HERALD INVESTMENT TRUST plc ANNUAL REPORT ...

HERALD INVESTMENT TRUST plc ANNUAL REPORT ...

HERALD INVESTMENT TRUST plc ANNUAL REPORT ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS continued<br />

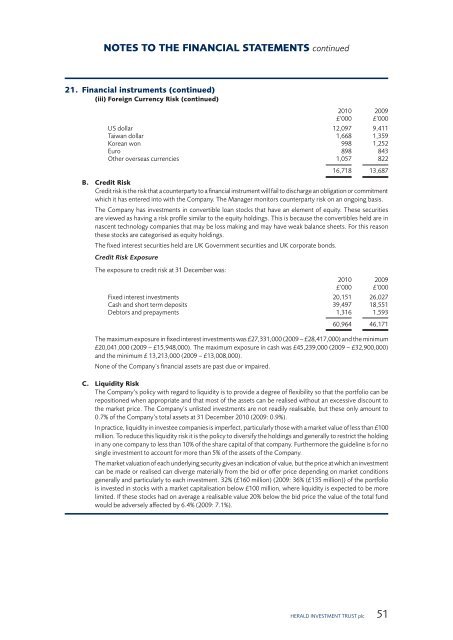

21. Financial instruments (continued)<br />

(iii) Foreign Currency Risk (continued)<br />

2010 2009<br />

£’000 £’000<br />

US dollar 12,097 9,411<br />

Taiwan dollar 1,668 1,359<br />

Korean won 998 1,252<br />

Euro 898 843<br />

Other overseas currencies 1,057 822<br />

16,718 13,687<br />

B. Credit Risk<br />

Credit risk is the risk that a counterparty to a financial instrument will fail to discharge an obligation or commitment<br />

which it has entered into with the Company. The Manager monitors counterparty risk on an ongoing basis.<br />

The Company has investments in convertible loan stocks that have an element of equity. These securities<br />

are viewed as having a risk profile similar to the equity holdings. This is because the convertibles held are in<br />

nascent technology companies that may be loss making and may have weak balance sheets. For this reason<br />

these stocks are categorised as equity holdings.<br />

The fixed interest securities held are UK Government securities and UK corporate bonds.<br />

Credit Risk Exposure<br />

The exposure to credit risk at 31 December was:<br />

2010 2009<br />

£’000 £’000<br />

Fixed interest investments 20,151 26,027<br />

Cash and short term deposits 39,497 18,551<br />

Debtors and prepayments 1,316 1,593<br />

60,964 46,171<br />

The maximum exposure in fixed interest investments was £27,331,000 (2009 – £28,417,000) and the minimum<br />

£20,041,000 (2009 – £15,948,000). The maximum exposure in cash was £45,239,000 (2009 – £32,900,000)<br />

and the minimum £ 13,213,000 (2009 – £13,008,000).<br />

None of the Company’s financial assets are past due or impaired.<br />

C. Liquidity Risk<br />

The Company’s policy with regard to liquidity is to provide a degree of flexibility so that the portfolio can be<br />

repositioned when appropriate and that most of the assets can be realised without an excessive discount to<br />

the market price. The Company’s unlisted investments are not readily realisable, but these only amount to<br />

0.7% of the Company’s total assets at 31 December 2010 (2009: 0.9%).<br />

In practice, liquidity in investee companies is imperfect, particularly those with a market value of less than £100<br />

million. To reduce this liquidity risk it is the policy to diversify the holdings and generally to restrict the holding<br />

in any one company to less than 10% of the share capital of that company. Furthermore the guideline is for no<br />

single investment to account for more than 5% of the assets of the Company.<br />

The market valuation of each underlying security gives an indication of value, but the price at which an investment<br />

can be made or realised can diverge materially from the bid or offer price depending on market conditions<br />

generally and particularly to each investment. 32% (£160 million) (2009: 36% (£135 million)) of the portfolio<br />

is invested in stocks with a market capitalisation below £100 million, where liquidity is expected to be more<br />

limited. If these stocks had on average a realisable value 20% below the bid price the value of the total fund<br />

would be adversely affected by 6.4% (2009: 7.1%).<br />

<strong>HERALD</strong> <strong>INVESTMENT</strong> <strong>TRUST</strong> <strong>plc</strong> 51