 million customers with 500,000 products worldwide. Starting in 1937 in London selling spare<br />

parts for radios, the Group now has operations in 27 countries. Revenue is close to £1bn, with 52% of<br />

sales now coming via e-commerce. Electrocomponents trades as RS in the UK, most of Europe and<br />

Asia, Radiospares in France, Radionics in Republic of Ireland and Allied Electronics in North America.<br />

NCC Group<br />

As a trusted adviser, NCC Group provides business critical IT assurance and protection to over 15,000<br />

organisations worldwide, including 94 out of the FTSE 100. The Group operates two main complementary<br />

divisions, Escrow and Assurance: Escrow, includes ensuring source code, data or other business critical<br />

material is protected and accessible should anything happen to a key supplier. Furthermore NCC confirm<br />

the material held is properly protected by verifying that it can be rebuilt from its source code components.<br />

NCC trades under the NCC Group Escrow and Escrow Europe brands. Assurance, incorporates expert<br />

led security testing, covering forensics, vulnerability research and the development of expert software<br />

to aid organisations in their on-going battle with information security breaches. NCC trades under the<br />

NGS Secure, iSEC Partners, SDLC Solutions, Meridian and Site Confidence brands.<br />

Country<br />

United Kingdom<br />

% of total assets 1.7<br />

% of issued share capital held 4.0<br />

31/12/10 31/12/09<br />

Valuation (£m) 9.14 3.34<br />

Shares (m) 20.64 19.95<br />

Country<br />

USA<br />

% of total assets 1.7<br />

31/12/10 31/12/09<br />

Valuation (£m) 8.88 6.30<br />

Shares (m) 0.24 0.25<br />

Country<br />

United Kingdom<br />

% of total assets 1.6<br />

31/12/10 31/12/09<br />

Valuation (£m) 8.65 5.88<br />

Shares (m) 1.25 1.35<br />

Country<br />

United Kingdom<br />

% of total assets 1.5<br />

% of issued share capital held 6.6<br />

31/12/10 31/12/09<br />

Valuation (£m) 8.08 7.66<br />

Shares (m) 4.04 4.14<br />

Country<br />

United Kingdom<br />

% of total assets 1.4<br />

% of issued share capital held 11.3<br />

31/12/10 31/12/09<br />

Valuation (£m) 7.71 6.98<br />

Shares (m) 6.88 6.98<br />

Country<br />

United Kingdom<br />

% of total assets 1.3<br />

% of issued share capital held 8.7<br />

31/12/10 31/12/09<br />

Valuation (£m) 6.86 3.52<br />

Shares (m) 5.40 4.40<br />

Country<br />

United Kingdom<br />

% of total assets 1.3<br />

31/12/10 31/12/09<br />

Valuation (£m) 6.80 4.30<br />

Shares (m) 2.56 2.66<br />

Country<br />

United Kingdom<br />

% of total assets 1.2<br />

% of issued share capital held 3.6<br />

31/12/10 31/12/09<br />

Valuation (£m) 6.66 1.16<br />

Shares (m) 1.21 0.3<br />

<strong>HERALD</strong> <strong>INVESTMENT</strong> <strong>TRUST</strong> <strong>plc</strong> 13